filmov

tv

I Stopped Budgeting After Discovering This Simpler Method

Показать описание

Tired of budgeting and never sticking to it? We've all been there. Here's a simpler way to manage your finances without feeling guilty.

📩 Want Financial Guidance and Plan For Your Money?

⬇ Feeling Stuck? Free Guide to Get Clear

👨 Who am I?

I am Jereme - my wife and I paid off 50k in debt, quit our 9-5 jobs, sold most of our stuff, drove across country from Oregon to Michigan, and bought a small A-Frame Cabin in cash to live simply.

This decision gave us more control over our time to actually focus on the things that matter to us - serving Christ, each other, and our community better.

I created this channel to empower you to become more intentional with your time, talent, and money in order to live the life that you want to, not what society expects of u.

More on Instagram @gojereme

🎥 My crispy, minimalist camera set-up

📩 Want Financial Guidance and Plan For Your Money?

⬇ Feeling Stuck? Free Guide to Get Clear

👨 Who am I?

I am Jereme - my wife and I paid off 50k in debt, quit our 9-5 jobs, sold most of our stuff, drove across country from Oregon to Michigan, and bought a small A-Frame Cabin in cash to live simply.

This decision gave us more control over our time to actually focus on the things that matter to us - serving Christ, each other, and our community better.

I created this channel to empower you to become more intentional with your time, talent, and money in order to live the life that you want to, not what society expects of u.

More on Instagram @gojereme

🎥 My crispy, minimalist camera set-up

I Stopped Budgeting After Discovering This Simpler Method

I Stopped Budgeting After Learning This | Financial Minimalism

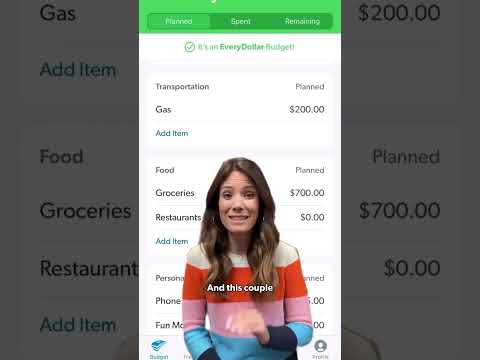

Making A Budget In Under A Minute

4 Things I Discovered From Looking At 5 Years Of My Budget

How Do I Make A Budget And Stick To It?

How Do I Stay On Budget When I'm a Natural Spender?

How To Budget a $70,000 Income

How to Stop Going Over-Budget on Groceries

8 Money Habits Keeping You Poor – Stop These Now!

The Truth About A Budget

An Almost $0 Spend Day | Travel Budget Day 253

Why I Hated Budgeting!

How to Budget With An Irregular Income

Secret 🤫 to Budgeting!

Me: When I Review My Budget

This Simple Budgeting Trick Changed Everything For Me

How to Budget Your Money

Sticking to a budget giving those good vibes 😎 #shorts #savings #savingsaccount #budget #sensational...

Minco police officers resign after city council chops budget

When You Spend Your Food Budget In ONE WEEK

How I Budget and Manage My Money as a Minimalist

Why I DON’T Budget (and what I do instead)

Planning a Budget and January Feels Like...

Our #1 Minimalist Budget Tip For Saving Money

Комментарии

0:09:32

0:09:32

0:11:01

0:11:01

0:00:58

0:00:58

0:06:25

0:06:25

0:04:25

0:04:25

0:03:20

0:03:20

0:00:54

0:00:54

0:08:41

0:08:41

0:04:11

0:04:11

0:00:43

0:00:43

0:00:23

0:00:23

0:00:21

0:00:21

0:00:52

0:00:52

0:00:06

0:00:06

0:00:06

0:00:06

0:22:42

0:22:42

0:00:45

0:00:45

0:00:06

0:00:06

0:02:30

0:02:30

0:00:07

0:00:07

0:15:51

0:15:51

0:12:11

0:12:11

0:00:09

0:00:09

0:05:46

0:05:46