filmov

tv

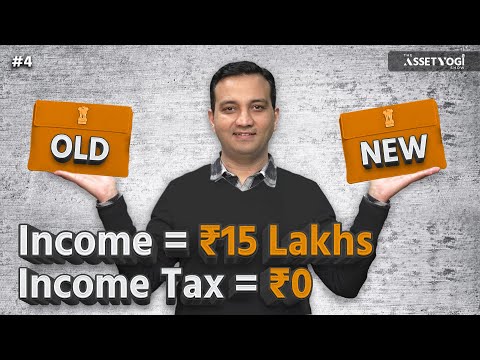

Income Tax Slab FY 2023-24 & AY 2024-25 : New vs. Old Regime (You must know to save tax)

Показать описание

📢 In FY 2023-24 and AY 2024-25, the Indian Government has introduced significant changes to the income tax regime. While the focus is primarily on the new tax regime with more than 6 alterations, the old tax regime remains unchanged.

🤑 Selecting the right income tax slab rate can lead to substantial tax savings. So, if you want to keep more of your hard-earned money, don't miss this video.

We'll guide you through the modifications in the new income tax regime for 2023-24 compared to 2022-23.

Stay informed and make tax-saving decisions with confidence! 💰📊

#incometax #TaxSlabs #TaxSavings

________________________________________________

📞 Call at 9150010400 (only for courses)

_______________________________________________

👉🏻 Instant Tax updates are now available on What'sapp channel , Telegram Channel & our Website as below:

_________________________________________________________

____________________________________________________

____________________________________________________

Let's Connect on your Mobile :

___________________________________________________________

♥Like 👍 ♥ Share ♥Subscribe ♥ press the 🔔

_____________________________________________________________________

Disclaimer: our videos are for educational purposes only, we will not be responsible in any circumstances for any decision which you have taken after watching the content.

------------------------------------------------------------------------------------------------------------------

#caguruji

#cagurujiclasses

#GST

#Incometax

#incometax2024

#Tax2024

#howto

#incometaxreturn

#GST

#accounting

#msme

#company

#TDS

#tcs

#Tallyprime

#new

#cagurujiclasses

#cagurujiwebsite

#studywudy

#taxupdates

🤑 Selecting the right income tax slab rate can lead to substantial tax savings. So, if you want to keep more of your hard-earned money, don't miss this video.

We'll guide you through the modifications in the new income tax regime for 2023-24 compared to 2022-23.

Stay informed and make tax-saving decisions with confidence! 💰📊

#incometax #TaxSlabs #TaxSavings

________________________________________________

📞 Call at 9150010400 (only for courses)

_______________________________________________

👉🏻 Instant Tax updates are now available on What'sapp channel , Telegram Channel & our Website as below:

_________________________________________________________

____________________________________________________

____________________________________________________

Let's Connect on your Mobile :

___________________________________________________________

♥Like 👍 ♥ Share ♥Subscribe ♥ press the 🔔

_____________________________________________________________________

Disclaimer: our videos are for educational purposes only, we will not be responsible in any circumstances for any decision which you have taken after watching the content.

------------------------------------------------------------------------------------------------------------------

#caguruji

#cagurujiclasses

#GST

#Incometax

#incometax2024

#Tax2024

#howto

#incometaxreturn

#GST

#accounting

#msme

#company

#TDS

#tcs

#Tallyprime

#new

#cagurujiclasses

#cagurujiwebsite

#studywudy

#taxupdates

Комментарии

0:05:27

0:05:27

0:13:35

0:13:35

0:08:44

0:08:44

0:10:40

0:10:40

0:07:31

0:07:31

0:20:11

0:20:11

0:11:06

0:11:06

0:11:48

0:11:48

0:12:18

0:12:18

0:07:53

0:07:53

0:07:28

0:07:28

0:18:29

0:18:29

0:05:51

0:05:51

0:21:13

0:21:13

0:08:34

0:08:34

0:19:01

0:19:01

0:11:36

0:11:36

0:11:02

0:11:02

0:05:58

0:05:58

0:13:13

0:13:13

0:02:58

0:02:58

0:13:34

0:13:34

0:22:57

0:22:57

0:10:28

0:10:28