filmov

tv

No Tax upto 7.5 Lakh | Income Tax Calculation 2024-25 | How To Calculate Income Tax 2023-24

Показать описание

No Tax upto 7.5 Lakh | Income Tax Calculation 2024-25 | How To Calculate Income Tax 2023-24

topics discussed in this video

income tax slab 2023-24

income tax calculation ay 2023-24

income tax calculator 2023-24

income tax calculation

how to calculate income tax 2023-24

old vs new slab income tax

old regime vs new regime

-------------------------------------------------------------------------------------------

*** Invest & Trade in Stocks & Mutual Funds ***

Open your Discount Demat Account here:

-------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------

#BankingBaba

topics discussed in this video

income tax slab 2023-24

income tax calculation ay 2023-24

income tax calculator 2023-24

income tax calculation

how to calculate income tax 2023-24

old vs new slab income tax

old regime vs new regime

-------------------------------------------------------------------------------------------

*** Invest & Trade in Stocks & Mutual Funds ***

Open your Discount Demat Account here:

-------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------------

#BankingBaba

No Tax upto 7.5 Lakh | Income Tax Calculation 2024-25 | How To Calculate Income Tax 2023-24

Zero tax on 7 lacs ! Really ? How ?

No Tax Limit, 5 lakh or 2.5 lakh? #LLAShorts 25

No Income Tax on 7.5 Lakh with New Tax Regime #fincalc #shorts

No Income Tax For Those Who Earn Below ₹7 Lakh Per Year

How No Income Tax on ₹7 Lakh INCOME | New 2024 INCOME TAX SLAB | with Calculation #INCOMETAX #SLAB

No tax till 7 lakh - Shandar ya doglapan? Budget new tax slab - BUDGET 2023 #shorts #iafkshorts

No income tax for those earning up to 7 lakhs annually (only for new tax regime)

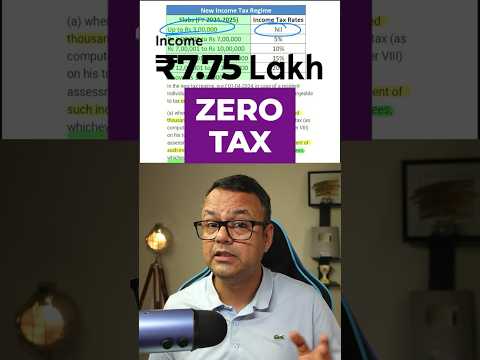

Zero Tax on ₹7.75 Lakh Income? Here's How! 🚀

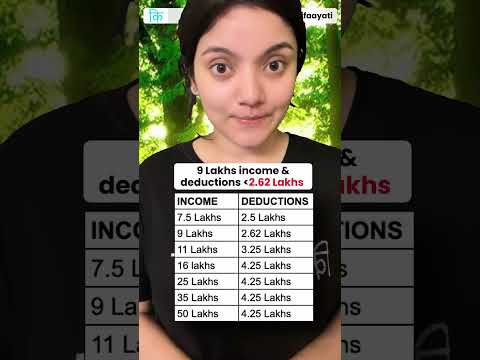

Pay 0 Tax on 9.5 Lakh Salary #tax #finance #education #law

Zero Tax till 7 LACS! Explained #unfinance #budget2023

ZERO TAX till 7 Lakhs u/s 87A 👍 #shorts

Big Tax Confusion, Solved! #LLAShorts 520

Income Tax Rebate Limit Increased To Rs 7 Lakh From Rs 5 Lakh

No Income Tax up to 7.5 Lakh with New Tax Regime #shorts #fincalc

Budget 2023 - NO TAX UPTO Rs 7 lakh! Rebate on Income Tax Raised from 5 Lakhs to 7 Lakhs #shorts

New Income Tax Slabs 2024-25 | New Tax Regime vs Old Tax Regime Calculation | Budget 2024 Analysis

New Income Tax Calculation 2024-25 | Tax Slab Rates for Old & New Tax Regime

No Income Tax For Income Upto 7 Lakh/Year | New Tax Slab and Tax Rebate | Union Budget 2023

Why No tax upto 7 Lakh income?New income tax slab 2023|CA inter may 2023 Budget 2023|#budget #shorts

Zero Income Tax 🤩 in New Tax Regime? #epmshorts

New Tax Regime vs Old Tax Regime SIMPLIFIED

No Income Tax For Income Upto 7 Lakh/Year - Finance Minister Nirmala Sitaraman

No Tax on Income up to Rs. 7 lakh

Комментарии

0:13:34

0:13:34

0:01:00

0:01:00

0:00:43

0:00:43

0:00:59

0:00:59

0:00:26

0:00:26

0:04:18

0:04:18

0:00:59

0:00:59

0:00:25

0:00:25

0:01:19

0:01:19

0:01:00

0:01:00

0:01:00

0:01:00

0:00:53

0:00:53

0:01:00

0:01:00

0:05:51

0:05:51

0:00:49

0:00:49

0:00:53

0:00:53

0:11:02

0:11:02

0:13:13

0:13:13

0:03:11

0:03:11

0:00:39

0:00:39

0:00:51

0:00:51

0:00:47

0:00:47

0:00:59

0:00:59

0:00:41

0:00:41