filmov

tv

Fed Chair Jerome Powell: Inflation has persisted longer than we thought

Показать описание

Facing both turbulent financial markets and raging inflation, the Federal Reserve on Wednesday indicated it could soon raise interest rates for the first time in more than three years as part of a broader tightening in historically easy monetary policy.

In a move that came as little surprise, the Fed’s policymaking group said a quarter-percentage point increase to its benchmark short-term borrowing rate is likely forthcoming. It would be the first increase since December 2018.

Chairman Jerome Powell added that the Fed could move on an aggressive path.

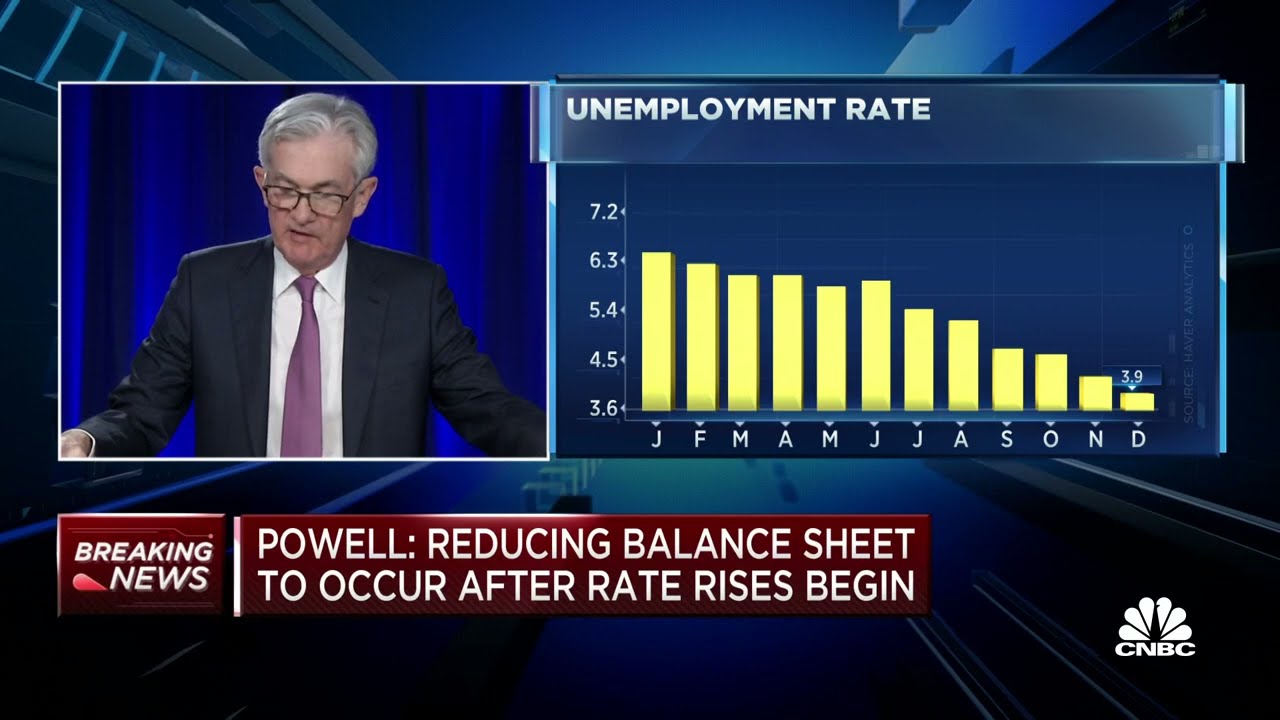

“I think there’s quite a bit of room to raise interest rates without threatening the labor market,” Powell said at his post-meeting news conference. After being up strongly earlier, the major stock market averages turned negative shortly following Powell’s pronouncement.

The committee’s statement came in response to inflation running at its hottest level in nearly 40 years. Though the move toward less accommodative policy has been well-telegraphed over the past several weeks, markets in recent days have been remarkably choppy as investors worried that the Fed might tighten policy even more than expected.

The post-meeting statement from the Federal Open Market Committee did not provide a specific time for when the increase will come, though indications are that it could happen as soon as the March meeting. The statement was adopted without dissent.

“With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be

appropriate to raise the target range for the federal funds rate,” the statement said. The Fed does not meet in February.

In addition, the committee noted the central bank’s monthly bond-buying will proceed at just $30 billion in February, indicating that program is expected to end in March as well at the same time that rates increase. Powell said later that the asset purchases indeed likely will end in March.

There were no specific indications Wednesday when the Fed might start to reduce bond holdings that have bloated its balance sheet to nearly $9 trillion.

However, the committee released a statement outlining “principles for reducing the size of the balance sheet.” The statement is prefaced with the notion that the Fed is preparing for “significantly reducing” the level of asset holdings.

That policy sheet noted that the benchmark funds rate is “primary means of adjusting the stance of monetary policy.” The committee further noted that the balance sheet reduction would happen after rate hikes start and would be “in a predictable manner” by adjusting how much of the bank’s proceeds from its bond holdings would be reinvested and how much would be allowed to roll off.

“The Fed’s announcement that it will ‘soon be appropriate’ to raise interest rates is a clear sign that a March rate hike is coming,” noted Michael Pearce, senior U.S. economist at Capital Economics. “The Fed’s plans to begin running down its balance sheet once rates begin to rise suggests an announcement on that could also come as soon as the next meeting, which would be slightly more hawkish than we expected.”

Markets had been anxiously awaiting the Fed’s decision. Stocks added to gains afterwards while government bond yields were mostly higher, though only slightly.

Investors had been expecting the Fed to tee up the first of multiple rate hikes, and in fact are pricing in a more aggressive schedule this year than FOMC officials indicated in their December outlook. At that time, the committee penciled in three 25 basis point moves this year, while the market is pricing in four hikes, according to the CME’s FedWatch tool that computes the probabilities through the fed funds futures market.

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBCTV

Комментарии

0:01:29

0:01:29

0:01:57

0:01:57

0:02:59

0:02:59

0:14:23

0:14:23

0:01:03

0:01:03

0:02:50

0:02:50

0:03:13

0:03:13

0:01:28

0:01:28

0:42:42

0:42:42

0:03:26

0:03:26

0:02:08

0:02:08

0:04:26

0:04:26

0:02:51

0:02:51

0:03:16

0:03:16

0:06:03

0:06:03

0:03:39

0:03:39

0:01:00

0:01:00

0:01:53

0:01:53

0:06:10

0:06:10

0:08:43

0:08:43

0:01:06

0:01:06

0:05:09

0:05:09

0:03:02

0:03:02

0:03:59

0:03:59