filmov

tv

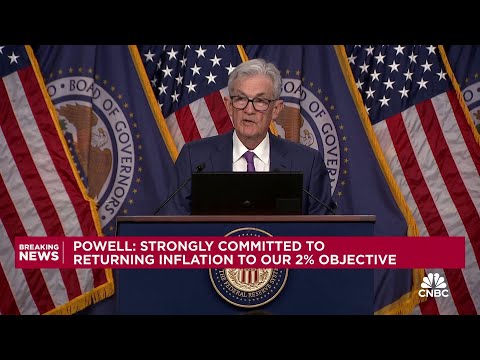

Fed Chair Powell: Inflation remains too high, and the labor market remains very tight

Показать описание

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBCTV

Fed Chair Powell: Inflation remains too high, and the labor market remains very tight

Fed Chair Powell: Slower economic growth may be needed to conquer stubbornly high inflation

Slowing inflation remains at an early stage, says Fed chair Jerome Powell

Fed Chair Powell: 2% will remain our inflation target

Fed chair Jerome Powell: We need to see inflation remain at 2%

Fed Chair Jerome Powell: Economic outlook uncertain, we remain highly attentive to inflation risks

Fed Chair Powell: Activity in housing remains weak

Fed Chair Powell on Banking System & Inflation

Fed Chair Powell: Soft landing remains a 'primary objective'

Fed's Jerome Powell: Inflation remains too high and path forward is uncertain

Fed Chair Jerome Powell: Labor market remains very tight

Fed Chair Powell Says Inflation Has Eased, Labor Market Is Solid

Fed Chair Powell: Activity in housing remains weak

Fed Chair Jerome Powell on the status of inflation

Fed Chair Powell: Want to be more confident that inflation is moving sustainably lower to 2%

Powell: 2% Is and Will Remain Our Inflation Target

Fed Chair Powell: Housing inflation is the one area that is 'dragging a bit'

Fed Chair Powell Says Inflation Has Eased, Labor Market Is Solid

Fed Chair Powell: We remain strongly committed to our 2% inflation goal

Fed's Powell: Long Way to Go to Get Inflation Down to 2%

Fed Chair Jerome Powell: Fed to keep rates higher to cut inflation

Fed Chair Powell: interest rates will remain near zero for time being

Fed chair Jerome Powell: One-time price increases not likely to lead to persistent inflation

Fed Chair Powell: We’re seeing inflation coming down

Комментарии

0:08:43

0:08:43

0:00:54

0:00:54

0:01:31

0:01:31

0:02:29

0:02:29

0:07:30

0:07:30

0:07:57

0:07:57

0:02:23

0:02:23

0:08:46

0:08:46

0:02:05

0:02:05

0:07:41

0:07:41

0:01:52

0:01:52

0:05:50

0:05:50

0:02:23

0:02:23

0:14:23

0:14:23

0:02:47

0:02:47

0:00:47

0:00:47

0:03:13

0:03:13

0:05:50

0:05:50

0:04:55

0:04:55

0:06:09

0:06:09

0:02:19

0:02:19

0:00:57

0:00:57

0:05:16

0:05:16

0:03:12

0:03:12