filmov

tv

Living on $100,000 After Taxes in the United Kingdom #unitedkingdom #uk #europe #salary

Показать описание

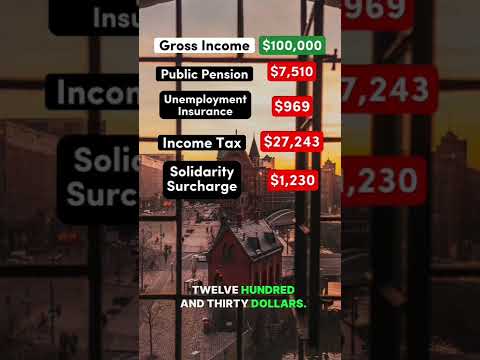

Living on $100k After Taxes in Germany #germany #conservative #liberal #taxes #salary

Living on $100,000 After Taxes in Florida #florida #democrat #republican #salary

Living on $100,000 After Taxes in the United Arab Emirates #uae #dubai #salary

Living on a $100k Salary After Taxes in England #england #uk #democrat #republican #viral

Living on $100,000 After Taxes in Maryland #maryland #taxes #democrat #republican #salary

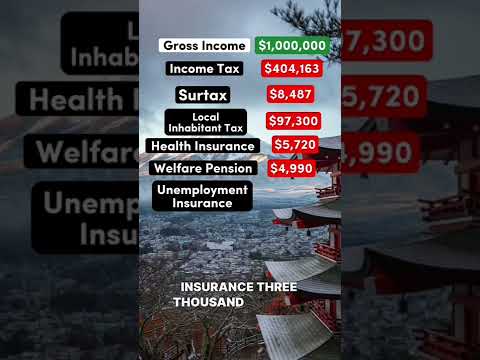

Living on $1,000,000 After Taxes in Japan #japan #democrat #republican #salary

Living on $100,000 After Taxes in India #india #democrat #republican #salary

Living on $100,000 After Taxes in the United Kingdom #unitedkingdom #uk #europe #salary

Living on $100,000 After Taxes in Hawaii #hawaii #democrat #republican #salary

Living on a $100,000 Salary After Taxes in Ireland #ireland #democrat #republican #salary

Living on $100,000 After Taxes in Stockholm, Sweden #sweden #democrat #republican #salary

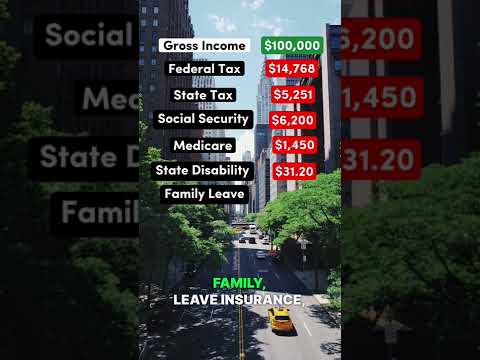

Surviving on $100k After Taxes in New York #newyork #democrat #nyc #republican #taxes #salary

Living on $100,000 After Taxes in Alberta, Canada #alberta #canada #democrat #republican #salary

Living on $100,000 After Taxes in Hong Kong #hongkong #china #democrat #republican #salary

Living on $100,000 After Taxes in Belgium #belgium #taxes #europe

Living on $100k After Taxes in Massachusetts #massachusetts #salary #viral #republican #democrat

Living on $100k After Taxes in Washington #washington #blowthisup #viral #republican #democrat

Living on $100k After Taxes in Portugal! #shorts #portugal #europe

Living on a $100,000 Salary After Taxes in Illinois #illinois #democrat #republican #salary

Living on $100,000 After Taxes in Bulgaria #bulgaria #democrat #republican #salary

Living on $100,000 After Taxes in New Zealand #newzealand #taxes #democrat #republican #salary

Living on $1 Million After Taxes in Zurich, Switzerland #switzerland #democrat #republican #salary

Living on $100k After Taxes in New Jersey #newjersey #taxes #democrat #republican #salary

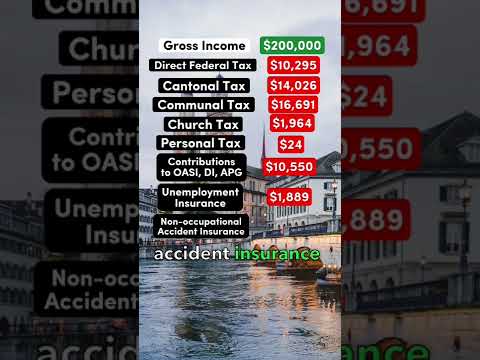

Living on $200,000 After Taxes in Zurich, Switzerland #switzerland #democrat #republican #salary

Комментарии

0:00:38

0:00:38

0:00:33

0:00:33

0:00:19

0:00:19

0:00:33

0:00:33

0:00:37

0:00:37

0:00:41

0:00:41

0:00:38

0:00:38

0:00:28

0:00:28

0:00:39

0:00:39

0:00:28

0:00:28

0:00:23

0:00:23

0:00:48

0:00:48

0:00:38

0:00:38

0:00:28

0:00:28

0:00:31

0:00:31

0:00:43

0:00:43

0:00:39

0:00:39

0:00:24

0:00:24

0:00:40

0:00:40

0:00:16

0:00:16

0:00:29

0:00:29

0:01:01

0:01:01

0:00:35

0:00:35

0:00:54

0:00:54