filmov

tv

Calculating Your Time-Weighted Rate of Return (TWRR)

Показать описание

In this two-part video series, I’m going to show you two popular ways to calculate your portfolio’s rate of return. In today’s part 1 video, I’ll cover the time-weighted rate of return (TWRR). In part 2, we’ll take a look at your money-weighted rate of return (MWRR).

Please feel free to download the model portfolios from my blog before getting started:

----

Follow Justin Bender on

Follow PWL Capital on:

Please feel free to download the model portfolios from my blog before getting started:

----

Follow Justin Bender on

Follow PWL Capital on:

Calculating Your Time-Weighted Rate of Return (TWRR)

Time Weighted Rate of Return (TWRR) Calculation Example

Calculating Your Money-Weighted Rate of Return (MWRR)

How to calculate Your Portfolio Return | Time Weighted Returns | Money Weighted Returns

Time Weighted Rate of Return | Exam FM | Financial Mathematics Lesson 27 - JK Math

How To Understand Investment Returns (MWR vs TWR??)

Time Weighted Rate of Return - How to calculate return on investment - CII R02, J10, J12, AF4

How to Calculate the Time Weighted Rate of Return

Special Lecture Programme || Material Costing by Kakali Bhattacharya

Time Weighted Rate of Return Examples | Exam FM | Financial Mathematics - JK Math

Money Weighted Versus Time Weighted Rates of Return

Calculating Time-Weighted Rate of Return

Calculating Your Rate of Return with the Modified Dietz Method

Time-Weighted Rate of Return (TWRR): Definition & Worked Example (CT1 video)

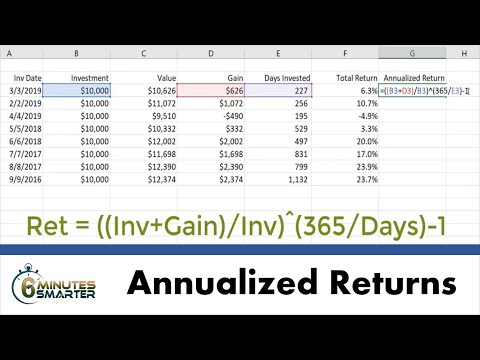

Calculate Annualized Returns for Investments in Excel

Dollar-Weighted and Time-Weighted Return Calculators with Example Problems (Google Sheets)

CFA Exam Level 1: Portfolio Management Time Weighted Rate of Return

Time Weighted Rate of Return & Money Weighted Rate of Return | TWRR & MWRR | CMA Final | CFA...

Time-Weighted Rate of Return Example Problem (Geometric Mean Return)

(Time Weighted Rate of Return) TWRR Explained | Wealthify

Dollar Weighted Rate of Return | Exam FM | Financial Mathematics Lesson 26 - JK Math

Time Weighted Rate of Return - Investing

TTWROR vs. IZF: Erklärung der Renditen in Portfolio Performance

Money Weighted Rate of Return - How to calculate return on investment 22/23 - CII R02, J10, J12, AF4

Комментарии

0:09:54

0:09:54

0:06:54

0:06:54

0:07:43

0:07:43

0:14:06

0:14:06

0:15:03

0:15:03

0:10:09

0:10:09

0:02:36

0:02:36

0:04:58

0:04:58

1:06:26

1:06:26

0:17:42

0:17:42

0:03:39

0:03:39

0:00:11

0:00:11

0:19:13

0:19:13

0:07:26

0:07:26

0:05:15

0:05:15

0:08:17

0:08:17

0:01:24

0:01:24

0:33:01

0:33:01

0:01:34

0:01:34

0:02:10

0:02:10

0:18:03

0:18:03

0:05:54

0:05:54

0:10:33

0:10:33

0:03:03

0:03:03