filmov

tv

Calculating Your Rate of Return with the Modified Dietz Method

Показать описание

In her debut video, Shannon explains how to calculate the Modified Dietz Method and the "Linked" Modified Dietz Method (and compares them to the money-weighted and time-weighted rates of return calculations from our previous videos).

----

Follow Justin Bender on

Follow PWL Capital on:

----

Follow Justin Bender on

Follow PWL Capital on:

Calculating Your Rate of Return with the Modified Dietz Method

How To Calculate Your Rate of Return

Math in Daily Life : How to Calculate Rate of Return

The Return On Investment (ROI) in One Minute: Definition, Explanation, Examples, Formula/Calculation

How to Calculate Your Rate of Return at Questrade

Calculating Your Rate of Return

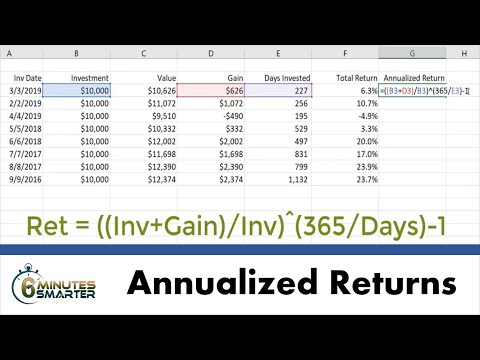

Calculate Annualized Returns for Investments in Excel

Calculating Your Money-Weighted Rate of Return (MWRR)

Understanding Cap Rates What Investors Should Know! #flippinghouses #realestatetips

Calculating Your Time-Weighted Rate of Return (TWRR)

How Is a 401(k) Rate of Return Calculated?

How to calculate stock returns

Calculating your Rate of return

Yield to Maturity Versus Rate of Return

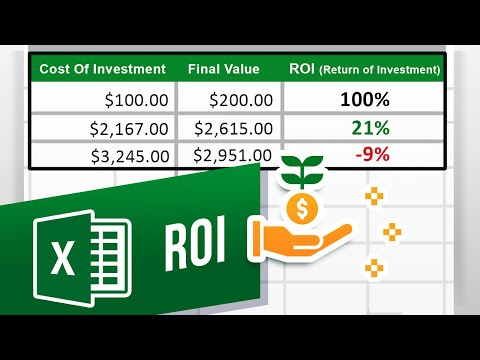

How to Calculate ROI (Return on Investment)

🔴 3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

Mint Money I DIY: Calculate your rate of return on Excel

Calculate your Rate of Return for Infinite banking

401k Returns: Understand Your Rate of Return (Compare, Calculate, & More)

How to Calculate Your Real Rate of Return | Making Sense with Ed Butowsky

Time Weighted Rate of Return - How to calculate return on investment - CII R02, J10, J12, AF4

HOW TO CALCULATE REAL RATE OF RETURN- After taxes and inflation, your return may be less. #invest

Calculating the Real Rate of Return (Finance)

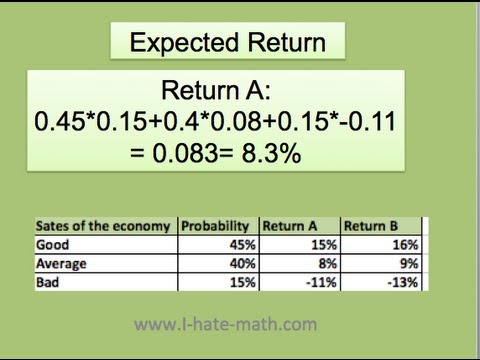

How to find the Expected Return and Risk

Комментарии

0:19:13

0:19:13

0:05:17

0:05:17

0:02:04

0:02:04

0:01:20

0:01:20

0:04:05

0:04:05

0:05:31

0:05:31

0:05:15

0:05:15

0:07:43

0:07:43

0:00:57

0:00:57

0:09:54

0:09:54

0:05:58

0:05:58

0:06:41

0:06:41

0:04:20

0:04:20

0:05:46

0:05:46

0:01:53

0:01:53

0:03:27

0:03:27

0:03:20

0:03:20

0:06:19

0:06:19

0:19:40

0:19:40

0:03:45

0:03:45

0:02:36

0:02:36

0:04:40

0:04:40

0:03:55

0:03:55

0:06:53

0:06:53