filmov

tv

Steps of Revenue Recognition: Example 1, 101

Показать описание

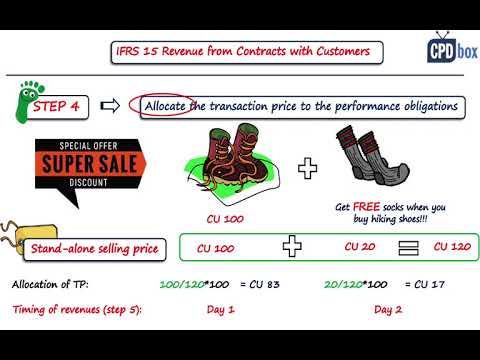

For Revenue from Contracts with Customers:

[An Example]

(1) Contract

To deliver Equipment and Service.

(2) Two Performance Obligations (POB):

(2a) Deliver Equipment on Dec. 31, 2022

(2b) Maintenance Service for 2023

(3) Total Transaction Price (TTP) $48,000

(4) Standalone Selling Price (SSP)

(4a) Equipment $34,000

(4b) Maintenance Service $16,000

Total SSP = $50,000

(5) Amount of Revenue Recognized (ARR)

(5a) Dec. 31, 2022, Equipment portion

$48,000 x (34,000 / 50,000) = $32,640

(5b) Dec. 31, 2023, Service portion

$48,000 x (16,000 / 50,000) = $15,360

Total Revenue from the Contract = $48,000

#Financial Accounting #Finance #Financial Statement Analysis #Earnings #Profit #GAAP #Generally Accepted Accounting Principles

#Revenue Recognition #Revenue from Contracts with Customers

#Standalone Selling Price

[An Example]

(1) Contract

To deliver Equipment and Service.

(2) Two Performance Obligations (POB):

(2a) Deliver Equipment on Dec. 31, 2022

(2b) Maintenance Service for 2023

(3) Total Transaction Price (TTP) $48,000

(4) Standalone Selling Price (SSP)

(4a) Equipment $34,000

(4b) Maintenance Service $16,000

Total SSP = $50,000

(5) Amount of Revenue Recognized (ARR)

(5a) Dec. 31, 2022, Equipment portion

$48,000 x (34,000 / 50,000) = $32,640

(5b) Dec. 31, 2023, Service portion

$48,000 x (16,000 / 50,000) = $15,360

Total Revenue from the Contract = $48,000

#Financial Accounting #Finance #Financial Statement Analysis #Earnings #Profit #GAAP #Generally Accepted Accounting Principles

#Revenue Recognition #Revenue from Contracts with Customers

#Standalone Selling Price

0:10:03

0:10:03

0:02:48

0:02:48

0:00:57

0:00:57

0:07:54

0:07:54

0:02:17

0:02:17

0:09:57

0:09:57

0:02:44

0:02:44

0:07:21

0:07:21

2:00:43

2:00:43

0:09:37

0:09:37

0:29:16

0:29:16

0:00:15

0:00:15

0:02:31

0:02:31

0:08:39

0:08:39

0:06:48

0:06:48

0:18:24

0:18:24

0:15:21

0:15:21

0:16:02

0:16:02

0:04:09

0:04:09

0:02:35

0:02:35

0:07:36

0:07:36

0:04:30

0:04:30

0:19:58

0:19:58

0:50:23

0:50:23