filmov

tv

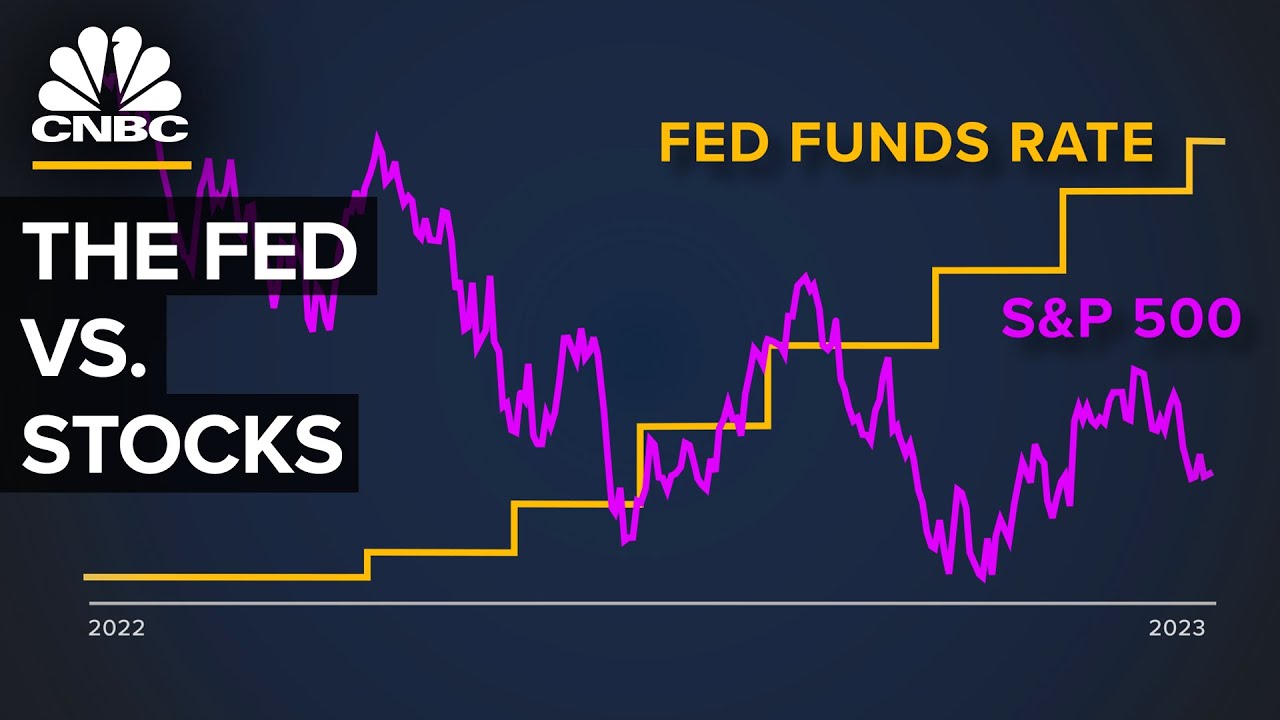

How The Government’s Bank Shapes The Stock Market

Показать описание

When members of the Federal Reserve make public statements, investors tend to listen. Over the past 2 decades, central bankers have consistently shared key information about the future trajectory of important inputs like interest rates. The Fed's forward guidance on interest rates amid historic inflation has taken stock markets for a ride in 2022. As investors wait for a pivot, a panel of experts explain why many in the market choose not to fight the Fed.

Producer: Carlos Waters

Supervising Producer: Lindsey Jacobson

Editor: Amy Marino

Camera: Blake Griffin, Magdalena Petrova

About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.

Connect with CNBC News Online

#CNBC

How The Government’s Bank Shapes The Stock Market

Producer: Carlos Waters

Supervising Producer: Lindsey Jacobson

Editor: Amy Marino

Camera: Blake Griffin, Magdalena Petrova

About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.

Connect with CNBC News Online

#CNBC

How The Government’s Bank Shapes The Stock Market

How The Government’s Bank Shapes The Stock Market

The International Monetary Fund (IMF) and the World Bank Explained in One Minute

How to spot a pyramid scheme - Stacie Bosley

How the Fed Steers Interest Rates to Guide the Entire Economy | WSJ

Why Companies Are 'Debranding'

How does the EU work (and why is it so complex)? | DW News

Why The U.S. Won’t Pay Down Its Debt

Monetary and Fiscal Policy: Crash Course Government and Politics #48

How to Answer Any Question on a Test

ABSTRACT REASONING Test Questions!

What is the Yield Curve, and Why is it Flattening?

The Ants Go Marching - Kids Songs and Nursery Rhymes | Bounce Patrol

The History of Global Banking: A Broken System?

fake money 🤣🤣😁

Racial Segregation and Concentrated Poverty: The History of Housing in Black America

How Hackers Stole $1.000.000.000 From Banks (Carbanak) Documentary

What’s going wrong in Cuba? | Start Here

Is The Government Hiding Alien Technology?

How A Professional Chef Cuts An Onion

How England Managed To Invade 90% Of The World

Botswana: How to Make a Country Rich (From Scratch)

60 Years Old and Nothing Saved for Retirement - Top 12 Recommendations

What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #1...

Could digital currencies put banks out of business?

Комментарии

0:13:40

0:13:40

0:01:24

0:01:24

0:05:02

0:05:02

0:05:19

0:05:19

0:03:04

0:03:04

0:05:09

0:05:09

0:11:28

0:11:28

0:09:19

0:09:19

0:00:27

0:00:27

0:13:25

0:13:25

0:08:59

0:08:59

0:02:27

0:02:27

0:21:54

0:21:54

0:00:16

0:00:16

0:06:02

0:06:02

0:15:59

0:15:59

0:09:02

0:09:02

0:19:21

0:19:21

0:00:29

0:00:29

0:19:08

0:19:08

0:06:24

0:06:24

0:16:49

0:16:49

0:09:25

0:09:25

0:11:10

0:11:10