filmov

tv

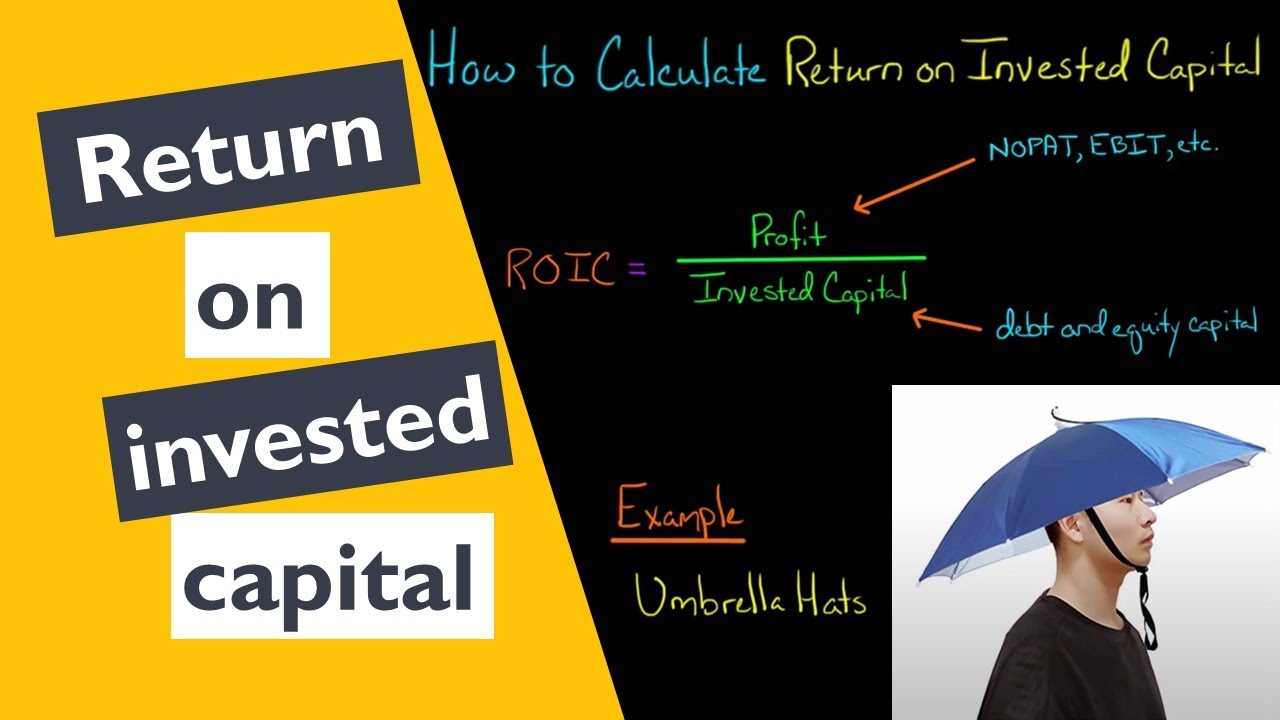

How to Calculate Return on Invested Capital

Показать описание

There are several different ways to calculate a company’s return on invested capital (ROIC).

Each method is a variation of this basic formula:

Return on Invested Capital = Profit / Invested Capital

You’re dividing some measure of profit by the company’s debt and equity capital.

The question is how to measure profit and how to measure invested capital.

Some people measure profit as net income, EBIT, NOPAT, or NOPLAT.

Some people measure invested capital as the average debt and stockholders' equity, while others subtract cash and cash equivalents from that amount.

If you're trying to calculate a company's return on invested capital, one of the more common ways is to divide the company's NOPAT (net operating profit after taxes, which is equivalent to EBIT times one minus the tax rate) by the average of the company's debt and stockholders' equity.

Return on Invested Capital = NOPAT / Average debt and stockholders' equity

The return on invested capital can then be compared to the company's weighted-average cost of capital. If the ROIC exceeds the WACC, the company is creating value. If ROIC is less than WACC, the company is destroying value.

0:00 Introduction

0:19 Example 1

0:47 How to measure profit

1:28 How to measure invested capital

2:13 McKinsey's ROIC formula

2:32 WSJ ROIC formula

2:56 Pepsi's ROIC formula

3:17 Target's ROIC formula

3:39 Recommended formula

4:00 Example 2

4:59 Comparing ROIC to WACC

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Each method is a variation of this basic formula:

Return on Invested Capital = Profit / Invested Capital

You’re dividing some measure of profit by the company’s debt and equity capital.

The question is how to measure profit and how to measure invested capital.

Some people measure profit as net income, EBIT, NOPAT, or NOPLAT.

Some people measure invested capital as the average debt and stockholders' equity, while others subtract cash and cash equivalents from that amount.

If you're trying to calculate a company's return on invested capital, one of the more common ways is to divide the company's NOPAT (net operating profit after taxes, which is equivalent to EBIT times one minus the tax rate) by the average of the company's debt and stockholders' equity.

Return on Invested Capital = NOPAT / Average debt and stockholders' equity

The return on invested capital can then be compared to the company's weighted-average cost of capital. If the ROIC exceeds the WACC, the company is creating value. If ROIC is less than WACC, the company is destroying value.

0:00 Introduction

0:19 Example 1

0:47 How to measure profit

1:28 How to measure invested capital

2:13 McKinsey's ROIC formula

2:32 WSJ ROIC formula

2:56 Pepsi's ROIC formula

3:17 Target's ROIC formula

3:39 Recommended formula

4:00 Example 2

4:59 Comparing ROIC to WACC

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:02:48

0:02:48

0:01:53

0:01:53

0:15:07

0:15:07

0:02:52

0:02:52

0:00:39

0:00:39

0:06:41

0:06:41

0:10:01

0:10:01

0:06:06

0:06:06

![[Solution] GoSkills Excel](https://i.ytimg.com/vi/gKGKXjZFsic/hqdefault.jpg) 0:12:21

0:12:21

0:02:04

0:02:04

0:01:44

0:01:44

0:02:09

0:02:09

0:06:17

0:06:17

0:00:15

0:00:15

0:05:15

0:05:15

0:00:58

0:00:58

0:04:58

0:04:58

0:01:32

0:01:32

0:03:56

0:03:56

0:01:26

0:01:26

0:06:42

0:06:42

0:00:59

0:00:59

0:13:45

0:13:45

0:00:12

0:00:12