filmov

tv

How To Calculate Cash-On-Cash Return

Показать описание

---

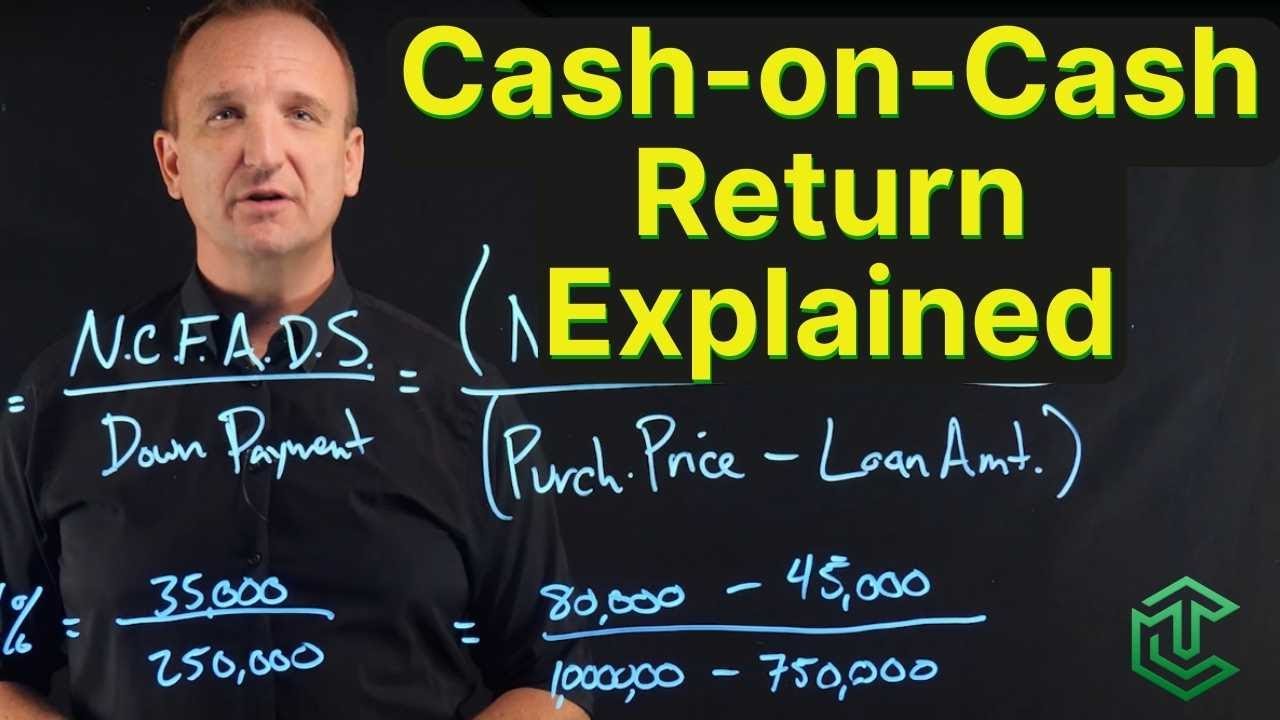

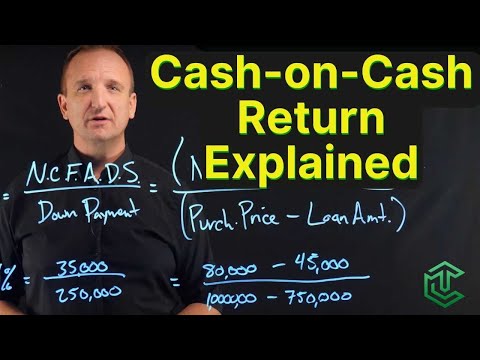

Cash-on-cash return is a real estate term related to cap rates, but accounts for leverage when determining an investor's actual return on investment. Cash-on-cash return takes into account the fact that investors typically use part down payment and part loan in order to buy a piece of real estate. So, cash on cash return really tells us the return on investment to the investor after accounting for leverage. Let's take a look at the formulas, and then we'll work through it and see how it's related.

1. Cash-on-Cash Return = Net Cash Flow / Down Payment

2. Net Cash Flow = Net Operating Income - Debt Service

3. Down Payment = Purchase Price - Loan Amount

Cash-on-cash return, often expressed as "C/C", is simply our net cash flow after debt service divided by the down payment. We arrive at this formula by extrapolating it from another formula. So let's take a look at it. It's actually our net operating income minus our debt service, over our value, or purchase price, minus our loan amount.

Imagine here we have $80,000 of net operating income and we have $45,000 in annual debt service. That gives us $35,000 of net cash flow. If our purchase price was a million and we leveraged 750,000 of that, then our down payment would be 250,000. So our net cash flow divided by our down payment would equal approximately 14%.

#realestateinvesting #realestate #TrevorCalton #realestatefinance #investing #commercialrealestate #commercialloan #commercialloans #apartmentloan #multifamilyloan #apartmentinvesting #multifamilyinvesting #EvergreenLLC #commercialloan #commercialloans #stepbystep #stepbysteptutorial #diagram #example #download #freedownload #howto

CRE loan

investing in real estate

investment properties and commercial real estate

commercial real estate lending

commercial real estate loan

SBA commercial real estate loan

commercial real estate financing

commercial property loan

commercial building loan

real estate lending

best commercial real estate loans

commercial property lending

OTHER QUERIES:

return on investment

real estate

finance

investing

cash on cash return real estate

how to calculate cash on cash return

cash on cash return formula

real estate investing

cash on cash return explained

what is cash on cash return

cash on cash return in real estate

cash on cash return calculator

rental property investing

what is cash on cash return in real estate

real estate rookie

commercial real estate

return on equity

bigger pockets

Cash-on-cash return is a real estate term related to cap rates, but accounts for leverage when determining an investor's actual return on investment. Cash-on-cash return takes into account the fact that investors typically use part down payment and part loan in order to buy a piece of real estate. So, cash on cash return really tells us the return on investment to the investor after accounting for leverage. Let's take a look at the formulas, and then we'll work through it and see how it's related.

1. Cash-on-Cash Return = Net Cash Flow / Down Payment

2. Net Cash Flow = Net Operating Income - Debt Service

3. Down Payment = Purchase Price - Loan Amount

Cash-on-cash return, often expressed as "C/C", is simply our net cash flow after debt service divided by the down payment. We arrive at this formula by extrapolating it from another formula. So let's take a look at it. It's actually our net operating income minus our debt service, over our value, or purchase price, minus our loan amount.

Imagine here we have $80,000 of net operating income and we have $45,000 in annual debt service. That gives us $35,000 of net cash flow. If our purchase price was a million and we leveraged 750,000 of that, then our down payment would be 250,000. So our net cash flow divided by our down payment would equal approximately 14%.

#realestateinvesting #realestate #TrevorCalton #realestatefinance #investing #commercialrealestate #commercialloan #commercialloans #apartmentloan #multifamilyloan #apartmentinvesting #multifamilyinvesting #EvergreenLLC #commercialloan #commercialloans #stepbystep #stepbysteptutorial #diagram #example #download #freedownload #howto

CRE loan

investing in real estate

investment properties and commercial real estate

commercial real estate lending

commercial real estate loan

SBA commercial real estate loan

commercial real estate financing

commercial property loan

commercial building loan

real estate lending

best commercial real estate loans

commercial property lending

OTHER QUERIES:

return on investment

real estate

finance

investing

cash on cash return real estate

how to calculate cash on cash return

cash on cash return formula

real estate investing

cash on cash return explained

what is cash on cash return

cash on cash return in real estate

cash on cash return calculator

rental property investing

what is cash on cash return in real estate

real estate rookie

commercial real estate

return on equity

bigger pockets

Комментарии

0:02:23

0:02:23

0:02:55

0:02:55

0:07:05

0:07:05

0:07:35

0:07:35

0:00:28

0:00:28

0:11:13

0:11:13

0:07:51

0:07:51

0:06:11

0:06:11

0:12:36

0:12:36

0:01:21

0:01:21

0:04:57

0:04:57

0:35:11

0:35:11

0:04:02

0:04:02

0:00:59

0:00:59

0:07:49

0:07:49

0:18:04

0:18:04

0:08:03

0:08:03

0:04:31

0:04:31

0:00:42

0:00:42

0:00:36

0:00:36

0:00:45

0:00:45

0:08:57

0:08:57

0:13:43

0:13:43

0:16:45

0:16:45