filmov

tv

Home Loan EMI Prepayment | How to Save Home Loan Interest Amount | Loan EMI Calculator

Показать описание

Home Loan EMI Prepayment Calculator | How to Save Home Loan Interest Amount | Save Loan Interest

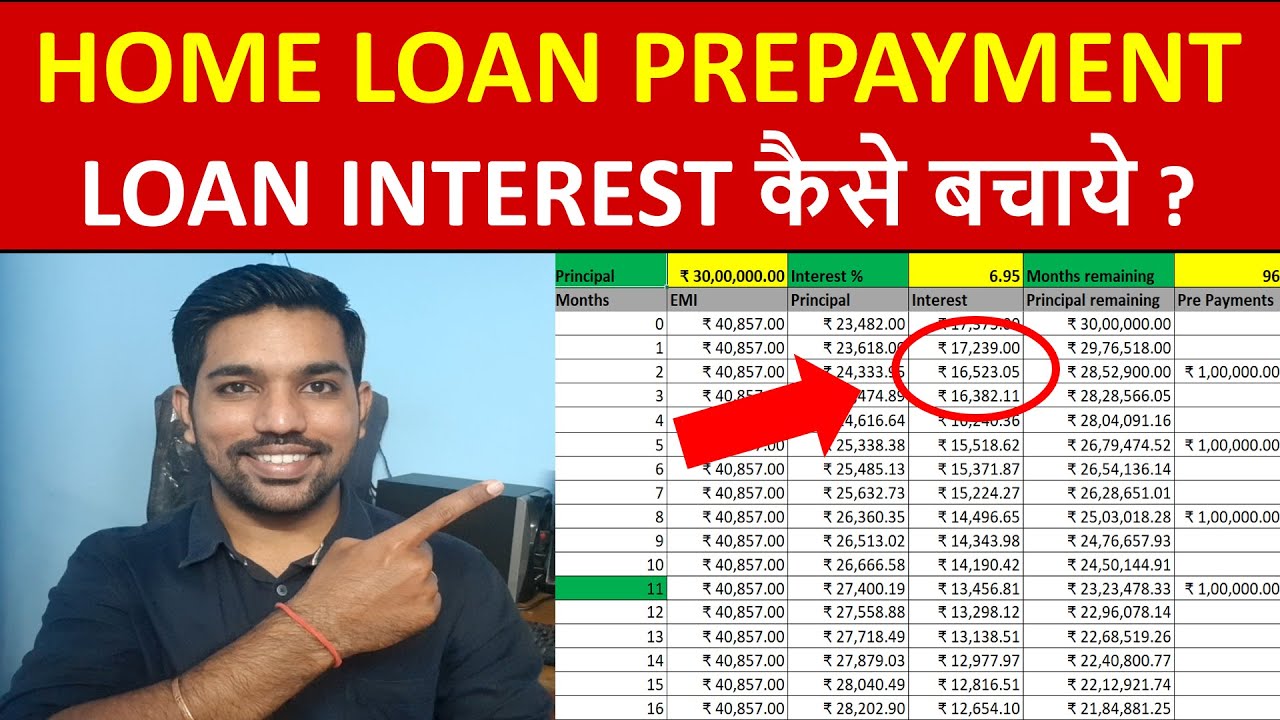

In this video by FinCalC TV, we will see how to calculate home loan EMI and interest using Excel Calculator formula examples in hindi, save home loan interest using prepayment and home loan principal & interest amounts calculation excel sheet prepayment option. We will also see how you can save home loan interest by home loan repayment calculation. We will also see how interest and principal amounts of Home Loan EMI will be calculated. Home loan EMI can be increased to reduce the total interest.

DOWNLOAD Home Loan EMI Excel Calculator:

After watching this video following queries will be solved:

How to calculate home loan EMI?

How to Save home loan interest?

How to calculate home loan EMI in excel sheet?

What is home loan EMI calculation excel formula?

What is home loan EMI calculation formula?

How to reduce home loan interest?

Loan prepayment excel examples to save loan interest?

Home loan prepayment or repayment options?

Principal and interest amounts of home loan emi?

Home loan emi increase will save interest amount?

Increase in EMI will decrease loan interest payment?

Benefits of home loan prepayments?

What is home loan emi not paid?

DOWNLOAD our FREE ANDROID APP "FinCalC":

OUR 2nd CHANNEL LINK:

What is Home Loan EMI Calculator?

Home Loan EMI Calculator assists in calculation of the loan installment i.e. EMI towards your home loan. It an easy to use calculator and acts as a financial planning tool for a home buyer.

What is Home Loan EMI?

EMI stands for Equated Monthly Installment. It includes repayment of the principal amount and payment of the interest on the outstanding amount of your home loan. A longer loan tenure (for a maximum period of 30 years) helps in reducing the EMI.

How does EMI calculation help in planning the home purchase?

Home Loan EMI calculator gives a clear understanding of the amount that needs to be paid towards the EMIs and helps make an informed decision about the outflow towards the housing loan every month. This helps estimate the loan amount that can be availed and helps in assessing the own contribution requirements and cost of the property. Therefore knowing the EMI is crucial for calculation of home loan eligibility and planning your home buying journey better.

Factors that Affect Housing Loan EMI

Principal- The principal is the loan amount that you avail from the lender. It is directly proportional to your EMIs - lower principal will lower your monthly instalments and vice versa.

Rate of interest- The rate of interest is the rate at which the lender offers you the loan. It is also directly proportional to the value of your loan EMIs.

Tenure- The tenure is the time within which you repay your loan. The tenure is inversely proportional to your loan EMIs - longer tenure makes the monthly instalments cheaper and vice versa.

What is Home Loan Amortization Schedule?

Loan amortization is the process of reducing the debt with regular payments over the loan period. A home loan amortization schedule is a table giving the details of the repayment amount, principal and interest component.

EMI calculators give a fair understanding about the ratio of the principal amount to the interest due, based on the loan tenure and interest rates. EMI calculator also provides an amortization table elucidating the repayment schedule. Home loan calculator provides a complete break-up of the interest and principal amount.

How do part-prepayments impact your EMIs?

Part-prepayment brings down the principal amount, which in turn lowers the interest amount that you have to pay, which results in lower EMI amounts overall.

#LoanEMICalculator #LoanPrepayment #EMIExcelFormula #Excel #Calculator #FinCalCTV

=============================

LIKE || SHARE || COMMENT || SUBSCRIBE

Mujhe Social Media par FOLLOW kare:

==========================================

PPF Interest Calculation with Examples in EXCEL:

Income Tax Calculation using EXCEL:

Senior Citizen Savings Scheme EXCEL Calculator:

Fixed Deposits EXCEL Calculator:

Income Tax Calculation for Senior Citizens Video:

==========================================

DISCLAIMER:

Examples used are for Illustration purpose only and might not cover every detail of examples shown. It is advised to seek professional help before taking any financial decisions. The owner of this channel shall not be liable in any way.

In this video by FinCalC TV, we will see how to calculate home loan EMI and interest using Excel Calculator formula examples in hindi, save home loan interest using prepayment and home loan principal & interest amounts calculation excel sheet prepayment option. We will also see how you can save home loan interest by home loan repayment calculation. We will also see how interest and principal amounts of Home Loan EMI will be calculated. Home loan EMI can be increased to reduce the total interest.

DOWNLOAD Home Loan EMI Excel Calculator:

After watching this video following queries will be solved:

How to calculate home loan EMI?

How to Save home loan interest?

How to calculate home loan EMI in excel sheet?

What is home loan EMI calculation excel formula?

What is home loan EMI calculation formula?

How to reduce home loan interest?

Loan prepayment excel examples to save loan interest?

Home loan prepayment or repayment options?

Principal and interest amounts of home loan emi?

Home loan emi increase will save interest amount?

Increase in EMI will decrease loan interest payment?

Benefits of home loan prepayments?

What is home loan emi not paid?

DOWNLOAD our FREE ANDROID APP "FinCalC":

OUR 2nd CHANNEL LINK:

What is Home Loan EMI Calculator?

Home Loan EMI Calculator assists in calculation of the loan installment i.e. EMI towards your home loan. It an easy to use calculator and acts as a financial planning tool for a home buyer.

What is Home Loan EMI?

EMI stands for Equated Monthly Installment. It includes repayment of the principal amount and payment of the interest on the outstanding amount of your home loan. A longer loan tenure (for a maximum period of 30 years) helps in reducing the EMI.

How does EMI calculation help in planning the home purchase?

Home Loan EMI calculator gives a clear understanding of the amount that needs to be paid towards the EMIs and helps make an informed decision about the outflow towards the housing loan every month. This helps estimate the loan amount that can be availed and helps in assessing the own contribution requirements and cost of the property. Therefore knowing the EMI is crucial for calculation of home loan eligibility and planning your home buying journey better.

Factors that Affect Housing Loan EMI

Principal- The principal is the loan amount that you avail from the lender. It is directly proportional to your EMIs - lower principal will lower your monthly instalments and vice versa.

Rate of interest- The rate of interest is the rate at which the lender offers you the loan. It is also directly proportional to the value of your loan EMIs.

Tenure- The tenure is the time within which you repay your loan. The tenure is inversely proportional to your loan EMIs - longer tenure makes the monthly instalments cheaper and vice versa.

What is Home Loan Amortization Schedule?

Loan amortization is the process of reducing the debt with regular payments over the loan period. A home loan amortization schedule is a table giving the details of the repayment amount, principal and interest component.

EMI calculators give a fair understanding about the ratio of the principal amount to the interest due, based on the loan tenure and interest rates. EMI calculator also provides an amortization table elucidating the repayment schedule. Home loan calculator provides a complete break-up of the interest and principal amount.

How do part-prepayments impact your EMIs?

Part-prepayment brings down the principal amount, which in turn lowers the interest amount that you have to pay, which results in lower EMI amounts overall.

#LoanEMICalculator #LoanPrepayment #EMIExcelFormula #Excel #Calculator #FinCalCTV

=============================

LIKE || SHARE || COMMENT || SUBSCRIBE

Mujhe Social Media par FOLLOW kare:

==========================================

PPF Interest Calculation with Examples in EXCEL:

Income Tax Calculation using EXCEL:

Senior Citizen Savings Scheme EXCEL Calculator:

Fixed Deposits EXCEL Calculator:

Income Tax Calculation for Senior Citizens Video:

==========================================

DISCLAIMER:

Examples used are for Illustration purpose only and might not cover every detail of examples shown. It is advised to seek professional help before taking any financial decisions. The owner of this channel shall not be liable in any way.

Комментарии

0:19:49

0:19:49

0:03:44

0:03:44

0:06:32

0:06:32

0:03:33

0:03:33

0:16:05

0:16:05

0:00:59

0:00:59

0:17:15

0:17:15

0:17:47

0:17:47

0:14:30

0:14:30

0:01:49

0:01:49

0:00:42

0:00:42

0:00:57

0:00:57

0:02:03

0:02:03

0:00:43

0:00:43

0:00:42

0:00:42

0:24:12

0:24:12

0:01:00

0:01:00

0:01:01

0:01:01

0:15:45

0:15:45

0:00:52

0:00:52

0:01:00

0:01:00

0:01:00

0:01:00

0:01:01

0:01:01

0:20:00

0:20:00