filmov

tv

Small Interest Rates - BIG LOANS! | Ankur Warikoo #shorts

Показать описание

------------------------------------------------------------------------------------------------------------------------------

My bestselling books:

My gear for shooting this video:

Useful links:

The above links are on Amazon.

If you buy any of these using the above links, I stand to make affiliate income from it. 100% of this income is contributed towards the education of kids who cannot afford it. In 2021 we contributed 38L and in 2022 we contributed 53L.

Let’s connect online:

My bestselling books:

My gear for shooting this video:

Useful links:

The above links are on Amazon.

If you buy any of these using the above links, I stand to make affiliate income from it. 100% of this income is contributed towards the education of kids who cannot afford it. In 2021 we contributed 38L and in 2022 we contributed 53L.

Let’s connect online:

Small Interest Rates - BIG LOANS! | Ankur Warikoo #shorts

How a small interest rate change can cost you big

Why Cutting Interest Rates Causes Inflation Explained

Post Office Saving Schemes interest rates and maturity values Table from 01/01/2024 to 31/03/2024

Interest Rates Explained #inflation #interestrates #economics

Tim Walz: Why Is MAGA Booing Low Interest Rates?

How does raising interest rates control inflation?

SBI FD interest rates 2025 | FD interest rates in SBI Bank

Rising Interest Rates WON'T Crash Housing- Here's Why

Is The US Economy Headed for a Recession?: 3-Minute MLIV

SBA Loans Explained: Types of Loans, Interest Rates, and What to Expect From the Process

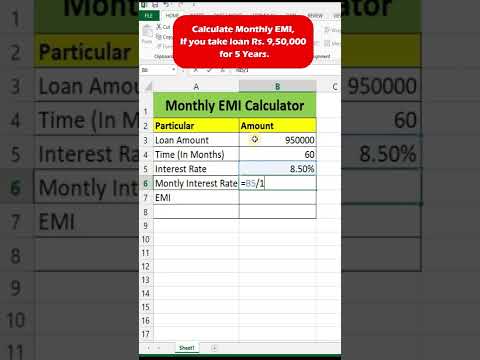

Calculate Monthly EMI for your loan amount🤩🤩

Government Bank Highest FD interest rates 2024 | Highest FD interest rates in Which Gov. Bank

Small change in interest rates = big impact on your wallet 💸

How Low Will Canadian Interest Rates Go in 2025 - What to Expect

Government Bank Highest FD interest rates 2024 | Highest FD interest rates in Which Gov. Bank

Low Interest Rates Are On SALE with These 'Secret' Mortgages

The Pros and Cons of Personal Loans

Top Banks Rate of Interest #bank #roi #rateofinterest #shorts #sbi #viral #fd

Big Story | Government slashes interest rates of small savings scheme

Why Are Bank Savings Interest Rates So Low?

What's So Bad About Low Interest Rates

Falling interest rates will cause a huge asset rally

Are your FIXED DEPOSITS really SAFE? | Ankur Warikoo #shorts

Комментарии

0:00:49

0:00:49

0:01:36

0:01:36

0:08:01

0:08:01

0:00:06

0:00:06

0:00:36

0:00:36

0:00:26

0:00:26

0:08:14

0:08:14

0:00:07

0:00:07

0:00:28

0:00:28

0:03:06

0:03:06

0:07:28

0:07:28

0:00:34

0:00:34

0:00:07

0:00:07

0:00:08

0:00:08

0:08:08

0:08:08

0:00:07

0:00:07

0:12:46

0:12:46

0:09:03

0:09:03

0:00:13

0:00:13

0:03:19

0:03:19

0:04:58

0:04:58

0:01:01

0:01:01

0:01:00

0:01:00

0:00:35

0:00:35