filmov

tv

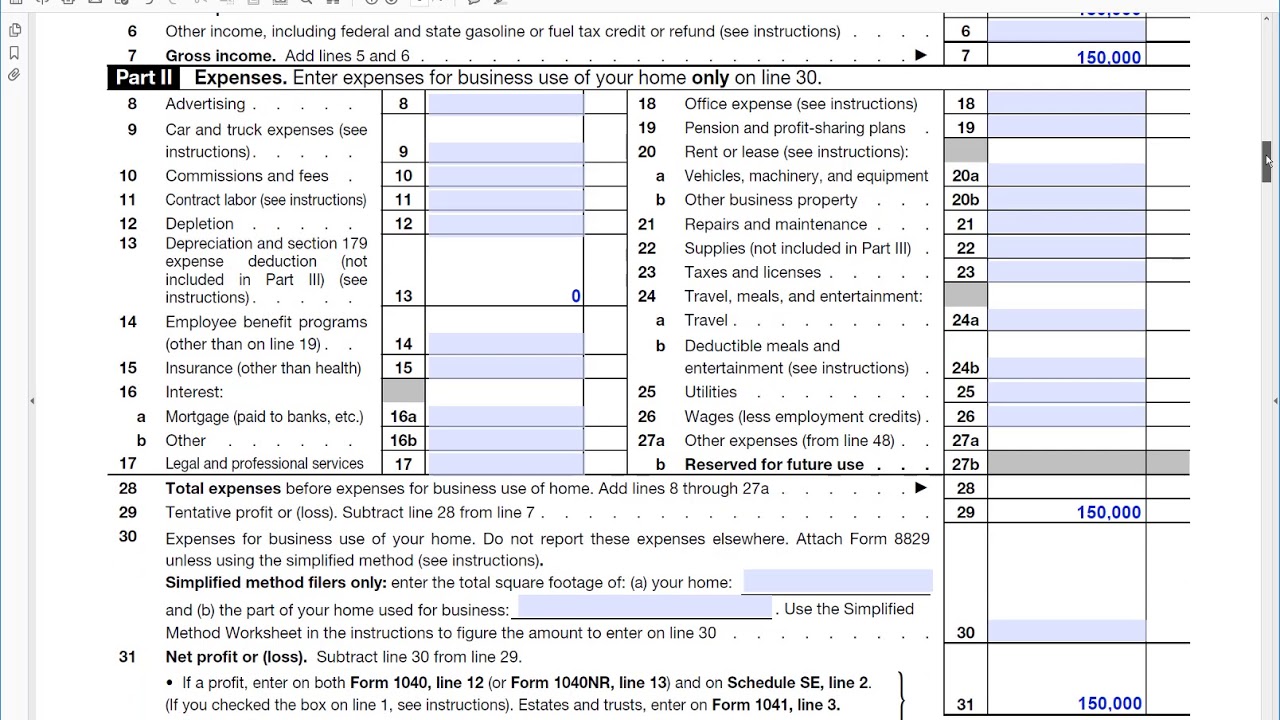

How to fill out a self-calculating Schedule C, Profit or Loss From Business

Показать описание

You can get the software here:

How to Fill Out a Money Order

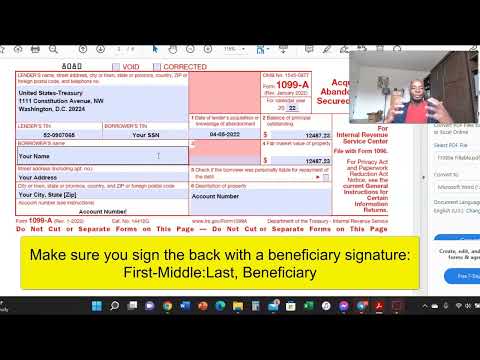

How To Fill Out The 1099A Form Debt Discharge Meet Your Strawman Pay Off Bills With Coupon

HOW TO FILL OUT PDF FORM THAT WAS SENT TO YOU ON IPHONE 2024

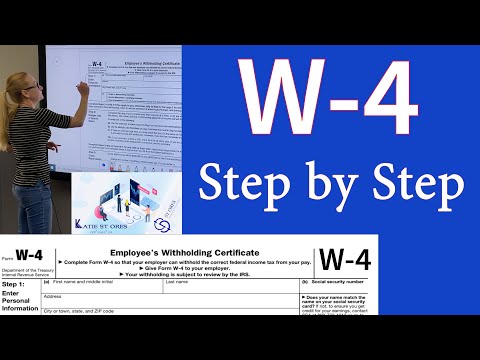

How to fill out a W4 Form

How to Fill in PDF Forms

How to fill out IRS form W4 Married Filing Jointly 2023

W9 Tax Form - How to fill out a Form W9, Tax Form W-9 and the 1099. Form W9 - W-9 Tax Form Explained

W4 tax form | w-4 tax form. How to fill out w4 tax form . Step by step, walk-through of w4.

how to fill out application sent by email on iphone

✅ How To Fill Out A Money Order 🔴

How To Fill Out A W-4 Form And Save On Taxes | NerdWallet

How to Fill Out a Pink Slip When Buying or Selling a Car

How to Fill out Form I-9: Easy Step-by-Step Instructions

How to Fill Out Form 1040 | Preparing your Taxes | Money Instructor

How to Fill Out the Free Application for Federal Student Aid (FAFSA®) Form

HOW TO FILL-OUT PHILHEALTH PMRF FORM 2020/PHILHEALTH/PHILIPPINES

How To Sign and Fill Out a PDF in Gmail

How to Fill Out Form 1040 for 2022 | Taxes 2023 | Money Instructor

How to Complete a Job Application

How to Fill Out a Car Title in Texas - Where to Sign when Selling Car?

How to fill out the IRS Form W4 2023

1099 NEC - How To Fill Out And File

11 PHRASAL VERBS with FILL: fill in, fill out, fill up...

How to Fill out IRS Form 941: Simple Step-by-Step Instructions

Комментарии

0:00:30

0:00:30

0:14:02

0:14:02

0:03:15

0:03:15

0:17:57

0:17:57

0:03:43

0:03:43

0:10:56

0:10:56

0:08:15

0:08:15

0:08:29

0:08:29

0:01:35

0:01:35

0:04:22

0:04:22

0:06:04

0:06:04

0:04:13

0:04:13

0:11:19

0:11:19

0:06:26

0:06:26

0:04:26

0:04:26

0:03:39

0:03:39

0:03:01

0:03:01

0:11:48

0:11:48

0:04:02

0:04:02

0:01:16

0:01:16

0:14:33

0:14:33

0:08:03

0:08:03

0:15:39

0:15:39

0:15:15

0:15:15