filmov

tv

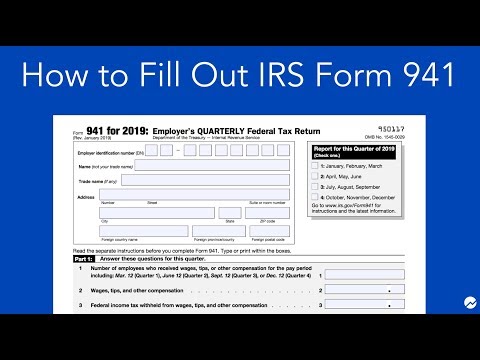

How to Fill out IRS Form 941: Simple Step-by-Step Instructions

Показать описание

Our video covers:

Form 941 Due Dates (1:01)

Part 1: Wage and Withholding Information for the Quarter (1:37)

Part 2: Deposit Schedule and Tax Liability (10:59)

Part 3: Business Information (12:44)

Part 4: Third-Party Designee (13:06)

Part 5: Signature and Title (13:39)

In this video, we provide a basic overview on filling out IRS Form 941. This video is not intended to provide legal advice or to form a professional relationship. We suggest contacting a business lawyer for advice specific to your circumstances.

How to Fill Out an IRS W-4 Form | Money Instructor

How to Fill out IRS Form 941: Simple Step-by-Step Instructions

How to fill out IRS Form 1040 for 2020

How to fill out IRS form W4 Married Filing Jointly 2023

How to Fill out IRS Form 2553: Easy-to-Follow Instructions

How to Fill out IRS Form SS-4

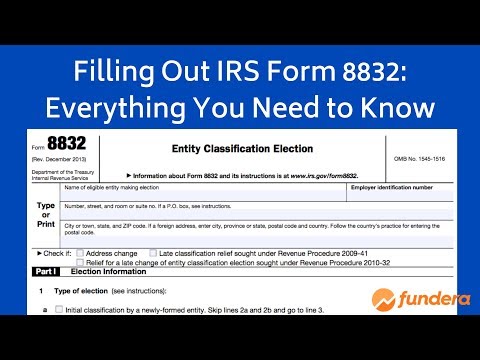

Filling out IRS Form 8832: An Easy-to-Follow Guide

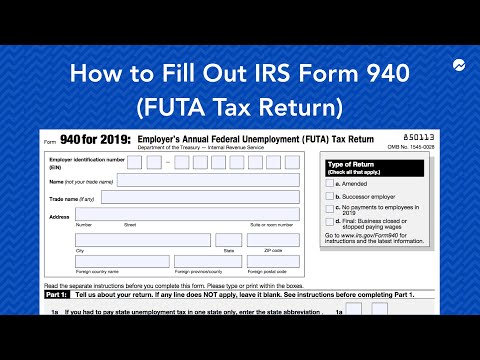

How to Fill out IRS Form 940 (FUTA Tax Return)

How to understand your CP53 Notice (IRS is sending tax refund by check instead of direct deposit)

How to fill out IRS form W4 SINGLE 2023

How to Complete IRS Form 1042-S for Payments to Nonresidents

How to fill out the IRS FORM W4 2023 LIKE A PRO!!!!

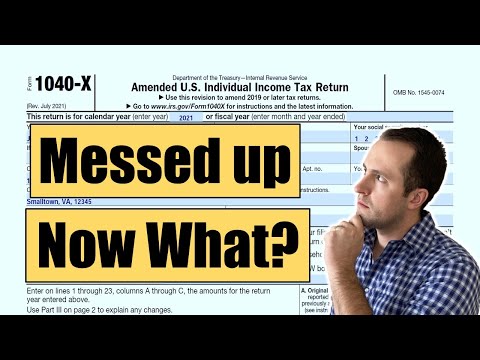

IRS Form 1040-X | How to File an Amended Tax Return

Filing Information Returns Electronically with the IRS

How to fill out the IRS Form W4 2023

How to Fill out IRS Form W4-P (2024)

How to Fill out IRS Form 2553 | S Corp Election | Complete Instructions

How to File Taxes for Free 2024 | IRS Free File

How to fill out IRS Form W-4P

2021 IRS Form 1040 Walkthrough | Single No Dependents

How to Fill Out IRS Form 8858 - Foreign Disregarded Entity

How to File Taxes For the First Time: Beginners Guide from a CPA

IRS Form W4 TAX ADJUSTMENT

How to Fill Out Form 1040 | Preparing your Taxes | Money Instructor

Комментарии

0:03:44

0:03:44

0:15:15

0:15:15

0:07:04

0:07:04

0:10:56

0:10:56

0:10:36

0:10:36

0:13:01

0:13:01

0:09:29

0:09:29

0:11:42

0:11:42

0:05:23

0:05:23

0:14:39

0:14:39

0:16:48

0:16:48

0:00:55

0:00:55

0:08:37

0:08:37

0:00:42

0:00:42

0:14:33

0:14:33

0:18:03

0:18:03

0:26:42

0:26:42

0:07:07

0:07:07

0:14:50

0:14:50

0:12:51

0:12:51

0:14:27

0:14:27

0:09:38

0:09:38

0:09:13

0:09:13

0:06:26

0:06:26