filmov

tv

Should You Pay Cash For A Rental Property

Показать описание

In this video, we're talking about whether or not you should pay cash for a rental property. This is a difficult decision, but one that can have a big impact on your financial future.

If you're looking to invest in real estate, then you may be wondering whether or not you should pay cash for a rental property. On one hand, paying cash can give you a higher return on your investment. On the other hand, some people may believe that you're not getting the best possible deal if you pay cash.

In this video, we're discussing both sides of the coin. We'll help you decide whether or not paying cash is the right decision for you!

How to make money five ways from real estate.

If you're looking to invest in real estate, then you may be wondering whether or not you should pay cash for a rental property. On one hand, paying cash can give you a higher return on your investment. On the other hand, some people may believe that you're not getting the best possible deal if you pay cash.

In this video, we're discussing both sides of the coin. We'll help you decide whether or not paying cash is the right decision for you!

How to make money five ways from real estate.

Why You Should Finance Your Car (And Not Pay Cash)

Should You Pay CASH For A Car? (My Thoughts)

Should I Really Pay Cash For A House?

Financing vs. Paying Cash For a Car: Which is the Best Strategy?

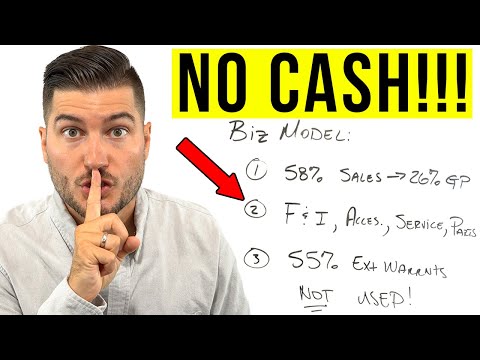

DON'T PAY CASH AT CAR DEALERSHIPS! (Here's Why)

Paying cash: why is it cheaper?

How Cash Changes The Way You Look At Money - Dave Ramsey Rant

Should you pay cash for a car?

Get Paid to Chill: Top Money-Making Apps | Make Money Online 2024

DON'T PAY CASH AT CAR DEALERSHIPS! (Here's Why) - Car Dealer Reacts - Marko - WhiteBoard F...

Should the UK Pay Cash Bonuses to Medal Winners?

Why You Should Buy Every Single Car ALL CASH (Even A Brand New Car)

How Much Cash Is Too Much To Keep At Home?

DON'T SAY 'I'M PAYING CASH' (at Car Dealers in 2024) - The Amazing ELIZABETH! Th...

Use Cash And Feel What You Pay For!

Is Paying Cash For A House Right For Me?

Should You Pay Cash, Finance or Lease A New Car? Expert Explains Which Is Best

Why cash buyers have the upper hand. So can you!

Should You Pay Cash or Finance Your New Car?

Right Now Is the BEST TIME EVER To PAY CASH FOR A CAR

Should You Get a Mortgage or Pay Cash For a Rental Property?

How Dealers turn your Cash down into profit! Car Buying Tips

Why Germans Love to Pay in Cash | Easy German 474

How to PAY CASH at CAR DEALERSHIPS in 2024 New and Used Cars by The Homework Guy

Комментарии

0:16:54

0:16:54

0:10:23

0:10:23

0:06:37

0:06:37

0:05:09

0:05:09

0:12:27

0:12:27

0:12:12

0:12:12

0:07:50

0:07:50

0:03:09

0:03:09

0:09:19

0:09:19

0:18:25

0:18:25

0:05:34

0:05:34

0:00:38

0:00:38

0:04:31

0:04:31

0:21:45

0:21:45

0:06:15

0:06:15

0:03:31

0:03:31

0:11:34

0:11:34

0:12:49

0:12:49

0:12:12

0:12:12

0:07:13

0:07:13

0:05:00

0:05:00

0:08:28

0:08:28

0:12:50

0:12:50

0:05:50

0:05:50