filmov

tv

Aula 5 | Functional Finance | Prof L. Randall Wray

Показать описание

LECTURE 5 - MINSKY’s MODERN MONEY THEORY (MMT) AND FUNCTIONAL FINANCE (Institute of Economics, Campinas, Unicamp, August 14th, 2018)

In the fifth section of the Modern Money Theory Course, Professor L. Randall Wray goes back and tracks the Minskyan routes of MMT and his connections with Abba Lerner’s principles of Functional Finance. Coming from this perspective, the main argument of MMT is that fiscal policy primary target might be full employment without high inflation. And also argues why a typical general aggregate demand stimulus does not generate full employment and leads to effects ranging from increasing financial fragility, inflation and inequality.

Bibliografia:

Lerner, A. 1943. Functional Finance and the Federal Debt. Social Research, v. 10. 1943.

Wray, L. Functional Finance: A Comparison of the Evolution of the Positions of Hyman Minsky

and Abba Lerner, Working Paper, n. 900. Levy Economics Institute. Jan, 2018.

Imagens: Alexandre Motta

In the fifth section of the Modern Money Theory Course, Professor L. Randall Wray goes back and tracks the Minskyan routes of MMT and his connections with Abba Lerner’s principles of Functional Finance. Coming from this perspective, the main argument of MMT is that fiscal policy primary target might be full employment without high inflation. And also argues why a typical general aggregate demand stimulus does not generate full employment and leads to effects ranging from increasing financial fragility, inflation and inequality.

Bibliografia:

Lerner, A. 1943. Functional Finance and the Federal Debt. Social Research, v. 10. 1943.

Wray, L. Functional Finance: A Comparison of the Evolution of the Positions of Hyman Minsky

and Abba Lerner, Working Paper, n. 900. Levy Economics Institute. Jan, 2018.

Imagens: Alexandre Motta

Aula 5 | Functional Finance | Prof L. Randall Wray

Aula 4 | Job Guarantee | Prof L. Randall Wray

Aula 2 | Endogenous Money | Prof L. Randall Wray

Be Lazy

BEST DEFENCE ACADEMY IN DEHRADUN | NDA FOUNDATION COURSE AFTER 10TH | NDA COACHING #shorts #nda #ssb

HOW CHINESE STUDENTS SO FAST IN SOLVING MATH OVER AMERICAN STUDENTS

Net Present Value (NPV) explained

Taxes Drive Money, Functional Finance, and Minsky | L. Randall Wray at MMT Summer School 2021

Functions of money | Financial sector | AP Macroeconomics | Khan Academy

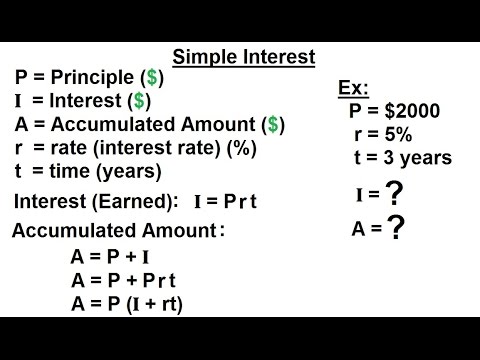

Business Math - Finance Math (1 of 30) Simple Interest

Most common mistake to 100% avoid when working with square roots #shorts #mathshorts #commonmistakes

algebraic expressions working model with led lights - shorts | howtofunda

Fourier Series in 50 Sec

💥Best Free AI Courses for Beginners! Must Do Courses for MBA Students☑️#mba #artificialintelligence...

Ecological Tax Reform + Functional Finance (GISP Green New Deal Series Episode 3)

6th semester Exam Date Extended | Calcutta University | @MathurSirClasses #shorts

Napping in Class? The Surprising School Routine in China!

Lesson Plan Format and Solved Example | #format #lessonplan #teacher

Chinese kindergartens are INSANE! 😱🔥

My 5-Step UX/UI Design Process — From Start to Deliver

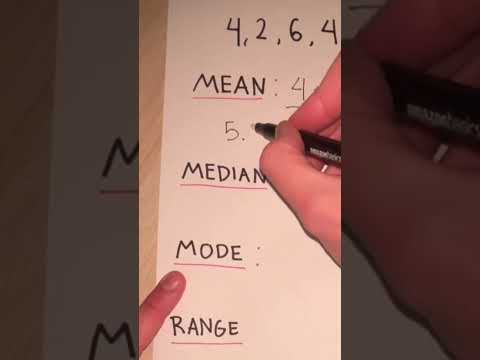

Mean median mode range

5. Carbohydrates and Glycoproteins

question tag - PRESENT TENSE

A-Level Biology - Carbonic Anhydrase | #alevelbiology #biologynotes #alevelrevision #biology

Комментарии

2:19:58

2:19:58

2:33:22

2:33:22

2:39:39

2:39:39

0:00:44

0:00:44

0:00:15

0:00:15

0:00:23

0:00:23

0:05:26

0:05:26

1:28:31

1:28:31

0:06:10

0:06:10

0:04:58

0:04:58

0:00:50

0:00:50

0:00:15

0:00:15

0:00:55

0:00:55

0:00:30

0:00:30

0:04:39

0:04:39

0:00:22

0:00:22

0:00:21

0:00:21

0:00:09

0:00:09

0:00:34

0:00:34

0:00:16

0:00:16

0:00:23

0:00:23

0:49:20

0:49:20

0:00:06

0:00:06

0:00:16

0:00:16