filmov

tv

Why you should avoid structured products - MoneyWeek Investment Tutorials

Показать описание

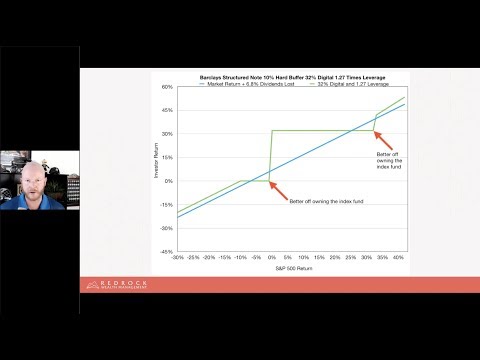

Tim Bennett evaluates structured products as an investment, using clear concise wording and easy to understand analysis.

Why you should avoid structured products - MoneyWeek Investment Tutorials

Jordan Peterson - Daily Structure Keeps You Sane

What are Structured Products?

Change your face structure in 2 months | Andrew Huberman

Structured Notes - 13 Things You Need To Know Before Investing in Structured Notes

5 tips to improve your critical thinking - Samantha Agoos

1x1 of Structured Products: What Are Structured Products?

What is a Structured Product?

Cambridge AS & A Level Chemistry (9701) || Atomic Structure || Part 1 || Detailed Explanations

How I structure my LLC's ✌🏽

CFA Level I Fixed Income - Structured Financial Instruments

The single biggest reason why start-ups succeed | Bill Gross | TED

What INFPs Really Need (Not Structure)

How To Simplify The BOS (Break Of Structure) Strategy - Market Manipulations And Imbalances

the rarest structure. ever.

How to Structure a Band 9 Opinion Essay

10 Reasons why you need the Trifecta! The Perfect Legal Structure

Simple Present Tense for beginners |Tenses | Present Tense | Example and Structure of Simple Present

Drinking Water NOT The Best Way To Hydrate - Structured Water vs Regular Water

The resume structure that got me my dream job | Wonsulting

Order Blocks + Market Structure Strategy (Smart Money Concepts) 🤯

the rarest structure in minecraft

Breaks Of Structure (BOS) EXPLAINED Simply For Traders🔥*SMC* #shortsA

Minecraft, But Any Structure I Say Spawns...

Комментарии

0:14:10

0:14:10

0:06:01

0:06:01

0:11:54

0:11:54

0:00:36

0:00:36

0:45:54

0:45:54

0:04:30

0:04:30

0:02:00

0:02:00

0:05:08

0:05:08

2:16:00

2:16:00

0:00:58

0:00:58

0:08:42

0:08:42

0:06:41

0:06:41

0:04:47

0:04:47

0:00:42

0:00:42

0:00:32

0:00:32

0:00:27

0:00:27

1:02:08

1:02:08

0:00:16

0:00:16

0:17:17

0:17:17

0:00:16

0:00:16

0:00:40

0:00:40

0:00:37

0:00:37

0:00:55

0:00:55

0:01:00

0:01:00