filmov

tv

Arithmetic Geometric Dollar Returns

Показать описание

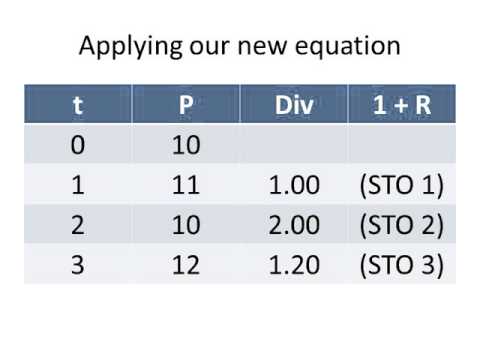

This video provides a quick overview of arithmetic average, geometric (time-weighted), and dollar-weighted approaches to calculating average returns. The arithmetic average is the simplest, but least effective method. The geometric is the best method for calculating the underlying return, but can be misleading when factoring in the changing value of your account. The dollar-weighted is best for looking at the true compounding rate of your investment portfolio over time.

Arithmetic Geometric Dollar Returns

Geometric vs. Arithmetic Returns | Explained with an Investing Example

(6 of 12) Ch.12 - Arithmetic & geometric average return: 2 examples

Geometric vs. Arithmetic Average Returns

Excel Finance Class 97: Using Geometric Mean & Arithmetic Mean to Estimate Future Returns

Arithmetic Mean Return vs. Geometric Return

What is the difference between arithmetic and geometric returns?

(Ch. 12 lecture) Arithmetic vs Geometric Average Annual Return

CFA Level 1 | Quantitative Methods: Measuring Return over time - Arithmetic vs Geometric Mean

Geometric average annual return

Arithmetic vs geometric average return • Fundamentals of investments • Episode 2

How to Calculate Average and Geometric Returns

Time-Weighted Rate of Return Example Problem (Geometric Mean Return)

Example Geometric Average Returns

Arithmetic v Geometric Average

Geometric Mean Return

Arithmetic Mean and Geometric Mean: Investment Growth Rate Application

Geometric average return definition for investment modeling

Arithmetic vs Geometric Average

Average returns: arithmetic vs geometric

(5 of 12) Ch.12 - Geometric average return calculation

Geometric Mean: Annual Rate of Return on an Investment

Geometric Mean Return - Corporate Finance

Geometric Mean Annual Return Practice Problem with Formula

Комментарии

0:11:35

0:11:35

0:03:14

0:03:14

0:02:36

0:02:36

0:11:27

0:11:27

0:03:52

0:03:52

0:09:44

0:09:44

0:00:51

0:00:51

0:31:33

0:31:33

0:03:50

0:03:50

0:11:17

0:11:17

0:15:56

0:15:56

0:05:23

0:05:23

0:01:34

0:01:34

0:09:15

0:09:15

0:05:57

0:05:57

0:01:39

0:01:39

0:02:57

0:02:57

0:04:53

0:04:53

0:06:24

0:06:24

0:01:51

0:01:51

0:17:28

0:17:28

0:11:31

0:11:31

0:03:36

0:03:36

0:02:05

0:02:05