filmov

tv

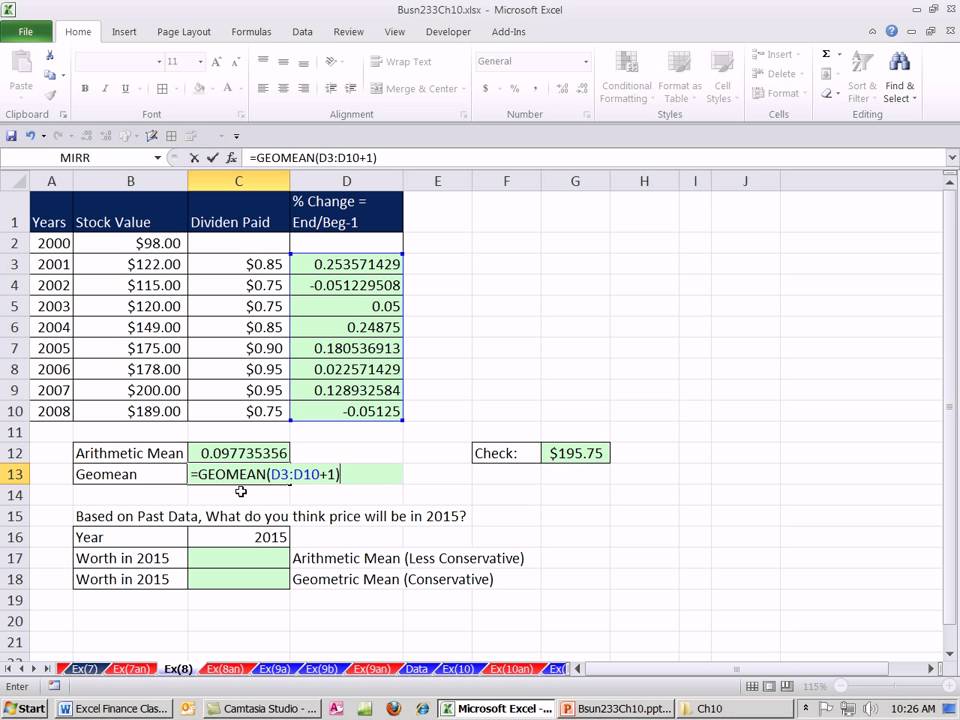

Excel Finance Class 97: Using Geometric Mean & Arithmetic Mean to Estimate Future Returns

Показать описание

See how to take past stock value data and then calculate Geometric Mean with Arithmetic Mean to Estimate Future Returns

Excel Finance Class 97: Using Geometric Mean & Arithmetic Mean to Estimate Future Returns

Excel Finance Class 95: Using Past Period Holding Returns to Estimate Future Returns Arithmetic Mean

VLOOKUP in Excel | Tutorial for Beginners

Change number in date format | Excel formulas | Text Function

Excel for Finance and Accounting Beginner Tutorial

Excel Finance Class 93: Period (Holding) Returns For Preferred Stock

Excel Finance Class 92: Period (Holding) Returns For Zero Bond

Excel Formulas and Functions You NEED to KNOW!

Excel Finance Class 91: Period (Holding) Nominal, Real & Dollar Returns For Coupon Bond

Top Excel Shortcuts For Finance and Modeling From an Ex-JP Morgan Investment Banking Analyst!

Excel Finance Class 103: 2 Ways To Calculate Geometric Mean

Excel Finance Class 20: Growth Ratios and Market Value Ratios

HOW CHINESE STUDENTS SO FAST IN SOLVING MATH OVER AMERICAN STUDENTS

How to use the IF function in Excel

How To Calculate Confidence Intervals In Excel

Excel Finance Class 102: In The Short Run Financial Markets Can Be Inefficient Mispriced Assets

Make a Professional Excel Dashboard From Scratch Using Real-World Data

Excel for Finance and Accounting Full Course Tutorial (3+ Hours)

Maths Ki Problem 😜 PIHOOZZ

How to add check boxes in Excel

How To Use VLOOKUP True Match Function | Excel for beginners #shorts

Excel Tutorial for Beginners

Tamasha Dekho 😂 IITian Rocks Relatives Shock 😂😂😂 #JEEShorts #JEE #Shorts

Pivot Table Excel Tutorial

Комментарии

0:03:52

0:03:52

0:03:56

0:03:56

0:32:09

0:32:09

0:00:24

0:00:24

0:57:06

0:57:06

0:02:41

0:02:41

0:03:51

0:03:51

0:10:47

0:10:47

0:04:18

0:04:18

0:39:26

0:39:26

0:04:46

0:04:46

0:14:53

0:14:53

0:00:23

0:00:23

0:03:36

0:03:36

0:04:49

0:04:49

0:04:15

0:04:15

0:21:28

0:21:28

3:58:57

3:58:57

0:00:23

0:00:23

0:00:28

0:00:28

0:00:36

0:00:36

0:16:17

0:16:17

0:00:13

0:00:13

0:13:36

0:13:36