filmov

tv

Refund Proposed to be Adjusted Against Outstanding Demand | Intimation u/s 245 | Refund Kept on Hold

Показать описание

Refund Proposed to be Adjusted Against Outstanding Demand | Intimation u/s 245 | Refund Kept on Hold

your refund is proposed to be adjusted against an outstanding demand

intimation u/s 245

intimation u/s 245 issued

refund adjusted against outstanding demand

refund kept on hold intimation u/s 245 is issued

adjusted refund amount

intimation u/s 245 password

your refund is proposed to be adjusted against an outstanding demand(is) − kindly respond

----------------------------------------------------------------------------------------------------------------------------------------

your refund is proposed to be adjusted against an outstanding demand

intimation u/s 245

intimation u/s 245 issued

refund adjusted against outstanding demand

refund kept on hold intimation u/s 245 is issued

adjusted refund amount

intimation u/s 245 password

your refund is proposed to be adjusted against an outstanding demand(is) − kindly respond

----------------------------------------------------------------------------------------------------------------------------------------

Refund Proposed to be Adjusted Against Outstanding Demand | Intimation u/s 245 | Refund Kept on Hold

Previous Period Refund | Now we can easily Adjust | Just follow 3 steps | FBR | IRIS |

Refund Adjustment Notice

What if you claimed refund while filing the original ITR but paying it back while filing revised ITR

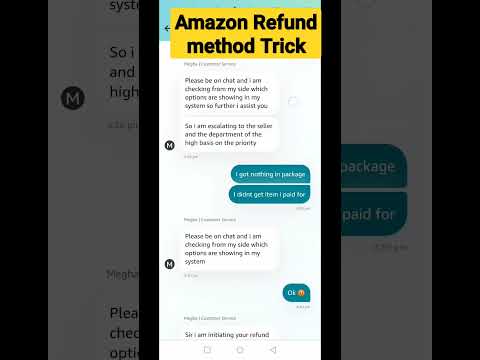

Amazon refund method Trick |

NO MORE GETTING IMMEDIATE TAX REFUNDS IN JAPAN 😭 #japan #taxfree #japantravel

Sahara India Important Notice| Sahara India New Updates| Sahara Refund Portal | Sahara Resubmission

Big Tax Refund Coming? Why You Should Adjust Your Tax Withholding

How to Boost Your Tax Refund SAFELY - Tax Expert's 10 Tips

How to get a REFUND from Fortnite…

FREE REFUND in Fortnite 😍😱

REMINDER To Get Your Free Refund Ticket In Fortnite #shorts #fortnite r

New Tax Laws Mean Your Refund May Be Less Sweet Than Last Year

Amazon's Sneaky Refund Trick EXPOSED!

New stat refund code in blox fruit update 20 #bloxfruit #roblox #newupdate

Georgia moves closer to new round of $250-$500 surplus refund checks

Codes for blox fruit stat refund 2024 #roblox #bloxfruits #bloxfrut #kitsune #shorts

PAYPAL REFUND SCAM 😈😬 #moneyhack #scam #scammer

Working state refund code #roblox #bloxfruits #viral

China ShortCuts | 20th November 2024: Export VAT Refund Update

How to Claim Last Year TDS Refund or Unclaimed TDS Refund From Last 6 Year | Tds Brought Forward

Can you file a revised Income Tax Return after getting refund? | Due Date to file Revised Return |

ITR Refund Status Check | Income Tax Refund #shorts #ytshorts

WITHOUT return refund on Amazon Rs.999 #ytshorts #shorts #tricks #refund #amazonproducts

Комментарии

0:09:35

0:09:35

0:08:36

0:08:36

0:01:55

0:01:55

0:01:00

0:01:00

0:00:21

0:00:21

0:00:25

0:00:25

0:07:05

0:07:05

0:01:45

0:01:45

0:11:55

0:11:55

0:00:21

0:00:21

0:00:18

0:00:18

0:00:22

0:00:22

0:05:03

0:05:03

0:00:32

0:00:32

0:00:22

0:00:22

0:00:24

0:00:24

0:00:15

0:00:15

0:00:23

0:00:23

0:00:15

0:00:15

0:01:00

0:01:00

0:05:12

0:05:12

0:03:58

0:03:58

0:00:26

0:00:26

0:00:21

0:00:21