filmov

tv

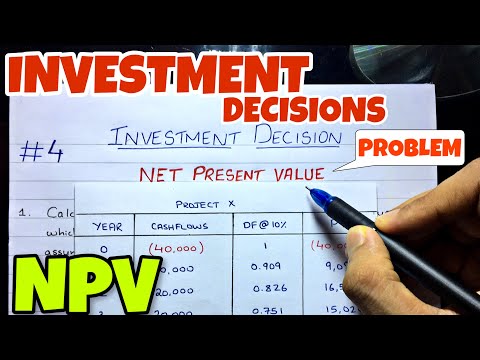

#4 Net present Value Method of capital budgeting | NPV calculation | with Solution | by kauserwise®

Показать описание

Here is the video about Net present Value Method of capital budgeting.

In this video we have seen how to calculate present value of inflows and present value of Outflows from the CFAT and Investments and then how to calculate NPV from the present value of inflow and present value of outflow along with scrap value. And finally seen how to take a decision according to the result of NPV.

Follow Us On😃:

===============================

===============================

===============================

👇List of Subjects and it's Play List👇

►Financial Management

►Financial Accounting

►Corporate Accounting

►Cost and Management Accounting

►Operations Research

►Statistics

Thanks

kauserwise®

In this video we have seen how to calculate present value of inflows and present value of Outflows from the CFAT and Investments and then how to calculate NPV from the present value of inflow and present value of outflow along with scrap value. And finally seen how to take a decision according to the result of NPV.

Follow Us On😃:

===============================

===============================

===============================

👇List of Subjects and it's Play List👇

►Financial Management

►Financial Accounting

►Corporate Accounting

►Cost and Management Accounting

►Operations Research

►Statistics

Thanks

kauserwise®

#4 Net Present Value (NPV) - Investment Decision - Financial Management ~ B.COM / BBA / CMA

Net Present Value (NPV) explained

#4 Net present Value Method of capital budgeting | NPV calculation | with Solution | by kauserwise®

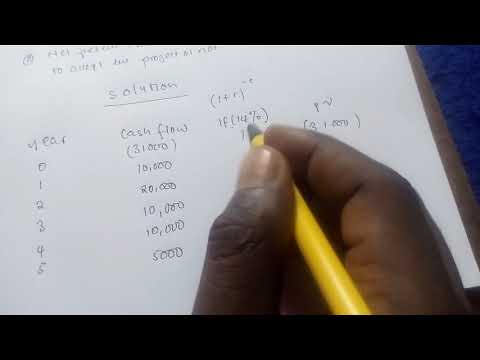

How to calculate the Net Present value (NPV)

How to Calculate a Project's NPV?

Net Present Value (NPV) Calculation Example Using Table | Non-constant (uneven) cash flows

How to Calculate NPV (Net Present Value) in Excel

Net Present Value - NPV, Profitability Index - PI, & Internal Rate of Return - IRR Using Excel

FR Consolidation - Ind AS 110 Live revision | CA Final Nov'24 | 3rd Oct 10 AM | By Suraj Sir

NPV and IRR explained

A level Business Revision - Net Present Value Method of Investment Appraisal

[#5] NPV with TWO Investments | Net Present Value Method | Capital Budgeting | FM | kauserwise®

Capital Budgeting Techniques in English - NPV, IRR , Payback Period and PI, accounting

What is Discounted Cash Flow (DCF)?

MA43 - Net Present Value, Payback Period, and IRR Sample Problem

MA42 - Capital Budgeting - Net Present Value - Explained

Net Present Value (NPV)

HP 10BII Financial Calculator NPV Calculation

Net Present Value NPV using Table | Constant Cashflows

Capital Investment Models - Net Present Value

Introduction to Net Present Value (NPV)

(3 of 20) Ch.9 - Net Present Value approach: comparing 2 projects

Net Present Value Explained | How to Calculate the NPV Method of Investment Appraisal

What is Net Present Value?

Комментарии

0:18:50

0:18:50

0:05:26

0:05:26

0:11:06

0:11:06

0:07:27

0:07:27

0:05:13

0:05:13

0:09:01

0:09:01

0:02:56

0:02:56

0:18:22

0:18:22

1:10:14

1:10:14

0:06:48

0:06:48

0:10:58

0:10:58

![[#5] NPV with](https://i.ytimg.com/vi/wVASMwfbOVw/hqdefault.jpg) 0:13:10

0:13:10

0:29:50

0:29:50

0:05:02

0:05:02

0:14:02

0:14:02

0:18:32

0:18:32

0:07:28

0:07:28

0:01:53

0:01:53

0:06:46

0:06:46

0:15:08

0:15:08

0:03:45

0:03:45

0:09:39

0:09:39

0:11:51

0:11:51

0:00:31

0:00:31