filmov

tv

This ONE Deposit Will Turn Your Kid Into A Millionaire

Показать описание

What if you could turn your kid into a millionaire at retirement by simply making one deposit when they are born?

Thanks for watching @ErinTalksMoney I appreciate you!

Disclaimer: Please note that this video is made for entertainment purposes only and not to be taken as financial advice. Always make sure to do your own research.

While you are here, why not check out some of my other videos:

#makingamillionaire #millionaire

Thanks for watching @ErinTalksMoney I appreciate you!

Disclaimer: Please note that this video is made for entertainment purposes only and not to be taken as financial advice. Always make sure to do your own research.

While you are here, why not check out some of my other videos:

#makingamillionaire #millionaire

This ONE Deposit Will Turn Your Kid Into A Millionaire

How to DEPOSIT Toncoin ($TON) on Telegram Wallet | Crypto App Tutorial

OrangeNXT - Goal Based Deposit

How to Deposit Toncoin $TON on Tonkeeper Wallet | Easy Step-by-Step Tutorial

How to Withdraw or Send ATH Token from Athene Mining App, Deposit to Athene LaunchPad

Golden time to add Banking Stocks as they Turn UNDERVALUED (Axis+1 more stock analysis)? -Rahul Jain

How to deposit with online bank transfer in Nigeria Exness

Steamery - Descale and clean your steamer

How to grow money through a fixed deposit account

Cash Deposit in Bank Income Tax Malayalam |CA Subin VR

How To: Change or Sign Up for Direct Deposit

TON Coin Deposit in TONKeeper Wallet || Ton coin Buy in Ton Wallet || Hamster Kombat Airdrop Claim

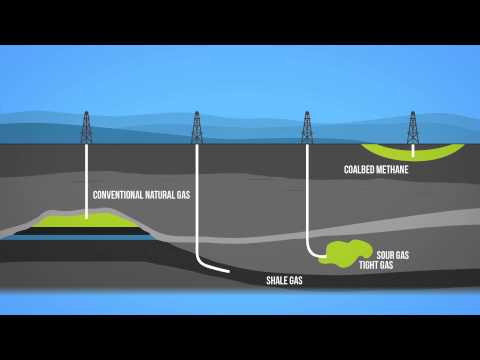

Natural Gas 101

Re-turn - Ireland's Deposit Return Scheme | Launch ad | 2024

How to Buy Ton & Deposit in Ton Keeper Wallet

Kieran Cuddihy gets honest about the Deposit Return Scheme one month on

How To Deposit and Withdraw On Trust Wallet App

Cash Deposit Limit to Avoid Income Tax Notice || Maximum UPI Limit In 1 Year

How Does Savings Account Interest Work?

KITNE TIME KI FIXED DEPOSIT FD JYADA INTEREST DEGI | FD PAR EXTRA INTEREST LENE KA BEST TARIKA 🙏

How Do Bees Make Honey?

How to DEPOSIT or WITHDRAW crypto on Blockchain Wallet | Bitcoin App Tutorial

How to Enable Cash App Check Deposit | 2023

Why Do We Cough?

Комментарии

0:11:26

0:11:26

0:03:10

0:03:10

0:00:17

0:00:17

0:03:02

0:03:02

0:03:47

0:03:47

0:14:33

0:14:33

0:00:55

0:00:55

0:01:08

0:01:08

0:02:08

0:02:08

0:04:33

0:04:33

0:01:48

0:01:48

0:13:29

0:13:29

0:03:39

0:03:39

0:00:30

0:00:30

0:06:48

0:06:48

0:02:46

0:02:46

0:03:46

0:03:46

0:06:42

0:06:42

0:01:50

0:01:50

0:05:28

0:05:28

0:06:33

0:06:33

0:05:00

0:05:00

0:01:24

0:01:24

0:01:18

0:01:18