filmov

tv

Edmentum Financial Math Unit1 Course Activity

Показать описание

Riley wants to purchase a new refrigerator that costs $1,025.99. Use this information to answer the following questions.

If Riley places $50 in an envelope every month, how long will she need to save to be able to afford the new refrigerator?

Riley doesn’t want to wait that long before purchasing the refrigerator, so she decides to consider using credit. After speaking with a store clerk, Riley learns that she qualifies for a special payment plan the store offers. Why should Riley should consider the amount of interest associated with the payment plan?

Riley agreed to a payment plan for the refrigerator. She used a graph to record her payments and the remaining balance. Which two statements are true about the graph?

In the video, you saw that Michael used a budget to make sure he pays bills when they’re due. What are some other reasons someone would want to create a budget?

Alyssa is drafting an email to Stuart, a financial advisor. He said he could help her create a personalized budget. What information will Stuart need to use to set up a personal budget for Alyssa? Select all that apply.

Stuart,

Hello! It was so great catching up with you at the supermarket! You mentioned that you might be able to help me create a personalized budget. I am currently employed as a director at a day care center on the corner of 1st and Main Street. My birthday is on June 3. My largest expense is my mortgage payment of $1,200 per month. I picked a house in this neighborhood because it is close to work. Last year, my annual salary was $40,030. Please let me know if you can help!

Terrance made a list of his expenses. He is creating a check-off matrix to organize when his bills are due. A check-off matrix is a table without dollar amounts. You can use a matrix to indicate what time of the year an expense will occur. Help Terrance complete his check-off matrix by placing an X in the correct cells of the table according to his list of expenses.

mortgage payment: monthly

utilities: monthly

insurance: quarterly

internet: monthly

cell phone: monthly

car loan: semiannually

lawn care: monthly, April–September

food: monthly

day care: every other month beginning with February

gym membership: annually, July

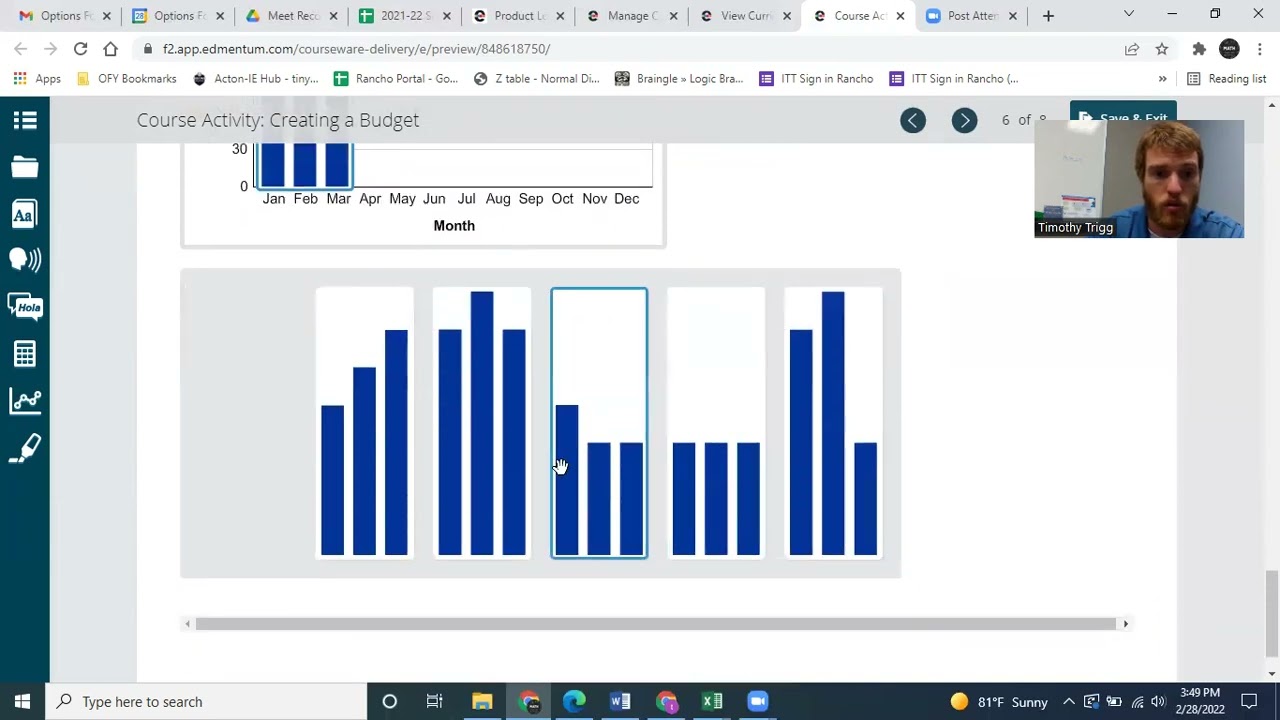

Maggie wants to create a bar graph to observe her electricity use and cost over the course of a year. Use the information from the table to construct a bar graph that represents this situation.

A budget can take the form of a list, a table, or a graph. You can make a budget using pencil and paper, or you can use a website or software. Whatever method you choose, creating a budget is a great way to observe how much money you make and how you spend your money.

When creating a budget, it’s important to make sure you spend less than you make. In other words, your income should be higher than your expenses. If your expenses exceed your income, you may need to find ways to reduce spending or find ways to increase your income.

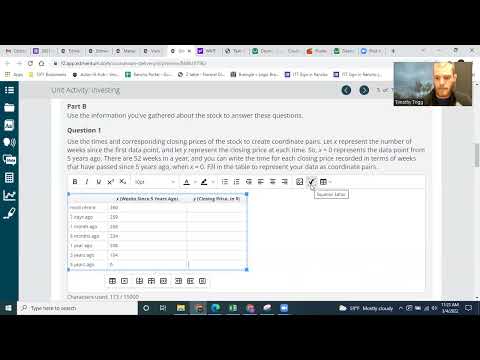

Think about a career you want to pursue. Then determine the average income for the occupation you’re considering. Record your findings in the provided table. For hourly occupations, assume a 40-hour work week for 52 weeks in a year.

Life can be unpredictable at times, and unexpected events can affect your budget. Suppose one month you have to pay an unexpected bill that greatly impacts your budget. What are some actions you could take to keep your budget on track despite the unexpected bill?

If Riley places $50 in an envelope every month, how long will she need to save to be able to afford the new refrigerator?

Riley doesn’t want to wait that long before purchasing the refrigerator, so she decides to consider using credit. After speaking with a store clerk, Riley learns that she qualifies for a special payment plan the store offers. Why should Riley should consider the amount of interest associated with the payment plan?

Riley agreed to a payment plan for the refrigerator. She used a graph to record her payments and the remaining balance. Which two statements are true about the graph?

In the video, you saw that Michael used a budget to make sure he pays bills when they’re due. What are some other reasons someone would want to create a budget?

Alyssa is drafting an email to Stuart, a financial advisor. He said he could help her create a personalized budget. What information will Stuart need to use to set up a personal budget for Alyssa? Select all that apply.

Stuart,

Hello! It was so great catching up with you at the supermarket! You mentioned that you might be able to help me create a personalized budget. I am currently employed as a director at a day care center on the corner of 1st and Main Street. My birthday is on June 3. My largest expense is my mortgage payment of $1,200 per month. I picked a house in this neighborhood because it is close to work. Last year, my annual salary was $40,030. Please let me know if you can help!

Terrance made a list of his expenses. He is creating a check-off matrix to organize when his bills are due. A check-off matrix is a table without dollar amounts. You can use a matrix to indicate what time of the year an expense will occur. Help Terrance complete his check-off matrix by placing an X in the correct cells of the table according to his list of expenses.

mortgage payment: monthly

utilities: monthly

insurance: quarterly

internet: monthly

cell phone: monthly

car loan: semiannually

lawn care: monthly, April–September

food: monthly

day care: every other month beginning with February

gym membership: annually, July

Maggie wants to create a bar graph to observe her electricity use and cost over the course of a year. Use the information from the table to construct a bar graph that represents this situation.

A budget can take the form of a list, a table, or a graph. You can make a budget using pencil and paper, or you can use a website or software. Whatever method you choose, creating a budget is a great way to observe how much money you make and how you spend your money.

When creating a budget, it’s important to make sure you spend less than you make. In other words, your income should be higher than your expenses. If your expenses exceed your income, you may need to find ways to reduce spending or find ways to increase your income.

Think about a career you want to pursue. Then determine the average income for the occupation you’re considering. Record your findings in the provided table. For hourly occupations, assume a 40-hour work week for 52 weeks in a year.

Life can be unpredictable at times, and unexpected events can affect your budget. Suppose one month you have to pay an unexpected bill that greatly impacts your budget. What are some actions you could take to keep your budget on track despite the unexpected bill?

Комментарии

0:23:48

0:23:48

0:28:28

0:28:28

0:00:58

0:00:58

0:00:27

0:00:27

0:24:23

0:24:23

0:40:55

0:40:55

1:08:57

1:08:57

0:41:17

0:41:17

0:42:40

0:42:40

0:05:26

0:05:26

0:03:57

0:03:57

0:32:05

0:32:05

0:14:37

0:14:37

0:04:41

0:04:41

0:55:05

0:55:05

0:31:45

0:31:45

0:04:47

0:04:47

0:04:45

0:04:45

0:09:20

0:09:20

1:47:28

1:47:28

0:46:18

0:46:18

0:03:30

0:03:30

0:21:53

0:21:53

0:21:18

0:21:18