filmov

tv

Capital Gain Exclusion: Selling Old Primary Residence Converted into a Rental [Tax Smart Daily 051]

Показать описание

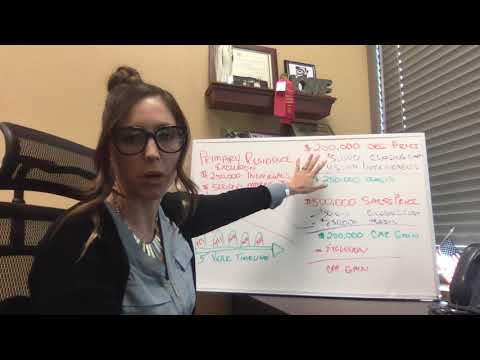

Today's topic is about the $250,000 and $500,000 gain exclusion that you can get when selling a primary residence that is converted into a rental.

—

Here are 3 ways to get involved:

1: JOIN OUR FACEBOOK GROUP

If you haven't joined the Tax Smart Real Estate Investors Facebook community, you need to jump on it ASAP! You'll get details on exclusive Live Q&As that I'm doing, updates on everything tax and accounting, and early access to events and content.

2: FREE TRIAL OF OUR NEWSLETTER

Interested in getting our premium Tax Strategy Newsletter every Tuesday? It breaks down the nuances of real estate investor taxation in an easy-to-read manner and contains investor tools and presentations.

3: WORK WITH US

Interested in working with our accounting firm at The Real Estate CPA? We are a boutique CPA firm providing advisory, tax, and accounting services to real estate investors and business owners across the U.S.

Let's connect:

—

Here are 3 ways to get involved:

1: JOIN OUR FACEBOOK GROUP

If you haven't joined the Tax Smart Real Estate Investors Facebook community, you need to jump on it ASAP! You'll get details on exclusive Live Q&As that I'm doing, updates on everything tax and accounting, and early access to events and content.

2: FREE TRIAL OF OUR NEWSLETTER

Interested in getting our premium Tax Strategy Newsletter every Tuesday? It breaks down the nuances of real estate investor taxation in an easy-to-read manner and contains investor tools and presentations.

3: WORK WITH US

Interested in working with our accounting firm at The Real Estate CPA? We are a boutique CPA firm providing advisory, tax, and accounting services to real estate investors and business owners across the U.S.

Let's connect:

Capital Gain Exclusion: Selling Old Primary Residence Converted into a Rental [Tax Smart Daily 051]

Home Sale Capital Gains Exclusion -121 Exclusion Explained

How to Avoid Capital Gains Tax When Selling Real Estate (2023) - 121 Exclusion Explained

Watch Out For Capital Gains when Selling Your House

Section 121 Home Sale Personal Residence Gain Exclusion

Selling Your Residence and the Capital Gain Exclusion

Capitial Gains Primary Residence exclusion.

Here's how to pay 0% tax on capital gains

Capital Gains on Selling a House Explained - How to Avoid Taxes

How To Avoid Taxes When Selling A House! $0 Capital Gains Tax!

Capital Gains On 2nd Property - (Primary Home Exclusion?)

Selling Your House? Remember THIS Exclusion!

How to Calculate Taxable Gain from Selling a Rental [Tax Smart Daily 020]

Capital Gains Tax When You Sell a Home: Exclusion, Tax Rate, How to Calculate Your Gain, & Exemp...

Video Podcast: Capital Gains and the IRS section 121 exclusion of $250,000 or $500,000

Selling a Home? Avoid Capital Gains Tax on Real Estate | NerdWallet

Capital Gains Tax Explained 2021 (In Under 3 Minutes)

Do I Pay Capital Gains Tax When Selling My Home?

How To Avoid Capital Gains Tax When Selling Real Estate (2019) - 121 Exclusion Explained

Principal Residence Exemption | What You Need To Know!

Do I Have To Pay Capital Gains Tax On An Inherited Property?

Don't Convert Your Primary Residence Into a Rental Property

Tax consequences when selling primary residence less than 2 years

How to PAY ZERO Taxes on Capital Gains (Yes, It's Legal!)

Комментарии

0:07:28

0:07:28

0:12:29

0:12:29

0:12:55

0:12:55

0:09:48

0:09:48

0:14:45

0:14:45

0:05:39

0:05:39

0:03:03

0:03:03

0:02:05

0:02:05

0:07:05

0:07:05

0:11:20

0:11:20

0:05:23

0:05:23

0:00:38

0:00:38

0:11:27

0:11:27

0:09:00

0:09:00

0:03:19

0:03:19

0:05:12

0:05:12

0:02:23

0:02:23

0:05:34

0:05:34

0:30:08

0:30:08

0:03:32

0:03:32

0:03:24

0:03:24

0:09:14

0:09:14

0:02:37

0:02:37

0:13:50

0:13:50