filmov

tv

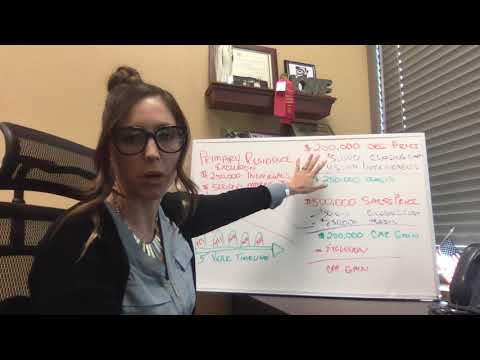

Home Sale Capital Gains Exclusion -121 Exclusion Explained

Показать описание

Real Estate: Section 121, or the home sale capital gains exclusion, is one of the single largest tax benefits available for homeowners. This video explains in detail the IRS parameters and guidelines. There are some pros and cons in taking this exclusion.

This video reviews what the IRS guidelines are for taking the 121 exclusion. Also a reminder of what the downside might be for those homeowner investors out there.

A Section 121 Exclusion is an Internal Revenue Service rule that allows you to exclude a gain of up to $250,000 from the sale of your principal residence from taxable income. A couple filing a joint return gets to exclude up to $500,000.

IRS Website Links:

www.IRS.gov

I have years of experience and am an active full-time realtor bringing you the most up to date information on what

If you are considering moving or selling your property in Orange County, don’t hesitate in reaching out to me.

💁♀️My name is Audra Lambert. I am a South Orange County realtor who focuses in the San Juan Capistrano area. I have over 20 years experience! I love what I do and Love where I live!

🔍 WATCH NEXT:

CONTACT INFO

Audra Lambert, Lambert Group Homes

📞 949.697.2232

👉🏾 DRE#01909872

👋 LET’S CONNECT

Follow me on Instagram: lambertaudra

#CARealEstate #CARealtor #CARealEstateAgent #Realtor #Homeownership #House #Homebuyers #Mortgage #San Juan Capistrano #SanJuanCapistranoRealtor #SJCrealtor #OrangeCounty #LivinginSanJuanCapistrano #MovingtoOC #audralambert #movingtosanjuancapistrano #toprealtorinSanJuan

This video reviews what the IRS guidelines are for taking the 121 exclusion. Also a reminder of what the downside might be for those homeowner investors out there.

A Section 121 Exclusion is an Internal Revenue Service rule that allows you to exclude a gain of up to $250,000 from the sale of your principal residence from taxable income. A couple filing a joint return gets to exclude up to $500,000.

IRS Website Links:

www.IRS.gov

I have years of experience and am an active full-time realtor bringing you the most up to date information on what

If you are considering moving or selling your property in Orange County, don’t hesitate in reaching out to me.

💁♀️My name is Audra Lambert. I am a South Orange County realtor who focuses in the San Juan Capistrano area. I have over 20 years experience! I love what I do and Love where I live!

🔍 WATCH NEXT:

CONTACT INFO

Audra Lambert, Lambert Group Homes

📞 949.697.2232

👉🏾 DRE#01909872

👋 LET’S CONNECT

Follow me on Instagram: lambertaudra

#CARealEstate #CARealtor #CARealEstateAgent #Realtor #Homeownership #House #Homebuyers #Mortgage #San Juan Capistrano #SanJuanCapistranoRealtor #SJCrealtor #OrangeCounty #LivinginSanJuanCapistrano #MovingtoOC #audralambert #movingtosanjuancapistrano #toprealtorinSanJuan

Комментарии

0:12:55

0:12:55

0:12:29

0:12:29

0:09:48

0:09:48

0:11:20

0:11:20

0:03:03

0:03:03

0:13:28

0:13:28

0:10:57

0:10:57

0:04:41

0:04:41

0:07:28

0:07:28

0:05:23

0:05:23

0:30:08

0:30:08

0:00:51

0:00:51

0:05:08

0:05:08

0:02:05

0:02:05

0:11:19

0:11:19

0:06:12

0:06:12

0:06:57

0:06:57

0:15:34

0:15:34

0:11:27

0:11:27

0:08:21

0:08:21

0:07:05

0:07:05

0:14:45

0:14:45

0:03:30

0:03:30

0:02:23

0:02:23