filmov

tv

Here's how to pay 0% tax on capital gains

Показать описание

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBCTV

#imjustakidchallenge with the childhood friends

heres'a your liver back

I Spent 7 Days Playing FC 24, Here`s What Happened...

hey, its ems! for those that ask for a face reveal, heres for you ❤️ #shorts

I Became A Millionaire And Left My Toxic Parents Without A Penny

Röyksopp 'Here She Comes Again' Choreography by TEVYN COLE

UPDATE 10.0 IS HERE! - ULTIMATE TOILET ROLEPLAY 2 NEW UPDATE SHOWCASE! (ROBLOX)

No Sugar, Dairy, and Gluten for 60 Days. Heres What Happened.

The Beatles - Here Comes The Sun Lyrics

But heres the scugs - rainworld

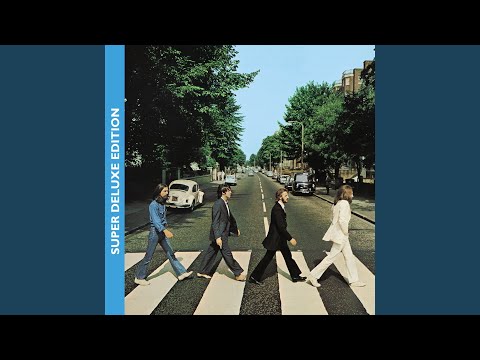

Here Comes The Sun (2019 Mix)

My Parents Allow Me To Do Everything I Want

Metal Gear Solid V - Soundtrack - Here's To You

Here’s why I’m never having kids

Here Comes the Sun - The Petersens (LIVE)

Royksopp ✴ Here She Comes Again (Dj Antonio Remix)

Jamie Miller - Here's Your Perfect (with salem ilese) [Official Music Video]

𝐈𝐭'𝐬 𝐚𝐥𝐥 𝐡𝐚𝐩𝐩𝐞𝐧𝐢𝐧𝐠 𝐡𝐞𝐫𝐞 😅#WomensAsiaCup2024 #ACC #HerStory #SLWvINDW #GrandFinale...

I Spent 14 Days Playing FIFA 23, Here`s What Happened...

Veggie version I Posted yesterday | heres just funny request

Here Comes The Sun - The Beatles (Subtitulada)

1964 NICKEL WORTH $30,000+ !!! HERES WHAT TO LOOK FOR 😲😲

BUYING THE NEW 1,064 HP C8 ZR1 * 0-60 MPH in 2.3? and 9.x @ 150+ 1/4 Mile!

HERES WHERE the ONI RESURRECTION MASK! Roblox zo samurai oni quest #roblox #zo

Комментарии

0:00:11

0:00:11

0:00:06

0:00:06

0:38:03

0:38:03

0:00:08

0:00:08

0:10:11

0:10:11

0:09:29

0:09:29

0:14:58

0:14:58

0:08:02

0:08:02

0:03:10

0:03:10

0:00:26

0:00:26

0:03:06

0:03:06

0:09:55

0:09:55

0:03:12

0:03:12

0:01:21

0:01:21

0:03:11

0:03:11

0:03:19

0:03:19

0:02:49

0:02:49

0:00:15

0:00:15

0:50:14

0:50:14

0:00:29

0:00:29

0:03:04

0:03:04

0:00:57

0:00:57

0:09:45

0:09:45

0:00:15

0:00:15