filmov

tv

How To Find The Budget You Can Actually Stick To

Показать описание

In our new series, Investing In Yourself, Chelsea walks you through the basics of getting your money under control so you can reach your long-term goals.

Written by Amanda Holden

The Financial Diet site:

Written by Amanda Holden

The Financial Diet site:

HOW TO: THE EASIEST AND SIMPLEST WAY TO CREATE A MONTHLY BUDGET! 6-MINUTES PROCESS

How Do I Make A Budget And Stick To It?

How To Find The Budget You Can Actually Stick To

How to Find More Money in Your Budget

How To Budget And Save in Your 20's | Tips and Tricks

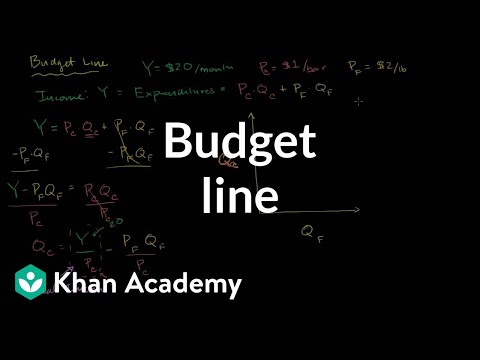

Budget Line

Excel Budget Template | Automate your budget in 15 minutes

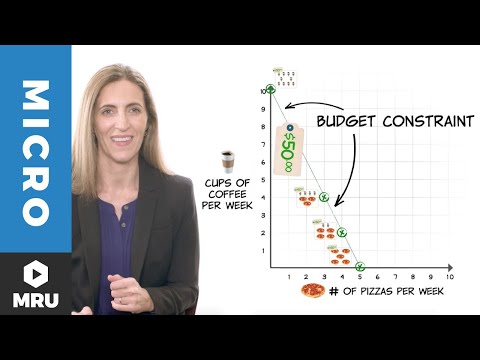

Budget Constraints

QiYi M Pro BALL-CORE 2x2 | NEW BEST Budget 2x2 Speedcube!?

How to Make a Budget Template in Excel - Budget versus Actual Cost!

Small Business Budgeting Simplified: How to Create a Budget for Your Small Business

How To Make Your First Budget (At Any Income)

How To Find Money To Save Without Killing Your Budget

Switzerland: How to Visit Switzerland on a Budget

How to Buy a Budget Friendly Project Car

how I manage my money 💵 income , expenses , budget , etc || personal finance in my 20s...

How I Budget my Paychecks 💸 paycheck breakdown, bi-weekly budget with me & more

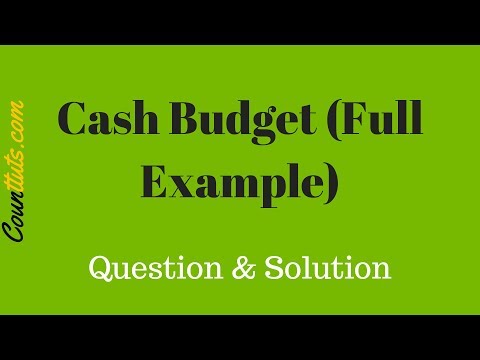

Cash Budget | Explained With Full Example | Cost Accounting

BBP REAL LIFE BUDGET | Budgeting When You Don't Make Enough

9 Ways You're Sabotaging Your Budget Without Realizing It

Optimal point on budget line | Microeconomics | Khan Academy

7 Steps on How to Create a Budget

HOW TO VISIT NEW YORK CITY ON A BUDGET | New York Travel Guide

How to Make a Budget That Actually Works for You

Комментарии

0:06:25

0:06:25

0:04:25

0:04:25

0:13:56

0:13:56

0:13:07

0:13:07

0:13:42

0:13:42

0:12:11

0:12:11

0:09:29

0:09:29

0:06:46

0:06:46

0:05:42

0:05:42

0:11:58

0:11:58

0:12:39

0:12:39

0:10:16

0:10:16

0:04:40

0:04:40

0:06:59

0:06:59

0:22:23

0:22:23

0:15:45

0:15:45

0:15:07

0:15:07

0:21:47

0:21:47

0:24:02

0:24:02

0:14:05

0:14:05

0:09:24

0:09:24

0:04:21

0:04:21

0:16:26

0:16:26

0:23:20

0:23:20