filmov

tv

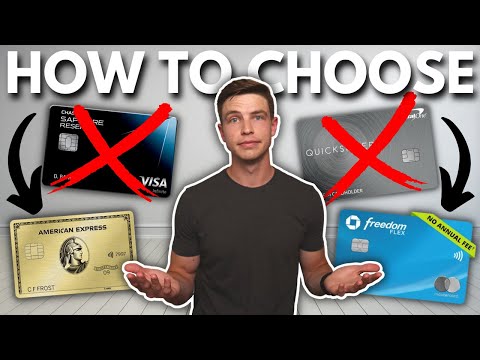

Choosing the Right Credit Card

Показать описание

When you are bombarded with credit card offers, it can be easy to either say no to all of them or tempting to accept each offer. Both decisions have the potential to hurt your credit. Below, Centric Federal Credit Union shares things to consider when choosing the right credit card for yourself:

1. Where Is the Credit Card Coming from?

• Credit cards from financial institutions are more beneficial for your credit and typically have lower rates.

• Retail store credit cards are tempting when there are promotions attached but can be dangerous if you don’t read the fine print.

• Centric’s Visa® credit card has competitive fixed rates, no hidden fees, and rewards!

2. What Are the Credit Card Terms?

• Pay attention to the terms and conditions when opening a credit card.

• Many credit card companies will charge your card automatically for monthly or annual fees.

• When opening a 0% interest credit card, pay attention to what you are agreeing to pay if the card is not paid off before the end of the promotion.

3. Do You Need a Credit Card?

• Revolving debt from credit cards is a big factor in what your credit score is so you don’t want to avoid credit cards all together.

• If you don’t have a credit card from a trustworthy financial institution, you want to consider opening one like Centric’s Visa® credit card.

• If you already have a dependable credit card with a comfortable limit, avoid opening new lines of credit.

#CentricFCU #LiveBetter #CreditUnion #Credit Cards #Rewards #Rates #RevolvingDebt

1. Where Is the Credit Card Coming from?

• Credit cards from financial institutions are more beneficial for your credit and typically have lower rates.

• Retail store credit cards are tempting when there are promotions attached but can be dangerous if you don’t read the fine print.

• Centric’s Visa® credit card has competitive fixed rates, no hidden fees, and rewards!

2. What Are the Credit Card Terms?

• Pay attention to the terms and conditions when opening a credit card.

• Many credit card companies will charge your card automatically for monthly or annual fees.

• When opening a 0% interest credit card, pay attention to what you are agreeing to pay if the card is not paid off before the end of the promotion.

3. Do You Need a Credit Card?

• Revolving debt from credit cards is a big factor in what your credit score is so you don’t want to avoid credit cards all together.

• If you don’t have a credit card from a trustworthy financial institution, you want to consider opening one like Centric’s Visa® credit card.

• If you already have a dependable credit card with a comfortable limit, avoid opening new lines of credit.

#CentricFCU #LiveBetter #CreditUnion #Credit Cards #Rewards #Rates #RevolvingDebt

0:15:45

0:15:45

0:00:34

0:00:34

0:20:31

0:20:31

0:01:53

0:01:53

0:14:21

0:14:21

0:07:27

0:07:27

0:03:05

0:03:05

0:03:19

0:03:19

0:08:08

0:08:08

0:12:39

0:12:39

0:21:50

0:21:50

0:19:12

0:19:12

0:21:35

0:21:35

0:15:39

0:15:39

0:01:01

0:01:01

1:30:41

1:30:41

0:13:40

0:13:40

0:11:52

0:11:52

0:44:44

0:44:44

0:04:11

0:04:11

0:00:42

0:00:42

0:06:39

0:06:39

0:02:20

0:02:20

0:07:47

0:07:47