filmov

tv

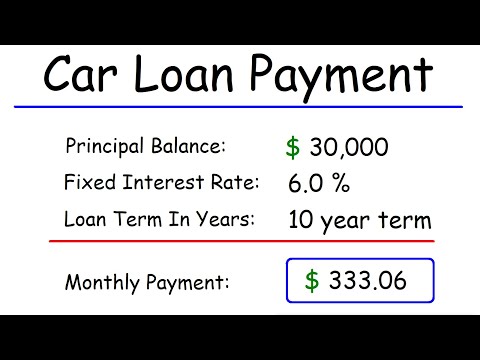

Car Loan Interest Rates Explained (For Beginners)

Показать описание

Auto loan interest explained (for beginners).

(I may be compensated by LightStream through this link.)

Car loan interest can be very expensive or relatively cheap depending on your terms and the rate you qualify for. You really want to pay attention to how much your borrowing, the interest rate and the length of the loan to determine how much interest your willing to pay on the car loan. You can easily lower your car payment if you extend the length of the loan, but you'll pay more interest on longer loans. So if you qualify for a high interest rate, try to refinance as soon as possible and don't take on a long car loan.

---------------

Robinhood Free Stock (Up to $200) with Sign Up:

Webull Up to 12 Free Fracional Shares (Each $3-$3,000):

M1 Finance (perfect for IRA's):

Instagram:

Advertiser Disclosure: Honest Finance participates in affiliate sales networks and may receive compensation by clicking through the links (at no cost to you). This compensation may impact how and where links appear in this description. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. This channel does not include all financial companies or all available financial offers.

---------------

Honest Finance covers a broad range of financial topics that'll give your life and finances more value. Subscribe today for future content and be sure to give this video a like!

Disclaimer: I am not a financial advisor. These videos are for education/entertainment purposes only. Investing of any kind involves risk, so please conduct your own research.

#honestfinance #carbuying

(I may be compensated by LightStream through this link.)

Car loan interest can be very expensive or relatively cheap depending on your terms and the rate you qualify for. You really want to pay attention to how much your borrowing, the interest rate and the length of the loan to determine how much interest your willing to pay on the car loan. You can easily lower your car payment if you extend the length of the loan, but you'll pay more interest on longer loans. So if you qualify for a high interest rate, try to refinance as soon as possible and don't take on a long car loan.

---------------

Robinhood Free Stock (Up to $200) with Sign Up:

Webull Up to 12 Free Fracional Shares (Each $3-$3,000):

M1 Finance (perfect for IRA's):

Instagram:

Advertiser Disclosure: Honest Finance participates in affiliate sales networks and may receive compensation by clicking through the links (at no cost to you). This compensation may impact how and where links appear in this description. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. This channel does not include all financial companies or all available financial offers.

---------------

Honest Finance covers a broad range of financial topics that'll give your life and finances more value. Subscribe today for future content and be sure to give this video a like!

Disclaimer: I am not a financial advisor. These videos are for education/entertainment purposes only. Investing of any kind involves risk, so please conduct your own research.

#honestfinance #carbuying

Комментарии

0:06:53

0:06:53

0:04:31

0:04:31

0:02:17

0:02:17

0:10:44

0:10:44

0:09:49

0:09:49

0:09:28

0:09:28

0:06:46

0:06:46

0:11:23

0:11:23

0:02:49

0:02:49

0:10:00

0:10:00

0:12:39

0:12:39

0:07:46

0:07:46

0:03:45

0:03:45

0:14:24

0:14:24

0:09:05

0:09:05

0:11:06

0:11:06

0:16:54

0:16:54

0:04:31

0:04:31

0:00:54

0:00:54

0:00:59

0:00:59

0:17:12

0:17:12

0:16:35

0:16:35

0:08:12

0:08:12

0:08:45

0:08:45