filmov

tv

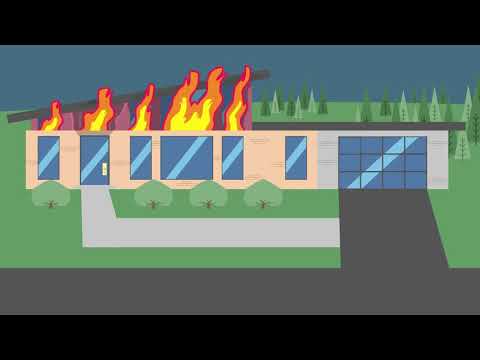

Homeowners Insurance 101 | Replacement Cost vs. Market Value

Показать описание

You’re covered! But to what extent?

There are two types of dwelling coverage you can purchase on a homeowners insurance policy: Replacement Cost and Market Value.

Connect with us on...

Closed Caption:

You’re covered! But to what extent?

Homeowners Insurance 101: Replacement Cost vs. Market Value

There are two types of dwelling coverage you can purchase on a homeowners insurance policy: Replacement Cost and Market Value.

Replacement cost coverage provides a more linear approach, covering the exact amount of money it costs to repair or rebuild your home to its original condition at the time it was damaged.

Market value coverage is a bit riskier. It covers the amount of money it would cost someone else to purchase your home and the land its sits on before it was damaged or destroyed. So if you purchased your home for $200,000, it gets completely destroyed and costs $225,000 to rebuild, you’d be stuck paying $25,000 out of pocket.

Since many homes cost more to rebuild than they’re worth on the open market, you’re typically safer with replacement cost coverage.

There are two types of dwelling coverage you can purchase on a homeowners insurance policy: Replacement Cost and Market Value.

Connect with us on...

Closed Caption:

You’re covered! But to what extent?

Homeowners Insurance 101: Replacement Cost vs. Market Value

There are two types of dwelling coverage you can purchase on a homeowners insurance policy: Replacement Cost and Market Value.

Replacement cost coverage provides a more linear approach, covering the exact amount of money it costs to repair or rebuild your home to its original condition at the time it was damaged.

Market value coverage is a bit riskier. It covers the amount of money it would cost someone else to purchase your home and the land its sits on before it was damaged or destroyed. So if you purchased your home for $200,000, it gets completely destroyed and costs $225,000 to rebuild, you’d be stuck paying $25,000 out of pocket.

Since many homes cost more to rebuild than they’re worth on the open market, you’re typically safer with replacement cost coverage.

0:02:57

0:02:57

0:25:48

0:25:48

0:01:11

0:01:11

0:08:34

0:08:34

0:02:08

0:02:08

0:01:07

0:01:07

0:04:37

0:04:37

0:08:32

0:08:32

0:00:53

0:00:53

0:08:43

0:08:43

0:01:38

0:01:38

0:03:52

0:03:52

0:01:20

0:01:20

0:29:49

0:29:49

0:05:11

0:05:11

0:00:59

0:00:59

0:01:35

0:01:35

0:15:05

0:15:05

0:00:47

0:00:47

0:00:51

0:00:51

0:00:53

0:00:53

0:01:12

0:01:12

0:07:47

0:07:47

0:01:01

0:01:01