filmov

tv

Homeowners Insurance 101, The Basics

Показать описание

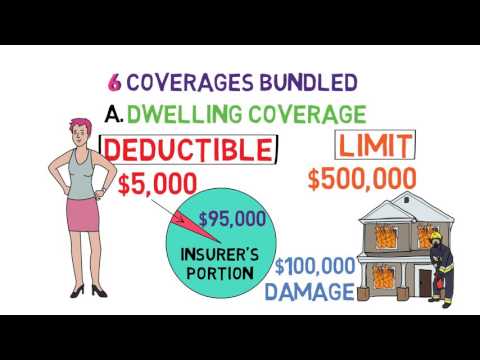

Homeowners Insurance 101, understand the basics about home insurance now! A standard home insurance policy includes 4 main types of coverage.

Coverage #1, the structure of your home. You receive a payout to repair covered damages—like those from a fire, storm, or burst pipe. You can even make a claim for damage caused by falling objects like a tree.

Coverage #2, your personal property. Home insurance protects your personal possessions—like clothes, furniture, or jewelry—if they get stolen or damaged during a covered event, like a wind storm or roof leak.

Coverage #3, your liability. In addition to covering your home and belongings, home insurance protects you from lawsuits. Someone could get hurt on your property or bitten by your dog.

Coverage #4, your additional living expenses. Additional living expenses for a hotel stay and meals can save the day you if have to leave your home while repairs are being made. Some home insurance policies put a cap on the amount of coverage you can get. For instance, there may be a dollar limit on items like cash, jewelry, silverware, and firearms. So be sure to know these limits or restrictions before you need to make a claim.

Coverage #1, the structure of your home. You receive a payout to repair covered damages—like those from a fire, storm, or burst pipe. You can even make a claim for damage caused by falling objects like a tree.

Coverage #2, your personal property. Home insurance protects your personal possessions—like clothes, furniture, or jewelry—if they get stolen or damaged during a covered event, like a wind storm or roof leak.

Coverage #3, your liability. In addition to covering your home and belongings, home insurance protects you from lawsuits. Someone could get hurt on your property or bitten by your dog.

Coverage #4, your additional living expenses. Additional living expenses for a hotel stay and meals can save the day you if have to leave your home while repairs are being made. Some home insurance policies put a cap on the amount of coverage you can get. For instance, there may be a dollar limit on items like cash, jewelry, silverware, and firearms. So be sure to know these limits or restrictions before you need to make a claim.

0:02:08

0:02:08

0:25:48

0:25:48

0:02:57

0:02:57

0:08:34

0:08:34

0:03:17

0:03:17

0:29:49

0:29:49

0:08:43

0:08:43

0:02:42

0:02:42

0:36:12

0:36:12

0:15:05

0:15:05

0:01:48

0:01:48

0:02:50

0:02:50

0:04:37

0:04:37

0:08:32

0:08:32

0:01:35

0:01:35

0:36:50

0:36:50

0:01:12

0:01:12

0:02:36

0:02:36

0:08:01

0:08:01

0:03:29

0:03:29

0:10:25

0:10:25

0:03:35

0:03:35

0:00:50

0:00:50

0:09:28

0:09:28