filmov

tv

How To Increase Your Dividend Snowball FAST

Показать описание

Nothing presented in this video is financial advice. Content in this video is for entertainment purposes only.

Video Tags:

#highyield #dividendstocks #dividendinvesting #yieldmax #defiance #qqqy

#tsly #jepy #nvdy #passiveincome #dividendetfs #dividends #entrepreneur #stockmarket #stocks #dropshipping #affiliatemarketing #shopify #shopifydropshipping #income #makemoneyonline #howtomakemoneyonline #incomeinvesting #finance #financialeducation #financialfreedom #financiallyfree #roadtoretirement #retirement #retirementplanning #dividend #dividendinvesting #coveredcalls #cashsecuredputs #optionstrading #optionincome

The 3 Fastest Ways to Grow Your Dividend Income

Are Dividend Investments A Good Idea?

The Truth About The Dividend Snowball - What They Don't Tell You

How To Get Dividends Every Month

How to Make $1,000 Per Month in Dividends! #shorts

Easiest and Fastest Way To Increase Your Dividend Snowball

Warren Buffett advice on how to live off dividends!!! #stockmarket #dividends

How To Build A Monster Dividend Portfolio | Ep. 325

quanto investir para receber R$10 pra sempre? #investimentos #dividendos #rendapassiva

How to improve your dividend investing.

Here's why dividend investing is a winning strategy

2 Options Strategies for Your Dividend Stock Portfolio (2021)

How to Reinvest Dividends (DRIP) #money #moneyminded #rothira

I Tested ALL the Monthly Dividend Stocks! #investing #dividends #dividendpayingstocks

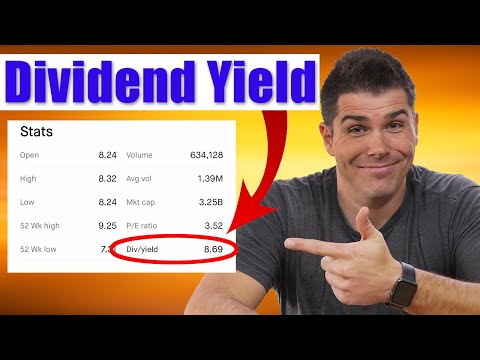

Dividend Yields Explained!

Dividend Yield Explained (For Beginners)

How Much $ Do You Need Invested To Live Off Dividends?

How to Build a Dividend Stock Portfolio With $100 (Free Course)

Free Dividend Fallacy--Why Dividends Don't Increase Your Wealth

🚀 2025 Dividend Stocks 📈 | Best Stocks Passive Income 💰 | High Dividend Stocks! #stocks #dividend...

How to Increase Cash Flow 600% RIGHT NOW || My Top 5 Dividend Stocks

Banks increasing their dividend after the 2025 stress test. 33% increase for Goldman Sachs!

Dividend Kings 👑 are companies that have at least 50 consecutive years of dividend increases!

7 Dividend Stocks INCREASING Payments | 82% Dividend Growth

Комментарии

0:04:04

0:04:04

0:03:38

0:03:38

0:12:56

0:12:56

0:00:47

0:00:47

0:01:00

0:01:00

0:10:15

0:10:15

0:00:16

0:00:16

0:43:04

0:43:04

0:01:01

0:01:01

0:09:48

0:09:48

0:10:58

0:10:58

0:17:43

0:17:43

0:00:42

0:00:42

0:00:44

0:00:44

0:00:30

0:00:30

0:04:42

0:04:42

0:13:54

0:13:54

0:20:16

0:20:16

0:24:06

0:24:06

0:00:06

0:00:06

0:10:16

0:10:16

0:00:16

0:00:16

0:00:38

0:00:38

0:10:05

0:10:05