filmov

tv

Chapter 7 Bankruptcy Explained | Step by Step

Показать описание

Finally! Chapter 7 bankruptcy explained step by step. For many who are struggling with serious debt problems the biggest source of stress and fear is not knowing what option are available.

In this video Attorney John Skiba walks you through the chapter 7 bankruptcy process - providing you with the information you need to make an informed decision.

🌟 Are You Ready to Break Free From the Chains of Debt?

🚀 Take Control of Your Financial Future Today!

You're not just another statistic in the world of debt and financial struggle. You're a fighter, ready to reclaim your financial freedom. And we're here to guide you every step of the way.

✅ Why Schedule a Consultation?

Personalized Solutions: Every debt story is unique. Get tailored advice that fits YOUR financial situation.

Expert Guidance: With over 20 years of experience in bankruptcy and debt defense, you'll receive top-tier legal strategies.

Empowerment: Knowledge is power. Understand your rights and options to make informed decisions.

Confidential & Judgement-Free: Your privacy is paramount. Discuss your situation in a secure and understanding environment.

👉 Don't let debt define your life. It's time to write a new chapter, one where you're in control. Your journey towards financial freedom starts with a click.

Book Your Free Strategy Session Now!

👉 Representing Yourself? Check Out These Forms, Templates, and Video Tutorials for Defending Debt Collection Lawsuits.

RECOMMENDED VIDEOS

If you enjoyed this video, I invite you to watch the following two:

I guarantee you will find them valuable.

KEY MOMENTS

00:00 Intro

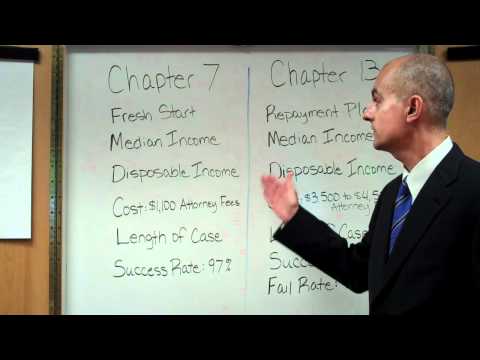

01:20 Chapter 7 Explained

05:45 Unsecured Debts

12:10 Discharge Order

#debt #bankruptcy #chapter7bankruptcy

In this video Attorney John Skiba walks you through the chapter 7 bankruptcy process - providing you with the information you need to make an informed decision.

🌟 Are You Ready to Break Free From the Chains of Debt?

🚀 Take Control of Your Financial Future Today!

You're not just another statistic in the world of debt and financial struggle. You're a fighter, ready to reclaim your financial freedom. And we're here to guide you every step of the way.

✅ Why Schedule a Consultation?

Personalized Solutions: Every debt story is unique. Get tailored advice that fits YOUR financial situation.

Expert Guidance: With over 20 years of experience in bankruptcy and debt defense, you'll receive top-tier legal strategies.

Empowerment: Knowledge is power. Understand your rights and options to make informed decisions.

Confidential & Judgement-Free: Your privacy is paramount. Discuss your situation in a secure and understanding environment.

👉 Don't let debt define your life. It's time to write a new chapter, one where you're in control. Your journey towards financial freedom starts with a click.

Book Your Free Strategy Session Now!

👉 Representing Yourself? Check Out These Forms, Templates, and Video Tutorials for Defending Debt Collection Lawsuits.

RECOMMENDED VIDEOS

If you enjoyed this video, I invite you to watch the following two:

I guarantee you will find them valuable.

KEY MOMENTS

00:00 Intro

01:20 Chapter 7 Explained

05:45 Unsecured Debts

12:10 Discharge Order

#debt #bankruptcy #chapter7bankruptcy

Комментарии

0:08:17

0:08:17

0:09:14

0:09:14

0:03:43

0:03:43

0:12:48

0:12:48

0:08:02

0:08:02

0:17:02

0:17:02

0:12:07

0:12:07

0:06:30

0:06:30

0:11:19

0:11:19

0:11:42

0:11:42

0:07:31

0:07:31

0:17:14

0:17:14

0:04:07

0:04:07

0:15:35

0:15:35

0:06:56

0:06:56

0:09:44

0:09:44

0:10:00

0:10:00

0:00:59

0:00:59

0:08:35

0:08:35

0:09:07

0:09:07

0:04:36

0:04:36

0:02:57

0:02:57

0:15:00

0:15:00

0:08:05

0:08:05