filmov

tv

FRM: TI BA II+ to compute bond price given zero (spot) rate curve

Показать описание

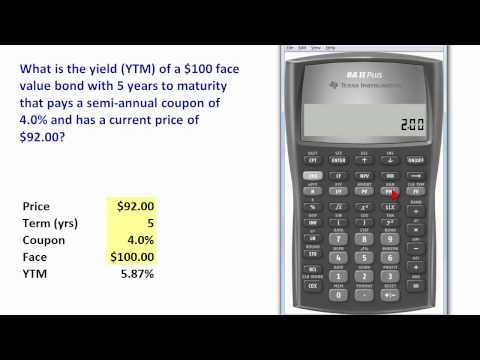

FRM: TI BA II+ to compute bond yield (YTM)

Texas Instruments BA II Plus Tutorial for CFA and FRM - How to format your calculator

FRM: TI BA II+ to price a bond

Setting Up the Texas BA II Plus Financial Calculator for the CFA Exam

Which Calculator to choose for CFA/FRM exams?

TI BA II Plus Professional Calculator Guide | FRM | CFA

Texas Instruments BA II Plus Tutorial for CFA and FRM - Square root function

Texas Instruments BA II Plus Tutorial for CFA and FRM - Reset the calculator to factory settings

Powerful Testimony Medjugorje - Three Sisters from Trinidad and Tobago

Solving Cash Flows Problems with Texas Instruments BA II Calculator (CFA, MBA, FRM)

FRM: TI BA II+ to compute bond price given zero (spot) rate curve

Texas Instruments BA II Plus Tutorial for CFA and FRM- IRR Function

BA II Plus | Cash Flows 1: Net Present Value (NPV) and IRR Calculations - DCF

Texas Instruments BA II Plus Tutorial for CFA and FRM - How to Use PMT Button from TVM row

Texas Instruments BA II Plus Tutorial for CFA and FRM - Annuity Calculations!

Texas Instruments BA ll Plus Financial Calculator #stationerywallah

Set up Texas instruments ba ii plus calculator for CFA FRM and other exams

Time Saving Tips for the BAII Plus™ Calculator

Setting Up the Texas Instruments BA II Financial Calculator (CFA, MBA, FRM)

Time Value of Money Calculations with Texas Instruments BA II Financial Calculator (CFA, MBA, FRM)

How to Calculate the Price of a Bond using a Financial Calculator

Basic Calculations with Texas Instruments BA II Financial Calculator (CFA, MBA, FRM)

Texas Instruments BA II Plus Tutorial for CFA and FRM - How to use NPV Function?

Introduction to Texas Instruments BA II Financial Calculator (CFA, MBA, FRM)

Комментарии

0:09:22

0:09:22

0:03:32

0:03:32

0:08:03

0:08:03

0:01:00

0:01:00

0:01:42

0:01:42

0:53:47

0:53:47

0:01:53

0:01:53

0:01:21

0:01:21

0:15:11

0:15:11

0:08:16

0:08:16

0:09:19

0:09:19

0:02:26

0:02:26

0:02:53

0:02:53

0:04:24

0:04:24

0:03:25

0:03:25

0:00:15

0:00:15

0:03:56

0:03:56

0:07:33

0:07:33

0:06:56

0:06:56

0:09:51

0:09:51

0:09:37

0:09:37

0:17:33

0:17:33

0:03:57

0:03:57

0:01:09

0:01:09