filmov

tv

How to Apply a Margin of Safety like Benjamin Graham! (Margin of Safety Explained + Example)

Показать описание

Get 50% off of Seeking Alpha Premium!

In this video, we got into detail on one of the most important things investors should do before buying a stock, which is applying a margin of safety. Margin of safety is the principle of buying a security at a significant discount to its intrinsic value, which is thought to not only provide high-return opportunities but also to minimize the downside risk of an investment.

Valuation model videos:

Multiples Valuation:

Dividend Discount Model:

Discounted Cash Flow Analysis:

Graham's Valuation:

I am not a Financial advisor or licensed professional. Nothing I say or produce on YouTube, or anywhere else, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.

How to set 1 inch Margins in Word

How to Create Margin Line in Microsoft Office Word 2021 | Margin Line In MS Word 2021

Trading With Margin - How I Do It

How to set margins in Microsoft word

Three Ways to Use Margin and Leverage

Pricing Part 3. How to Set a Profit Margin for One Product

What is a Margin Loan?

How to Apply a Margin of Safety like Benjamin Graham! (Margin of Safety Explained + Example)

Forex Leverage: 90% Of Beginners Make This Mistake When Trading With Margin...

How to set margin of a page in MS-WORD? #msword #mswordinhindi #mswordforbeginners #mswordtutorial

Applying Margin of Safety in Warren Buffett Way

Utm thesis format (margin)

Warren Buffett On: How to apply a margin of safety

How to Find Difference Between Markup Vs Profit Margin - Easy Trick

HOW TO SET MARGIN IN M.S WORD

Binance Margin Trading Tutorial for Beginners (Full Guide)

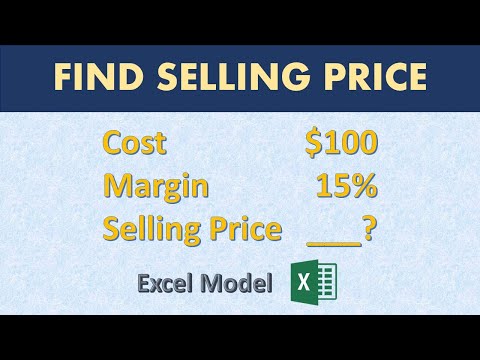

How to find selling price with cost and profit margin only

How to calculate gross profit margin on calculator

How to put 1.5 Margin in Microsoft Word

Portfolio Margin Explained

How Margin Loans Work And How I Personally Use Them

How to put 1 Inch Margin In Canva | Tutorial

Charles Schwab Is Changing Their Margin Rules?

What is margin of safety and how to apply it in investing?

Комментарии

0:00:24

0:00:24

0:01:24

0:01:24

0:10:42

0:10:42

0:01:25

0:01:25

0:03:55

0:03:55

0:01:01

0:01:01

0:02:22

0:02:22

0:06:58

0:06:58

0:15:16

0:15:16

0:01:00

0:01:00

0:04:43

0:04:43

0:02:52

0:02:52

0:04:43

0:04:43

0:03:56

0:03:56

0:00:44

0:00:44

0:21:49

0:21:49

0:06:07

0:06:07

0:02:27

0:02:27

0:01:27

0:01:27

0:13:35

0:13:35

0:18:48

0:18:48

0:01:11

0:01:11

0:07:14

0:07:14

0:05:19

0:05:19