filmov

tv

Trading With Margin - How I Do It

Показать описание

Trading With Margin - How I Do It

Intro: 0:00

What Is Margin?: 0:21

How To Open A Margin Account: 1:08

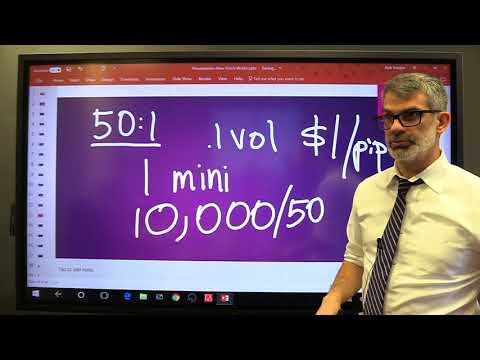

What Is Buying Power?: 2:04

Portfolio Margin 7:36

What Is Margin?

When opening a trading account, you can open a CASH or a MARGIN account.

With a cash account, if you put $10,000 into the cash account, you have $10,000 in buying power.

Now, when you have a margin account when you put in $10,000 in cash, the broker will actually lend you another $10,000 giving you $20,000 in buying power.

How To Open A Margin Account?

So with tastyworks, which is what I use, If you want to open an account, it asks what kind of account do you want to open? Is it an individual account, an entity, a trust, or a joint account?

And do you want to open a margin, cash, or retirement account?

In a cash or retirement account, the broker does not lend you money, but when you use a margin account, you're getting a 2:1 buying power.

What Is Buying Power?

- Buying power for options is always non-leveraged. So if you put $10,000 in cash, even in a margin account, it means that you have $10,000 in buying power for options.

- Buying power for stocks is leveraged. So $10,000 in cash will give you $20,000 in buying power.

- Portfolio margin

Buying Power For Stocks VS Options

AAPL Example:

What happens if you want to sell, let's say you want to trade the Wheel.

- If you're selling puts, you might be forced to buy Apple at 125 & for each option you have to buy 100 shares of Apple at $125 if assigned, so you would have to bring $12,500 to the table, right?

When you're selling options, the broker is already giving you a discount. The buying power that will be reduced from your options is $2,202. So as you can see, if you are buying Apple at 125, you would have to bring $12,500 to the table, but here the broker is only charging you $2,202.

On a $10,000 account, you could sell 4 of these options. So we see that the broker will charge you $8,795. So on a $10,000 account, at first it seems that you have enough margin for this. Wrong. Don't do that.

Doing it that way would be irresponsible.

On a $10,000 account you're getting $20,000 in buying power. So if you're selling one option, and you would get assigned, then you would have to buy stocks for $12,500 and only have $7,500 left, this is why you only sell one option, and even though your broker will only charge you $2,205.

This is the right way to do this because you're not over-leveraging yourself.

What if you DID sell 4 options and got assigned? You would have to bring to the table 4 times $12,500, so this is $50,000, but you only have $20,000 in buying power.

You are $30,000 short & this $30K becomes a so-called margin call.

A margin call means that right now you have to wire the broker $30,000

Portfolio Margin.

You are getting a 5:1 leverage, or some brokers even offer a 6:1 leverage, instead of 2:1.

I personally use this "excess buying power" when things go wrong when I need to save a trade that is in trouble.

Recommended links and videos:

#MarginTrading #MarginAccount #StockMarket

================================================================================

================================================================================

tastyworks, Inc. (“tastyworks”) has entered into a Marketing Agreement with Rockwell Trading Services, LLC whereby tastyworks pays compensation to Rockwell Trading Services, LLC to recommend tastyworks’ brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Rockwell Trading Services, LLC by tastyworks and/or any of its affiliated companies. Neither tastyworks nor any of its affiliated companies is responsible for the privacy practices of Rockwell Trading Services, LLC or this website. tastyworks does not warrant the accuracy or content of the products or services offered by Rockwell Trading Services, LLC or this website. Rockwell Trading Services, LLC is independent and is not an affiliate of tastyworks.

Intro: 0:00

What Is Margin?: 0:21

How To Open A Margin Account: 1:08

What Is Buying Power?: 2:04

Portfolio Margin 7:36

What Is Margin?

When opening a trading account, you can open a CASH or a MARGIN account.

With a cash account, if you put $10,000 into the cash account, you have $10,000 in buying power.

Now, when you have a margin account when you put in $10,000 in cash, the broker will actually lend you another $10,000 giving you $20,000 in buying power.

How To Open A Margin Account?

So with tastyworks, which is what I use, If you want to open an account, it asks what kind of account do you want to open? Is it an individual account, an entity, a trust, or a joint account?

And do you want to open a margin, cash, or retirement account?

In a cash or retirement account, the broker does not lend you money, but when you use a margin account, you're getting a 2:1 buying power.

What Is Buying Power?

- Buying power for options is always non-leveraged. So if you put $10,000 in cash, even in a margin account, it means that you have $10,000 in buying power for options.

- Buying power for stocks is leveraged. So $10,000 in cash will give you $20,000 in buying power.

- Portfolio margin

Buying Power For Stocks VS Options

AAPL Example:

What happens if you want to sell, let's say you want to trade the Wheel.

- If you're selling puts, you might be forced to buy Apple at 125 & for each option you have to buy 100 shares of Apple at $125 if assigned, so you would have to bring $12,500 to the table, right?

When you're selling options, the broker is already giving you a discount. The buying power that will be reduced from your options is $2,202. So as you can see, if you are buying Apple at 125, you would have to bring $12,500 to the table, but here the broker is only charging you $2,202.

On a $10,000 account, you could sell 4 of these options. So we see that the broker will charge you $8,795. So on a $10,000 account, at first it seems that you have enough margin for this. Wrong. Don't do that.

Doing it that way would be irresponsible.

On a $10,000 account you're getting $20,000 in buying power. So if you're selling one option, and you would get assigned, then you would have to buy stocks for $12,500 and only have $7,500 left, this is why you only sell one option, and even though your broker will only charge you $2,205.

This is the right way to do this because you're not over-leveraging yourself.

What if you DID sell 4 options and got assigned? You would have to bring to the table 4 times $12,500, so this is $50,000, but you only have $20,000 in buying power.

You are $30,000 short & this $30K becomes a so-called margin call.

A margin call means that right now you have to wire the broker $30,000

Portfolio Margin.

You are getting a 5:1 leverage, or some brokers even offer a 6:1 leverage, instead of 2:1.

I personally use this "excess buying power" when things go wrong when I need to save a trade that is in trouble.

Recommended links and videos:

#MarginTrading #MarginAccount #StockMarket

================================================================================

================================================================================

tastyworks, Inc. (“tastyworks”) has entered into a Marketing Agreement with Rockwell Trading Services, LLC whereby tastyworks pays compensation to Rockwell Trading Services, LLC to recommend tastyworks’ brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Rockwell Trading Services, LLC by tastyworks and/or any of its affiliated companies. Neither tastyworks nor any of its affiliated companies is responsible for the privacy practices of Rockwell Trading Services, LLC or this website. tastyworks does not warrant the accuracy or content of the products or services offered by Rockwell Trading Services, LLC or this website. Rockwell Trading Services, LLC is independent and is not an affiliate of tastyworks.

Комментарии

0:10:42

0:10:42

0:02:11

0:02:11

0:12:31

0:12:31

0:16:21

0:16:21

0:15:16

0:15:16

0:21:49

0:21:49

0:03:55

0:03:55

0:16:57

0:16:57

0:00:53

0:00:53

0:06:20

0:06:20

0:05:17

0:05:17

0:05:18

0:05:18

0:01:11

0:01:11

0:30:00

0:30:00

0:09:45

0:09:45

0:14:39

0:14:39

0:23:38

0:23:38

0:10:10

0:10:10

0:01:10

0:01:10

0:20:10

0:20:10

0:26:59

0:26:59

0:11:14

0:11:14

0:04:52

0:04:52

0:07:33

0:07:33