filmov

tv

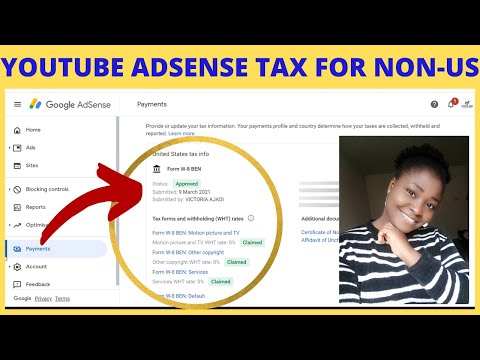

YOUTUBE TAXES Explained! 10 Tax Tips for YouTube Creators!

Показать описание

YouTube Taxes can be complicated. Both Small YouTubers and Full-time YouTubers struggle with YouTube Taxes and understanding paying taxes on their YouTube Money. I've partnered with TurboTax Self-Employed to help you better understand YouTube Taxes on your YouTube Earnings, Brand Deals, and Affiliate Marketing Revenue.

#YOUTUBETAXES #TAXES #AD

TurboTax Live Self-Employed as an easy solution for filing your taxes and working with credentialed tax experts who can answer your tax questions, give you unlimited advice all year long and help you keep more money in your pocket at tax time.

0:20 Does YouTube Take Out Taxes for You?

1:29 Can You Deduct Purchase for YouTube From Your Taxes?

2:00 How Much Do You Need to Earn to Pay YouTube Taxes?

2:59 What I Can You Deduct From Your YouTube Taxes?

3:34 How Much Money Do You Need to Set Aside for YouTube Taxes?

4:28 Should You Pay YouTube Taxes Quarterly or Yearly?

5:08 Do You Need to Set Aside Money Besides YouTube Taxes?

6:10 Do I Need to Incorporate as a Business?

6:40 How Should You Separate Business from Personal Finances?

Many YouTube Creators don't know if they need to pay taxes on YouTube Ad Revenue. The short answer is YES. You do need to pay YouTube Taxes and you have to pay taxes on YouTube income from Brand Deals and on Affiliate Marketing Income.

YouTube Income Taxes represent self-employed income, your YouTube Taxes are not taken out for you by YouTube since you are not a YouTube Employee. YouTube Adsense earnings are reported on a 1099 form you receive for your YouTube monetization earnings and you will be filing a 1044 Tax for or a Schedule C.

**Disclaimer: I am not a Financial Advisor or Licensed Tax Professional, this information for entertainment and education purposes only. Please consult a licensed financial professional.

Invest in Your Future By Getting Some FREE Stocks

Get a Free Stock When You Signup for Robinhood

Get 2 Free Stocks on WeBull When You Deposit $100 (Valued up to $1400)

JOIN MY WEEKLY GROUP COACHING PROGRAM!

BEST TOOL TO GROW A YOUTUBE CHANNEL

DISCOUNT CODE: robertosbuddy

GET THE YOUTUBE STARTER KIT

REQUEST A 30 MINUTE YOUTUBE CHANNEL REVIEW

GET A 30 DAY FREE TRIAL OF EPIDEMIC SOUND

GET CLOSED CAPTIONS AND TRANSLATIONS FOR VIDEO

START YOUR OWN WEBSITE WITH BLUEHOST

WHAT I USE TO SHOOT MY VIDEOS(Affiliate)

Cameras For Photography and Video 📸

Camera Lenses 📷

Microphones for Video and Podcasting 🎤

Lighting Gear 💡

DRONES

CONNECT WITH ME ONLINE

SEND ME FAN MAIL AND STUFF

WeWork c/o Roberto Blake

1372 Peachtree St

Atlanta, GA 30309

Roberto Blake is a Creative Entrepreneur, Keynote Speaker and YouTube Certified Educator. He is the founder of Awesome Creator Academy and Host of the Create Something Awesome Today Podcast.

Roberto Blake helps entrepreneurs and social media influencers, through educational videos on YouTube, motivational content on Instagram and career development advice on LinkedIn, as well as offering 1 on 1 Coaching and a Group Coaching Program.

Disclaimers: all opinions are my own, sponsors are acknowledged. Links in the description are typically affiliate links that let you help support the channel at no extra cost.

#YOUTUBETAXES #TAXES #AD

TurboTax Live Self-Employed as an easy solution for filing your taxes and working with credentialed tax experts who can answer your tax questions, give you unlimited advice all year long and help you keep more money in your pocket at tax time.

0:20 Does YouTube Take Out Taxes for You?

1:29 Can You Deduct Purchase for YouTube From Your Taxes?

2:00 How Much Do You Need to Earn to Pay YouTube Taxes?

2:59 What I Can You Deduct From Your YouTube Taxes?

3:34 How Much Money Do You Need to Set Aside for YouTube Taxes?

4:28 Should You Pay YouTube Taxes Quarterly or Yearly?

5:08 Do You Need to Set Aside Money Besides YouTube Taxes?

6:10 Do I Need to Incorporate as a Business?

6:40 How Should You Separate Business from Personal Finances?

Many YouTube Creators don't know if they need to pay taxes on YouTube Ad Revenue. The short answer is YES. You do need to pay YouTube Taxes and you have to pay taxes on YouTube income from Brand Deals and on Affiliate Marketing Income.

YouTube Income Taxes represent self-employed income, your YouTube Taxes are not taken out for you by YouTube since you are not a YouTube Employee. YouTube Adsense earnings are reported on a 1099 form you receive for your YouTube monetization earnings and you will be filing a 1044 Tax for or a Schedule C.

**Disclaimer: I am not a Financial Advisor or Licensed Tax Professional, this information for entertainment and education purposes only. Please consult a licensed financial professional.

Invest in Your Future By Getting Some FREE Stocks

Get a Free Stock When You Signup for Robinhood

Get 2 Free Stocks on WeBull When You Deposit $100 (Valued up to $1400)

JOIN MY WEEKLY GROUP COACHING PROGRAM!

BEST TOOL TO GROW A YOUTUBE CHANNEL

DISCOUNT CODE: robertosbuddy

GET THE YOUTUBE STARTER KIT

REQUEST A 30 MINUTE YOUTUBE CHANNEL REVIEW

GET A 30 DAY FREE TRIAL OF EPIDEMIC SOUND

GET CLOSED CAPTIONS AND TRANSLATIONS FOR VIDEO

START YOUR OWN WEBSITE WITH BLUEHOST

WHAT I USE TO SHOOT MY VIDEOS(Affiliate)

Cameras For Photography and Video 📸

Camera Lenses 📷

Microphones for Video and Podcasting 🎤

Lighting Gear 💡

DRONES

CONNECT WITH ME ONLINE

SEND ME FAN MAIL AND STUFF

WeWork c/o Roberto Blake

1372 Peachtree St

Atlanta, GA 30309

Roberto Blake is a Creative Entrepreneur, Keynote Speaker and YouTube Certified Educator. He is the founder of Awesome Creator Academy and Host of the Create Something Awesome Today Podcast.

Roberto Blake helps entrepreneurs and social media influencers, through educational videos on YouTube, motivational content on Instagram and career development advice on LinkedIn, as well as offering 1 on 1 Coaching and a Group Coaching Program.

Disclaimers: all opinions are my own, sponsors are acknowledged. Links in the description are typically affiliate links that let you help support the channel at no extra cost.

Комментарии

0:08:41

0:08:41

0:08:28

0:08:28

0:04:06

0:04:06

0:18:05

0:18:05

0:04:38

0:04:38

0:04:47

0:04:47

0:04:29

0:04:29

0:00:20

0:00:20

0:59:11

0:59:11

0:01:00

0:01:00

0:03:46

0:03:46

0:05:00

0:05:00

0:00:59

0:00:59

0:09:54

0:09:54

0:13:37

0:13:37

0:00:40

0:00:40

0:12:29

0:12:29

0:00:34

0:00:34

0:00:20

0:00:20

0:08:37

0:08:37

0:19:12

0:19:12

0:02:48

0:02:48

0:00:37

0:00:37

0:00:31

0:00:31