filmov

tv

GET CREDIT CARD BALANCES & DEBT OFF PERSONAL CREDIT (LEGALLY) | BAD credit TURN TO GOOD! FAST!

Показать описание

GET CREDIT CARD BALANCES & DEBT OFF PERSONAL CREDIT (LEGALLY) | BAD credit TURN TO GOOD! FAST! Increase your CREDIT SCORE for good. Real Results I share with you in the Video. This is How to Increase your Credit Score yourself. Business Credit and Business Loans & Funding

Repair and raise your Credit by Make DEBT and BALANCE disappear off your Personal Credit. BE PERSONALLY DEBT FREE!

FREE MONEY:

Your credit score is determined by five factors. The following is a breakdown of these credit score factors:

History of payments (35%)

(30%) Credit Utilization

(15%) Average Credit Age

Mix of credit (10%)

New credit and hard enquiries (10%)

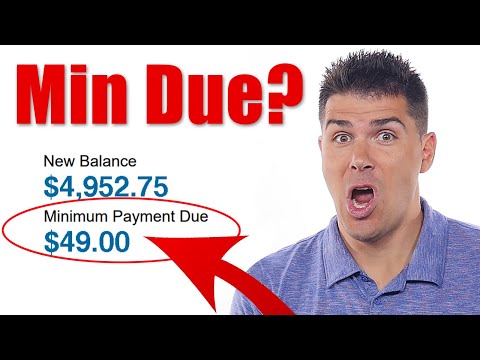

As you can see, 30% of your credit score is determined by your credit usage, or the proportion of open credit that you are using. You should aim to keep your credit usage ratio below 30% as a general rule. It would be nice if you could reduce it to 0%.

This is when things become a little complicated. If you frequently use credit, your credit report is likely to reflect a balance. That's because you have no control over when your credit card provider informs the bureaus about activities.

Consider the scenario where your limit is $5,000 and your balance is 0. After that, you spend $100. Even if the bill hasn't yet been due, if your creditor later files a report with the bureau, you will have a 2% credit usage ratio ($100/$5,000 = 2%).

However, having a credit utilization ratio exceeding 0% isn't always cause for concern. Consumers with a flawless 850 FICO score have an average credit utilization of 5.8%, according to Experian.

It doesn't follow that the average person with a flawless score is always carrying a 5.8% balance. When your creditor submits a report to the bureaus, they are merely giving them a current snapshot of your account.

Even if you pay off your bill in full each month, your account is likely to appear that you are still utilizing some of your available credit.

Your score can suffer if your credit use ratio is 0% since you never use your credit cards. You aren't creating activity that is reported to the credit bureaus when you aren't using credit frequently and you don't have any unpaid loans.

That's bad since your payment history matters much more than how much credit you spend.

Additionally, the corporation that issues your credit card may suspend it for lack of use. Your score is impacted in two ways by this: Due to a reduction in your available credit, your credit usage may rise. Your average credit history will decrease if the card was also one of your older accounts.

Your credit score is unaffected when you don't pay off your bill in full. Unless you take advantage of a brief interest-free period, you'll also pay unneeded interest.

Having said that, you shouldn't be concerned if a balance appears on your credit record. You may establish good credit as long as your balances—both overall and on each individual card—remain below 30%.

Consider the following advice from those with credit scores over 800:

MORE GREAT BONUSES:

CONTACT ME:

NOTICE OF RISK: Content is for News & Entertainment purposes only. Do not make accounting, legal, business, personal or financial decisions based on content provided. ALWAYS CONSULT A PAID PROFESSIONAL. The content provided is owned and expressed by ORIGIN, LLC, a multimedia company. Andrew Cartwright is an employed personality and is not LEGALLY responsible for the following content. The information provided is the opinion of Origin, LLC. Andrew Cartwright and/or Capital Velocity may receive compensation for your use of the Products and Services advertised in this content through the use of affiliate links.

#CreditCard #CreditScore #CreditRepair #debtfree

Repair and raise your Credit by Make DEBT and BALANCE disappear off your Personal Credit. BE PERSONALLY DEBT FREE!

FREE MONEY:

Your credit score is determined by five factors. The following is a breakdown of these credit score factors:

History of payments (35%)

(30%) Credit Utilization

(15%) Average Credit Age

Mix of credit (10%)

New credit and hard enquiries (10%)

As you can see, 30% of your credit score is determined by your credit usage, or the proportion of open credit that you are using. You should aim to keep your credit usage ratio below 30% as a general rule. It would be nice if you could reduce it to 0%.

This is when things become a little complicated. If you frequently use credit, your credit report is likely to reflect a balance. That's because you have no control over when your credit card provider informs the bureaus about activities.

Consider the scenario where your limit is $5,000 and your balance is 0. After that, you spend $100. Even if the bill hasn't yet been due, if your creditor later files a report with the bureau, you will have a 2% credit usage ratio ($100/$5,000 = 2%).

However, having a credit utilization ratio exceeding 0% isn't always cause for concern. Consumers with a flawless 850 FICO score have an average credit utilization of 5.8%, according to Experian.

It doesn't follow that the average person with a flawless score is always carrying a 5.8% balance. When your creditor submits a report to the bureaus, they are merely giving them a current snapshot of your account.

Even if you pay off your bill in full each month, your account is likely to appear that you are still utilizing some of your available credit.

Your score can suffer if your credit use ratio is 0% since you never use your credit cards. You aren't creating activity that is reported to the credit bureaus when you aren't using credit frequently and you don't have any unpaid loans.

That's bad since your payment history matters much more than how much credit you spend.

Additionally, the corporation that issues your credit card may suspend it for lack of use. Your score is impacted in two ways by this: Due to a reduction in your available credit, your credit usage may rise. Your average credit history will decrease if the card was also one of your older accounts.

Your credit score is unaffected when you don't pay off your bill in full. Unless you take advantage of a brief interest-free period, you'll also pay unneeded interest.

Having said that, you shouldn't be concerned if a balance appears on your credit record. You may establish good credit as long as your balances—both overall and on each individual card—remain below 30%.

Consider the following advice from those with credit scores over 800:

MORE GREAT BONUSES:

CONTACT ME:

NOTICE OF RISK: Content is for News & Entertainment purposes only. Do not make accounting, legal, business, personal or financial decisions based on content provided. ALWAYS CONSULT A PAID PROFESSIONAL. The content provided is owned and expressed by ORIGIN, LLC, a multimedia company. Andrew Cartwright is an employed personality and is not LEGALLY responsible for the following content. The information provided is the opinion of Origin, LLC. Andrew Cartwright and/or Capital Velocity may receive compensation for your use of the Products and Services advertised in this content through the use of affiliate links.

#CreditCard #CreditScore #CreditRepair #debtfree

Комментарии

0:12:10

0:12:10

0:14:19

0:14:19

0:05:49

0:05:49

0:03:54

0:03:54

0:10:49

0:10:49

0:13:08

0:13:08

0:14:21

0:14:21

0:15:10

0:15:10

0:14:44

0:14:44

0:03:00

0:03:00

0:04:28

0:04:28

0:10:28

0:10:28

0:02:43

0:02:43

0:00:58

0:00:58

0:08:51

0:08:51

0:03:22

0:03:22

0:03:35

0:03:35

0:10:34

0:10:34

0:08:04

0:08:04

0:04:41

0:04:41

0:01:02

0:01:02

0:12:18

0:12:18

0:11:04

0:11:04

0:05:07

0:05:07