filmov

tv

Telematics Explained! | Car Insurance 101

Показать описание

------

------

-------

“I paid $205 for insurance with GEICO, and really was unhappy with them. I stayed with them so long because I couldn’t find it in me to go through the agony of comparing companies. The Penny Hoarder gave Jerry a great review and I am so happy I gave them a try!” — M. Swatt

“Jerry took care of everything, even canceling my old policy and getting me a refund!” — S.C.

“Saved $600 a year. Every 6 months Jerry automatically checks rates again.” — B.D.

“It has better pricing than going directly to the Insurance Company. I have used Jerry for two policies now.” — Dave M.

“I downloaded 3 insurance searching apps and Jerry was the best one by far. Easy. Accurate. Great customer service!” — Kyerra S.

-------

Telematics can help you save a lot of money on your car insurance. But ... what exactly is it?

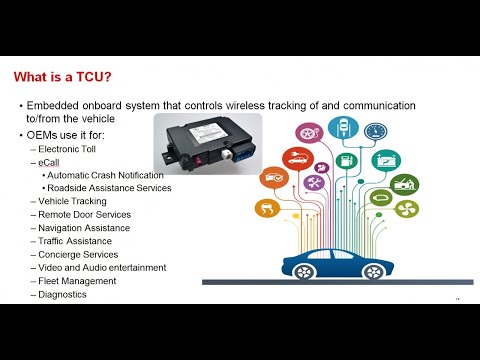

When you sign up for a new insurance policy, your company may provide you with a "telematics device" that should be installed in your car. The device records information about your driving — like speed, mileage, how hard you break, and even what time of day you drive.

These are factors that can contribute to whether or not you're a "high-risk" driver. And they can use that data to lower your insurance premiums if you are driving safely. If you're naturally a good driver with a clean record, telematics can help you save a lot. And if you do have some bad driving habits or risky behaviors, using telematics might help you remember to be more careful.

Insurance companies use telematics in different ways. Some ask you to have the device in your vehicle for six months before they adjust your rates. Others give you an automatic discount once you install the device, and then adjust your rates each pay period based on your driving habits.

------

-------

“I paid $205 for insurance with GEICO, and really was unhappy with them. I stayed with them so long because I couldn’t find it in me to go through the agony of comparing companies. The Penny Hoarder gave Jerry a great review and I am so happy I gave them a try!” — M. Swatt

“Jerry took care of everything, even canceling my old policy and getting me a refund!” — S.C.

“Saved $600 a year. Every 6 months Jerry automatically checks rates again.” — B.D.

“It has better pricing than going directly to the Insurance Company. I have used Jerry for two policies now.” — Dave M.

“I downloaded 3 insurance searching apps and Jerry was the best one by far. Easy. Accurate. Great customer service!” — Kyerra S.

-------

Telematics can help you save a lot of money on your car insurance. But ... what exactly is it?

When you sign up for a new insurance policy, your company may provide you with a "telematics device" that should be installed in your car. The device records information about your driving — like speed, mileage, how hard you break, and even what time of day you drive.

These are factors that can contribute to whether or not you're a "high-risk" driver. And they can use that data to lower your insurance premiums if you are driving safely. If you're naturally a good driver with a clean record, telematics can help you save a lot. And if you do have some bad driving habits or risky behaviors, using telematics might help you remember to be more careful.

Insurance companies use telematics in different ways. Some ask you to have the device in your vehicle for six months before they adjust your rates. Others give you an automatic discount once you install the device, and then adjust your rates each pay period based on your driving habits.

0:01:23

0:01:23

0:02:54

0:02:54

0:01:21

0:01:21

0:03:10

0:03:10

0:02:50

0:02:50

0:06:04

0:06:04

0:10:50

0:10:50

0:32:02

0:32:02

0:01:45

0:01:45

0:13:44

0:13:44

0:04:52

0:04:52

0:02:22

0:02:22

0:05:10

0:05:10

0:02:46

0:02:46

0:05:59

0:05:59

0:01:01

0:01:01

0:02:46

0:02:46

0:01:48

0:01:48

0:01:28

0:01:28

0:01:35

0:01:35

0:11:37

0:11:37

0:09:05

0:09:05

0:20:16

0:20:16

0:02:43

0:02:43