filmov

tv

TELEMATICS MOTOR INSURANCE CONCEPT (#TELEMATICS) | #insuranceworldtv

Показать описание

@InsuranceWorldTv #insuranceworldtv

FIND US HERE:

WHAT IS #TELEMATICS?

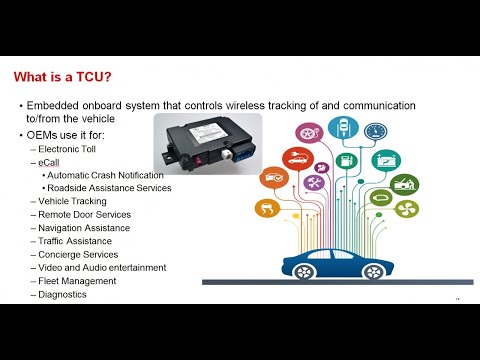

Telematics is a technology that combines telecommunications and informatics to collect and transmit data over long distances. In the context of the automotive industry, telematics refers to the use of electronic devices and communication systems to gather, store, and transmit information about a vehicle's location, speed, duration on the road, and performance among others.

This technology uses devices that are installed in vehicles. These devices use various sensors and GPS technology to collect data about driving behavior, such as speed, acceleration, braking, and cornering which is then be transmitted to a remote location, where it can be analyzed and used for a variety of purposes, such as tracking vehicle performance, monitoring driver behavior, and improving road safety. This technology is used in a variety of applications, including vehicle tracking and fleet management, emergency services, and insurance.

WHAT IS USAGE-BASED OR #TELEMATICS #MOTORINSURANCE?

Telematics motor insurance, also known as usage-based insurance, is a type of car insurance policy that uses technology to track and analyze your driving behavior.

With telematics motor insurance, a device is installed in your vehicle that collects data on your driving habits, such as speed, acceleration, braking, and cornering. This data is then used by the insurance company to assess your risk as a driver and to calculate your insurance premiums. By tracking your driving behavior, the insurance company can offer you a personalized premium that is based on your actual driving habits rather than on assumptions about drivers in your demographic group. Telematics motor insurance can also provide feedback on your driving, giving you insights into how to become a safer and more efficient driver. Some telematics policies also offer additional benefits, such as theft recovery services or roadside assistance.

REASONS WHY #TELEMATICS #INSURANCE IS GAINING POPULARITY

1. Cost Savings:

2. Personalization:

2. Improved Safety:

3. Data Analytics:

4. Environmental Concerns:

5. Technological Advances:

WHY TELEMATICS MOTOR INSURANCE IS BETTER THAN ORDINARY MOTOR INSURANCE

Telematics motor insurance is better than ordinary motor insurance in several ways. Firstly, telematics insurance offers personalized premiums based on your actual driving behavior, whereas ordinary motor insurance policies typically use general risk factors, such as age, gender, and location, to determine premiums. This means that with telematics insurance, you have the opportunity to save money on your insurance premiums by driving safely and responsibly. Secondly, telematics insurance provides feedback on your driving behavior, which can help you become a safer and more responsible driver. By using real-time data on your driving habits, telematics devices can identify areas where you need to improve your driving, such as speeding or harsh braking, and provide you with feedback on how to drive more safely. Thirdly, telematics insurance can help reduce the risk of accidents by encouraging safer driving habits. When drivers know that their driving behavior is being monitored, they tend to drive more carefully and responsibly, which can lead to fewer accidents and lower insurance costs. Finally, telematics insurance provides greater transparency and accountability than traditional motor insurance policies. With telematics insurance, drivers have a clearer understanding of how their premiums are calculated and can see how their driving behavior affects their insurance costs. This can help foster greater trust between insurance companies and drivers, as well as encourage safer and more responsible driving behavior. Overall, telematics motor insurance offers a range of benefits that make it a better option than ordinary motor insurance. From personalized premiums to safer driving habits, telematics insurance is an innovative and effective way to protect your vehicle while also becoming a better driver.

ADVANTAGES OF #TELEMATICS INSURANCE

There are several advantages of telematics insurance, including:

1. Personalized premiums:

2. Improved driving behavior:

3. Theft recovery:

4. Roadside assistance:

5. Data insights:

6. Cost savings:

By incentivizing safe driving behavior and reducing the number of accidents on the road, telematics insurance can ultimately lead to cost savings for insurance companies and drivers alike.

DOWNSIDES OF #TELEMATICS INSURANCE

While there are several advantages to telematics insurance, there are also some potential downsides to consider:

1. Privacy concerns:

2. Upfront costs:

3. Data accuracy:

4. Limited coverage options:

5. Technology issues:

FIND US HERE:

WHAT IS #TELEMATICS?

Telematics is a technology that combines telecommunications and informatics to collect and transmit data over long distances. In the context of the automotive industry, telematics refers to the use of electronic devices and communication systems to gather, store, and transmit information about a vehicle's location, speed, duration on the road, and performance among others.

This technology uses devices that are installed in vehicles. These devices use various sensors and GPS technology to collect data about driving behavior, such as speed, acceleration, braking, and cornering which is then be transmitted to a remote location, where it can be analyzed and used for a variety of purposes, such as tracking vehicle performance, monitoring driver behavior, and improving road safety. This technology is used in a variety of applications, including vehicle tracking and fleet management, emergency services, and insurance.

WHAT IS USAGE-BASED OR #TELEMATICS #MOTORINSURANCE?

Telematics motor insurance, also known as usage-based insurance, is a type of car insurance policy that uses technology to track and analyze your driving behavior.

With telematics motor insurance, a device is installed in your vehicle that collects data on your driving habits, such as speed, acceleration, braking, and cornering. This data is then used by the insurance company to assess your risk as a driver and to calculate your insurance premiums. By tracking your driving behavior, the insurance company can offer you a personalized premium that is based on your actual driving habits rather than on assumptions about drivers in your demographic group. Telematics motor insurance can also provide feedback on your driving, giving you insights into how to become a safer and more efficient driver. Some telematics policies also offer additional benefits, such as theft recovery services or roadside assistance.

REASONS WHY #TELEMATICS #INSURANCE IS GAINING POPULARITY

1. Cost Savings:

2. Personalization:

2. Improved Safety:

3. Data Analytics:

4. Environmental Concerns:

5. Technological Advances:

WHY TELEMATICS MOTOR INSURANCE IS BETTER THAN ORDINARY MOTOR INSURANCE

Telematics motor insurance is better than ordinary motor insurance in several ways. Firstly, telematics insurance offers personalized premiums based on your actual driving behavior, whereas ordinary motor insurance policies typically use general risk factors, such as age, gender, and location, to determine premiums. This means that with telematics insurance, you have the opportunity to save money on your insurance premiums by driving safely and responsibly. Secondly, telematics insurance provides feedback on your driving behavior, which can help you become a safer and more responsible driver. By using real-time data on your driving habits, telematics devices can identify areas where you need to improve your driving, such as speeding or harsh braking, and provide you with feedback on how to drive more safely. Thirdly, telematics insurance can help reduce the risk of accidents by encouraging safer driving habits. When drivers know that their driving behavior is being monitored, they tend to drive more carefully and responsibly, which can lead to fewer accidents and lower insurance costs. Finally, telematics insurance provides greater transparency and accountability than traditional motor insurance policies. With telematics insurance, drivers have a clearer understanding of how their premiums are calculated and can see how their driving behavior affects their insurance costs. This can help foster greater trust between insurance companies and drivers, as well as encourage safer and more responsible driving behavior. Overall, telematics motor insurance offers a range of benefits that make it a better option than ordinary motor insurance. From personalized premiums to safer driving habits, telematics insurance is an innovative and effective way to protect your vehicle while also becoming a better driver.

ADVANTAGES OF #TELEMATICS INSURANCE

There are several advantages of telematics insurance, including:

1. Personalized premiums:

2. Improved driving behavior:

3. Theft recovery:

4. Roadside assistance:

5. Data insights:

6. Cost savings:

By incentivizing safe driving behavior and reducing the number of accidents on the road, telematics insurance can ultimately lead to cost savings for insurance companies and drivers alike.

DOWNSIDES OF #TELEMATICS INSURANCE

While there are several advantages to telematics insurance, there are also some potential downsides to consider:

1. Privacy concerns:

2. Upfront costs:

3. Data accuracy:

4. Limited coverage options:

5. Technology issues:

0:13:44

0:13:44

0:02:54

0:02:54

0:32:02

0:32:02

0:01:23

0:01:23

0:03:10

0:03:10

0:10:50

0:10:50

0:01:27

0:01:27

0:06:04

0:06:04

0:01:48

0:01:48

0:02:43

0:02:43

0:00:22

0:00:22

0:05:13

0:05:13

0:05:59

0:05:59

0:01:19

0:01:19

0:01:28

0:01:28

0:01:18

0:01:18

0:05:39

0:05:39

0:01:54

0:01:54

0:05:10

0:05:10

0:10:20

0:10:20

0:20:16

0:20:16

0:04:30

0:04:30

0:03:37

0:03:37

0:01:35

0:01:35