filmov

tv

GST Section 17 Rule 42 and Rule 43 Notice | GST updates | CA Kapil Jain

Показать описание

FOR MORE DETAIL CONTACT : 8700-802-813, 9999-3231-64

ICAI GST Faculty & Motivational Speaker, He is GST Expert (for Practical Training) and GST Pen/Google Drive classes are also available.

GST PRACTICAL TRAINING | Pen drive classes by FCA Kapil Jain

Advantages of Pen Drive / Google Drive Classes

#1 Saves the Travelling Time

#2 Flexible Timings

#3 Plays as per your Comfort

#4 Forget missing the classes

#5 24X7 hours online support

INTERESTED CANDIDATES PLEASE CONTACT 8700-802-813, 9999-3231-64

🔥 Our Courses:-

🌍 Download KJ CLASSES App 👇(SPECIAL OFFER)🔥

🔥 Follow us:-

ICAI GST Faculty & Motivational Speaker, He is GST Expert (for Practical Training) and GST Pen/Google Drive classes are also available.

GST PRACTICAL TRAINING | Pen drive classes by FCA Kapil Jain

Advantages of Pen Drive / Google Drive Classes

#1 Saves the Travelling Time

#2 Flexible Timings

#3 Plays as per your Comfort

#4 Forget missing the classes

#5 24X7 hours online support

INTERESTED CANDIDATES PLEASE CONTACT 8700-802-813, 9999-3231-64

🔥 Our Courses:-

🌍 Download KJ CLASSES App 👇(SPECIAL OFFER)🔥

🔥 Follow us:-

GST Section 17 Rule 42 and Rule 43 Notice | GST updates | CA Kapil Jain

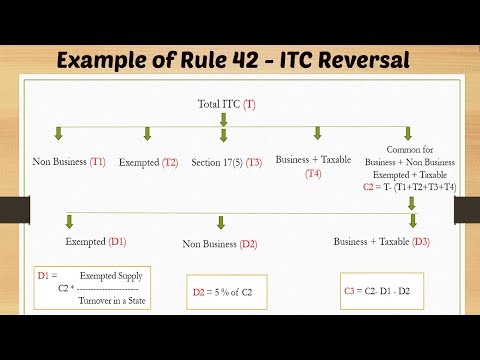

Examples of Rule 42- ITC Reversal

Very Famous Bottle Waala Experiment | Best way to understand Rule 42 of GST| Nikunj Goenka

Apportionment of Input Tax Credit in GST - Section 17, Rule 42 & Rule 43 of GST Law

Sec 17 Basic of Apportionment of Credit ITC and Rule 42 Under GST

Know about Rule 42 | Input Tax Credit Rule | Section (17) of CGST Act, 2017 | GST | C.A.R.S |

GST Common Credit Apportionment | Section 17 + Rule 42, 43 Detailed Analysis | Handwritten Notes

ITC (Section 17 and rule 42) - Detailed discussion || CA final || GST

Rule 42 of CGST Rules, 2017 : Computation of ineligible common credit with our super excel sheet

How to calculate ITC Reversal under Rule 42 & 43?

Input Tax Credit attributable to Taxable and Exempt Supplies_Section 17(1) & 17(2) read with Rul...

How to Handle Reversal of ITC under Rule 42 and 43 of GST with regards to Input & Capital Goods

COMMON CREDIT REVERSAL - ITC - GST - RULE 42 - CA/CMA STUDENTS-SOLVED PROBLEM

Section 17(1) of CGST Act read with Rule 42 -- Apportionment of common credit under GST

Rule 42 & Rule 43 of CGST Rules with Examples | Input Tax Credit in GST | CA/CMA/CS May 25 &...

RULE 42 & 43 OF INPUT TAX CREDIT RULES

Duty Credit Scrips Amendment under GST - Reversal of ITC under Rule 42 (Explained) - Exempt Turnover

GST Rule 42 explained with example in Malayalam

Chart 31 Input Tax Credit Rule 42 & Rule 43 | IDT May 22 Revision | CA Ramesh Soni

Section 17 of CGST: Basis of Apportionment of Credit ITC & Rule 42 by CA Vishal Jain on #CAring

Rule 42 Apportionment of Credit ITCon Input and Input Services With Examples - Input Tax Credit

What is Section 42 & 43 of SGST/CGST Act by The Accounts

TAMIL/APPORTIONMENT OF COMMON CREDIT Sec.17 of CGST Act 2017 and Rule 42 of CGST Rules 2017 |CA/CS

Rule 42 of CGST Rules - Ineligible Inputs & Input Services Credit - Use in Taxable & Exempte...

Комментарии

0:08:40

0:08:40

0:12:31

0:12:31

0:18:47

0:18:47

0:23:21

0:23:21

1:02:54

1:02:54

0:07:52

0:07:52

1:46:56

1:46:56

0:10:08

0:10:08

0:11:48

0:11:48

0:12:59

0:12:59

0:30:39

0:30:39

0:18:02

0:18:02

0:10:40

0:10:40

0:26:33

0:26:33

3:29:36

3:29:36

0:38:22

0:38:22

0:29:32

0:29:32

0:18:17

0:18:17

0:27:42

0:27:42

0:18:38

0:18:38

0:37:09

0:37:09

0:11:24

0:11:24

0:06:56

0:06:56

0:13:39

0:13:39