filmov

tv

Rule 42 of CGST Rules, 2017 : Computation of ineligible common credit with our super excel sheet

Показать описание

GST READYMADE SOLUTIONS :

-----------------------------------------------------------------------------------------------------

Buy Now

-----------------------------------------------------------------------------------------------------

Buy Now

Very Famous Bottle Waala Experiment | Best way to understand Rule 42 of GST| Nikunj Goenka

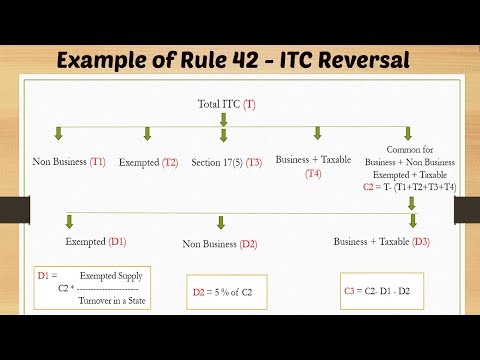

Examples of Rule 42- ITC Reversal

GST Section 17 Rule 42 and Rule 43 Notice | GST updates | CA Kapil Jain

Chart 31 Input Tax Credit Rule 42 & Rule 43 | IDT May 22 Revision | CA Ramesh Soni

#16 Rule 42 Input tax credit in tamil / indirect taxation /gst/ CMA inter /CA inter

Rule 42 of CGST Rules - Ineligible Inputs & Input Services Credit - Use in Taxable & Exempte...

CY: Input Tax Credit | Rule 42 of CGST Rules | Manner of determination of ITC

Rule 42 of CGST Rules, 2017 : Computation of ineligible common credit with our super excel sheet

TAMIL/APPORTIONMENT OF COMMON CREDIT Sec.17 of CGST Act 2017 and Rule 42 of CGST Rules 2017 |CA/CS

How to calculate ITC Reversal under Rule 42 & 43?

CA Final Rule 42 Apportionment of credit Most easy Method GST ITC CA Ramesh Soni

GST ITC Reversal rule 42 of CGST Rules

Rule 43 of GST Act Quick Revision| CA animated lectures | Potential 8 to 10 Marks in CA exam

Reversal of Inputs as per Rule 42 of CGST Rules 2017

GST News 06.12.2017 by TaxHeal I Rule 42 CGST Rules I Example

GST Rule 42 explained with example in Malayalam

RULE 42 & 43 OF INPUT TAX CREDIT RULES

Rule 42 Apportionment of Credit ITCon Input and Input Services With Examples - Input Tax Credit

Common Credit Ka Reversal Kaise Karen | Rule 42 of CGST | Input Tax Credit | ITC Reversal | GST ITC

**🔍 Understanding Rule 42 of CGST: Apportionment of Input Tax Credit (ITC) 📊💼** #gstupdate #gstr...

39. Input Tax Credit | Rule 42 & Rule 43 of Central Goods and Services Tax (CGST) Rules, 2017

10 Rule 42 ITC calculations

What is Section 42 & 43 of SGST/CGST Act by The Accounts

8 Situation for ITC ( Input Tax Credit ) Reversal in GST | ITC Reversal in GST

Комментарии

0:18:47

0:18:47

0:12:31

0:12:31

0:08:40

0:08:40

0:27:42

0:27:42

0:19:22

0:19:22

0:13:39

0:13:39

0:05:24

0:05:24

0:11:48

0:11:48

0:06:56

0:06:56

0:12:59

0:12:59

0:30:20

0:30:20

0:07:54

0:07:54

0:06:48

0:06:48

0:04:22

0:04:22

0:21:31

0:21:31

0:18:17

0:18:17

0:38:22

0:38:22

0:37:09

0:37:09

0:11:41

0:11:41

0:01:01

0:01:01

0:52:05

0:52:05

0:17:32

0:17:32

0:11:24

0:11:24

0:07:46

0:07:46