filmov

tv

Rule 42 & Rule 43 of CGST Rules with Examples | Input Tax Credit in GST | CA/CMA/CS May 25 & Nov 24

Показать описание

#Rule42 #Rule43 #InputTaxCredit

In this lecture, we will study Rule 42 and Rule 43 of the CGST Rules, 2017 fully amended and applicable for CA/CMA/CS Inter and Final May 25 and Nov 24. We will study these rules along with Section 17 of the CGST, 17 (Input Tax Credit).

00:00:00 Rule 42 of the CGST Rules, 2017 with Examples and Bare Reading.

01:49:32 Rule 43 of the CGST Rules, 2017 with Examples and Bare Reading.

02:52:00 Practical Illustration on Rule 43 of the CGST Rules, 2017.

👉 LETS CONNECT 👈

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Follow Me:

Be my friend:

In this lecture, we will study Rule 42 and Rule 43 of the CGST Rules, 2017 fully amended and applicable for CA/CMA/CS Inter and Final May 25 and Nov 24. We will study these rules along with Section 17 of the CGST, 17 (Input Tax Credit).

00:00:00 Rule 42 of the CGST Rules, 2017 with Examples and Bare Reading.

01:49:32 Rule 43 of the CGST Rules, 2017 with Examples and Bare Reading.

02:52:00 Practical Illustration on Rule 43 of the CGST Rules, 2017.

👉 LETS CONNECT 👈

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Follow Me:

Be my friend:

ITC Reversal Rules 42 and 43 #gstbilling #invoiceprocessing

Rule 43 of GST Act Quick Revision| CA animated lectures | Potential 8 to 10 Marks in CA exam

How to calculate ITC Reversal under Rule 42 & 43?

Very Famous Bottle Waala Experiment | Best way to understand Rule 42 of GST| Nikunj Goenka

Chart 31 Input Tax Credit Rule 42 & Rule 43 | IDT May 22 Revision | CA Ramesh Soni

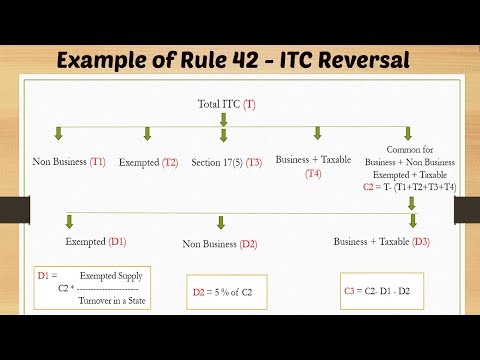

Examples of Rule 42- ITC Reversal

GST Section 17 Rule 42 and Rule 43 Notice | GST updates | CA Kapil Jain

TAMIL/APPORTIONMENT OF COMMON CREDIT Sec.17 of CGST Act 2017 and Rule 42 of CGST Rules 2017 |CA/CS

(OPEN) Abnormality Dancin Girl MEP || Parts (10/53) || Read desc for rules

How to Handle Reversal of ITC under Rule 42 and 43 of GST with regards to Input & Capital Goods

ITC Rule 42 IP/IPS | CA Sanjay Mundhra | SJC Institute

60 Important Rules Of Grammar | Rule - 43 | Basic English Grammar in Hindi | English With Rani Mam

39. Input Tax Credit | Rule 42 & Rule 43 of Central Goods and Services Tax (CGST) Rules, 2017

How to Reply for Notice on Rule 42, Rule 43

GST ITC Reversal rule 42 of CGST Rules

Rule 42 of CGST Rules - Ineligible Inputs & Input Services Credit - Use in Taxable & Exempte...

CA FINAL NOV24 Input Tax Credit(ITC) Rule42/rule 43 Input Service Distributor(ISD) Question revision

Reporting ITC and Reversals Simplified! #itc #reversals

Rule 43 of CGST Rules, 2017 : Computation of ineligible common credit with our super excel sheet

Rule 42 of CGST Rules, 2017 : Computation of ineligible common credit with our super excel sheet

rule 42 and 43 in gst

Apportionment of Input Tax Credit in GST - Section 17, Rule 42 & Rule 43 of GST Law

RULE 42 & 43 OF INPUT TAX CREDIT RULES

ITC Rule 42 & 43 - Most tricky question of CA Final IDT | Important Q May 22 | CA Mayank Trive...

Комментарии

0:01:39

0:01:39

0:06:48

0:06:48

0:12:59

0:12:59

0:18:47

0:18:47

0:27:42

0:27:42

0:12:31

0:12:31

0:08:40

0:08:40

0:06:56

0:06:56

0:03:25

0:03:25

0:18:02

0:18:02

1:04:49

1:04:49

0:04:49

0:04:49

0:52:05

0:52:05

0:07:03

0:07:03

0:07:54

0:07:54

0:13:39

0:13:39

5:46:42

5:46:42

0:00:54

0:00:54

0:11:44

0:11:44

0:11:48

0:11:48

0:15:14

0:15:14

0:23:21

0:23:21

0:38:22

0:38:22

0:14:40

0:14:40