filmov

tv

Bid / Ask Spread | Trading Terms

Показать описание

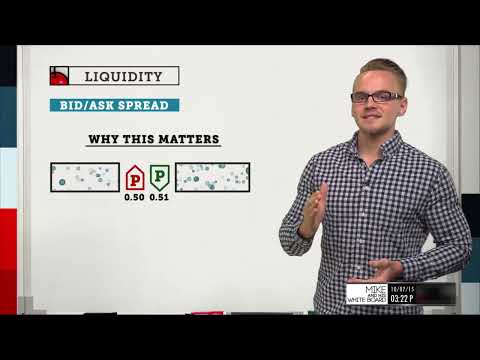

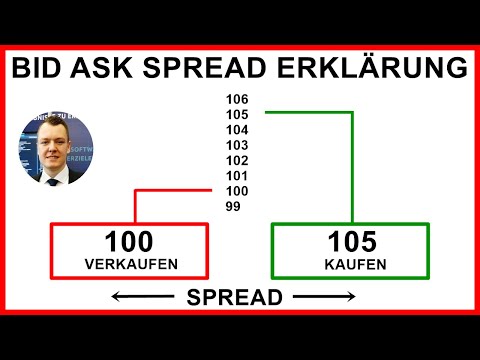

The difference between the buy and sell price (also known as bid and ask) is one of those things that mystifies newbies. We’re not used to having two prices for the same thing when we go to a store or shop online. This video explains in detail what they mean and why it’s there in the first place.

As there are many connected things stemming from the bid/ask price David covers them as well, to provide a more holistic description of the term.

The exact terminology, its place on a chart, how to interpret it is discussed in a simple and easy to grasp way before continuing to a bit more advanced things like liquidity and illiquid instruments, different types of spread. But everything is accompanied with real market examples and shows things exactly as you’ll find them in the Trading 212 platform whether on a laptop or in our trading app.

Still have questions? Comments are below, ask away.

At Trading 212 we provide an execution only service. This video should not be construed as investment advice. Investments can fall and rise. Capital at risk. CFDs are higher risk because of leverage.

As there are many connected things stemming from the bid/ask price David covers them as well, to provide a more holistic description of the term.

The exact terminology, its place on a chart, how to interpret it is discussed in a simple and easy to grasp way before continuing to a bit more advanced things like liquidity and illiquid instruments, different types of spread. But everything is accompanied with real market examples and shows things exactly as you’ll find them in the Trading 212 platform whether on a laptop or in our trading app.

Still have questions? Comments are below, ask away.

At Trading 212 we provide an execution only service. This video should not be construed as investment advice. Investments can fall and rise. Capital at risk. CFDs are higher risk because of leverage.

Комментарии

0:02:31

0:02:31

0:03:52

0:03:52

0:01:50

0:01:50

0:15:21

0:15:21

0:12:41

0:12:41

0:08:56

0:08:56

0:16:23

0:16:23

0:10:12

0:10:12

0:00:36

0:00:36

0:00:54

0:00:54

0:14:52

0:14:52

0:11:06

0:11:06

0:05:32

0:05:32

0:02:43

0:02:43

0:03:53

0:03:53

0:03:18

0:03:18

0:00:57

0:00:57

0:01:06

0:01:06

0:00:59

0:00:59

0:05:46

0:05:46

0:15:21

0:15:21

0:01:00

0:01:00

0:00:38

0:00:38

0:07:29

0:07:29