filmov

tv

Bid-Ask Spread Explained | Options Trading For Beginners

Показать описание

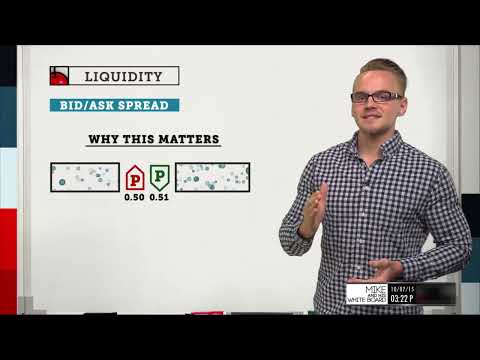

The bid-ask spread is a very important liquidity metric that all stock and options traders should pay attention to before entering a trade.

The bidding price represents the highest price someone is willing to pay for a stock or option, while the asking price is the lowest price someone is willing to receive for a stock or option.

The bid-ask spread represents the "hidden" cost of entering and exiting a stock or option position. In this video, you'll learn the minimum bid-ask spread values you should be looking for, how the bid-ask spread changes with an option's "moneyness," how the bid-ask spread changes with the number of days until an option expires, and how market volatility contributes to wider bid-ask spreads. tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Project Finance(Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’ brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

Комментарии

0:01:50

0:01:50

0:15:21

0:15:21

0:12:41

0:12:41

0:03:52

0:03:52

0:00:57

0:00:57

0:00:54

0:00:54

0:10:12

0:10:12

0:04:34

0:04:34

0:03:37

0:03:37

0:03:53

0:03:53

0:02:43

0:02:43

0:07:29

0:07:29

0:16:23

0:16:23

0:08:45

0:08:45

0:06:57

0:06:57

0:16:49

0:16:49

0:03:18

0:03:18

0:00:59

0:00:59

0:08:18

0:08:18

0:08:59

0:08:59

0:04:00

0:04:00

0:17:32

0:17:32

0:01:00

0:01:00

0:11:23

0:11:23