filmov

tv

What is a Bid Price/What is an Ask Price? | FXTM Learn Forex in 60 Seconds

Показать описание

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

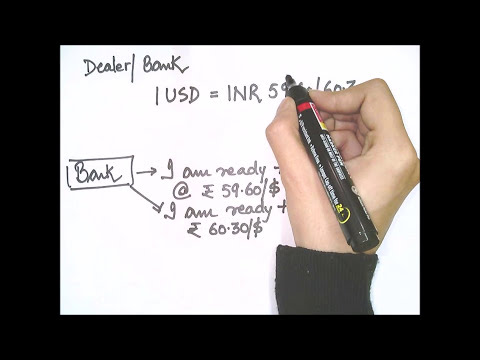

The Bid price is the price a forex trader is willing to sell a currency pair for. Ask price is the price a trader will buy a currency pair at. Both of these prices are given in real-time and are constantly updating. So for example, the British pound against the US dollar has a bid price of 1.20720, that’s the price a trader wants to sell the GBPUSD. A seller who thinks a currency will decline, might sell at the bid price to take advantage of the fall. If the British pound against the US dollar has an ask price of 1.20740, that’s the price a trader wants to pay in order to buy the currency pair. The difference between the ask and the bid price is the spread.

Disclaimer: The content in this video comprises personal opinions and ideas and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice.

The Bid price is the price a forex trader is willing to sell a currency pair for. Ask price is the price a trader will buy a currency pair at. Both of these prices are given in real-time and are constantly updating. So for example, the British pound against the US dollar has a bid price of 1.20720, that’s the price a trader wants to sell the GBPUSD. A seller who thinks a currency will decline, might sell at the bid price to take advantage of the fall. If the British pound against the US dollar has an ask price of 1.20740, that’s the price a trader wants to pay in order to buy the currency pair. The difference between the ask and the bid price is the spread.

Disclaimer: The content in this video comprises personal opinions and ideas and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice.

Комментарии

0:01:06

0:01:06

0:03:52

0:03:52

0:02:31

0:02:31

0:05:49

0:05:49

0:01:18

0:01:18

0:06:21

0:06:21

0:01:05

0:01:05

0:07:29

0:07:29

0:00:22

0:00:22

0:08:45

0:08:45

0:06:24

0:06:24

0:15:21

0:15:21

0:02:44

0:02:44

0:00:22

0:00:22

0:01:50

0:01:50

0:07:40

0:07:40

0:08:18

0:08:18

0:16:23

0:16:23

0:05:56

0:05:56

0:03:40

0:03:40

0:01:01

0:01:01

0:05:32

0:05:32

0:15:18

0:15:18

0:04:31

0:04:31