filmov

tv

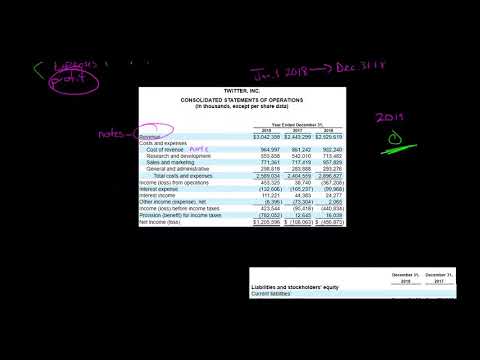

Connecting the Income Statement, Balance Sheet, and Cash Flow Statement

Показать описание

Every public company in the US has Three Financial Statements. Investors can link these financial statements to better make sense of the financial position of a business. This video explains how the Three Financial Statements connect (link).

Major Sections:

1. Income Statement

2. Profit/Loss

3. Cash Flow Statement

4. Depreciation/Amortization

5. Changes in Working Capital

6. Balance Sheet

PS I apologize for the nasally sound, I had Covid while recording this.

PLEASE LEAVE A LIKE AND SUBSCRIBE IF YOU ENJOYED!

Major Sections:

1. Income Statement

2. Profit/Loss

3. Cash Flow Statement

4. Depreciation/Amortization

5. Changes in Working Capital

6. Balance Sheet

PS I apologize for the nasally sound, I had Covid while recording this.

PLEASE LEAVE A LIKE AND SUBSCRIBE IF YOU ENJOYED!

Connecting the Income Statement, Balance Sheet, and Cash Flow Statement

Balance sheet and income statement relationship

How the Three Financial Statements Fit Together

Connecting the Income Statement and Balance Sheet

Financial Statements Explained in One Minute: Balance Sheet, Income Statement, Cash Flow Statement

FINANCIAL STATEMENTS: all the basics in 8 MINS!

The BALANCE SHEET for BEGINNERS (Full Example)

Relationship between 💵 Income Statement & ⚖️ Balance Sheet

ETFs for income and how to calculate the yield of ASX ETFs

How the Income Statement and Balance Sheet are Connected | Example

7. The connection between balance sheet, P&L statement and cash flow statement

How an Income Statement, Balance Sheet and Cash Flow Statement Work Together

Financial Statements Explained | Balance Sheet | Income Statement | Cash Flow Statement

Part 1: How to connect the Balance Sheet, Income Statement and Statement of Cash Flows together?

Turn a Trial Balance into an Income Statement in 4 steps

Balance Sheet vs Income Statement

How the 3 financial statements link together

Relationship between financial statements

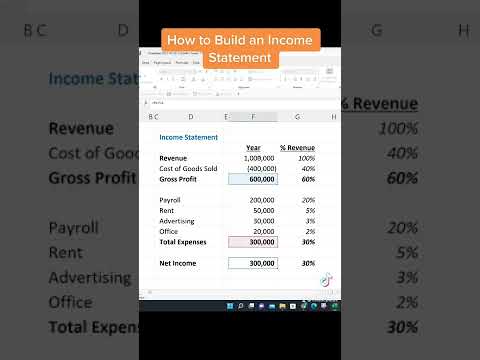

Excel Build an Income Statement

Connection between the Balance sheet & Income statement

How to Build Financial Statements - Income Statement, Balance Sheet, and Cash Flow Statement

Balance Sheet vs. Income Statement

Connection between the Balance sheet & Income statement

Interview Question: How to describe the relationship between the 3 financial statements

Комментарии

0:12:19

0:12:19

0:04:33

0:04:33

0:06:30

0:06:30

0:02:54

0:02:54

0:01:19

0:01:19

0:09:06

0:09:06

0:06:59

0:06:59

0:09:17

0:09:17

0:24:25

0:24:25

0:01:15

0:01:15

0:04:34

0:04:34

0:02:12

0:02:12

0:30:28

0:30:28

0:07:16

0:07:16

0:09:34

0:09:34

0:05:17

0:05:17

0:09:16

0:09:16

0:02:21

0:02:21

0:00:32

0:00:32

0:04:43

0:04:43

0:17:37

0:17:37

0:11:04

0:11:04

0:04:46

0:04:46

0:07:14

0:07:14