filmov

tv

How the Three Financial Statements Fit Together

Показать описание

Brought to you by StratPad: Simple Business Plan App.

This video completes our course on financial statements by showing you how the income statement, balance sheet and statement of cash flows are connected. We'll take you through two months in the life of a company as it's recorded in the financial statements. If you've watched all the videos in the series, you'll recognize all the terms and realize how far you've come in your understanding of financial statements.

Video Transcript

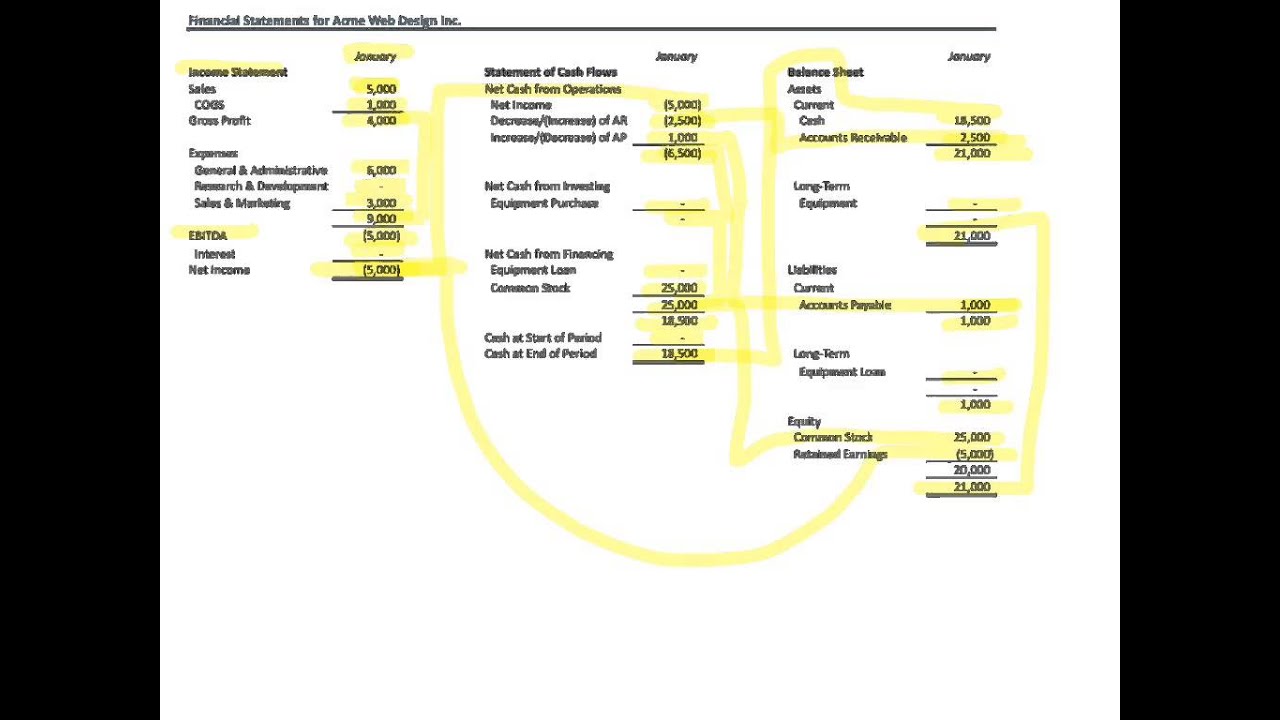

Nicely done! You've made it to the last video. And, by the way, don't be put off by the busy-ness of this screen. You know all this stuff here: income statement, statement of cash flows, the balance sheet. What I'm going to do now is a very fast rattle through of all three of these, just to cover off all the work that you already know.

Alright are you ready? Let's get going. Oh one thing -- by the way -- you'll see negative numbers don't have a dash in front of them; they're represented with brackets around them. Ok, ready go.

This is for January for Acme Web Design. The income statement starts off with sales of $5,000 and a corresponding costs of goods sold of $1,000. We know to subtract the $1,000 from the $5,000 to get to $4,000. Then we have a bunch of expenses: general and and administrative $6,000 -- that's your rent, telecommunications costs, administrative costs, that type of thing; no research and development costs; we have sales and marketing -- there was salary in there and a small campaign. Add all those up to get to $9,000.

Then subtract $9,000 from $4,000 to get to ($5,000). That's our fancily named subtotal: earnings before interest, taxes, depreciation and amortization or called EBITDA. We didn't have no interest -- we didn't pay anything to the bank — and therefore our net income is a ($5,000) loss. That means we didn't make any money here.

That ($5,000) goes over to the top of the statement of cash flows. The $5,000 worth of sales wasn't paid to us. Half of it instead went to accounts receivable ($2,500). When that happens it decreases the amount of cash available, therefore a negative number. But you can also see that it increases the accounts receivable showing on the balance sheet $2,500. But then, we didn't pay some of the costs this month. That increased our accounts payable $1,000 and also increased the amount of cash that we have on hand. There's our accounts payable down here $1,000.

So total cash from operations is ($6,500). We didn't buy any equipment, we didn't take out a loan, but the founder did put in $25,000 against common stock. Therefore, the total cash proceeds coming into the company this month is $18,500. That's the total of this ($6,500) and this zero and this $25,000. Cash at the start of the period was zero. Therefore, cash at the end of the period was $18,500 and this starts off our balance sheet right here.

We know what the accounts receivable is $2,500, therefore total current assets is $21,000. No equipment. There's the accounts payable $1,000. Total current liabilities of $1,000. No long-term liabilities. Total overall liabilities of $1,000.

There's the common stock $25,000 sliding in here. Retained earnings is, as you know, the total of all the profits and losses since the company began. If you look down, you see a total of liabilities and equity of $21,000 which balances with the total assets of $21,000. Our balance sheet balances -- whew.

We're almost there. I just want to show you one more thing.

Ok, so what I've done here is added in another month. We're going to go through the month of February and we're going to do it very quickly.

Alright, sales of $7,000 is up from the previous month. Corresponding 20 per cent of cost of goods sold $1,400 leaves a total gross profit of $5,600. Expenses hasn't changed, still $9,000 worth of expenses. $5,600 of gross profit minus the $9,000 of expenses equals the EBITDA of ($3,400). So we're still losing money but not as badly, which is exactly what you want to see in a new company.

We did pay the bank $100 worth of interest and I'll show you why in just a minute. ($3,400) minus $100 is equal to ($3,500) the loss for the month. And that starts off our statement of cash flows at the top ($3,500).

Ok, here's a little trickiness. The $2,500 in accounts receivable last month got paid to us this month but we also then took half. This sales then went back into accounts receivable. The difference between the $2,500 from last month and the $3,500 from this month is $1,000. So accounts receivable went up by $1,000 as you can see here, which just reduces our cash.

The rest of the video transcript can be found here:

This video completes our course on financial statements by showing you how the income statement, balance sheet and statement of cash flows are connected. We'll take you through two months in the life of a company as it's recorded in the financial statements. If you've watched all the videos in the series, you'll recognize all the terms and realize how far you've come in your understanding of financial statements.

Video Transcript

Nicely done! You've made it to the last video. And, by the way, don't be put off by the busy-ness of this screen. You know all this stuff here: income statement, statement of cash flows, the balance sheet. What I'm going to do now is a very fast rattle through of all three of these, just to cover off all the work that you already know.

Alright are you ready? Let's get going. Oh one thing -- by the way -- you'll see negative numbers don't have a dash in front of them; they're represented with brackets around them. Ok, ready go.

This is for January for Acme Web Design. The income statement starts off with sales of $5,000 and a corresponding costs of goods sold of $1,000. We know to subtract the $1,000 from the $5,000 to get to $4,000. Then we have a bunch of expenses: general and and administrative $6,000 -- that's your rent, telecommunications costs, administrative costs, that type of thing; no research and development costs; we have sales and marketing -- there was salary in there and a small campaign. Add all those up to get to $9,000.

Then subtract $9,000 from $4,000 to get to ($5,000). That's our fancily named subtotal: earnings before interest, taxes, depreciation and amortization or called EBITDA. We didn't have no interest -- we didn't pay anything to the bank — and therefore our net income is a ($5,000) loss. That means we didn't make any money here.

That ($5,000) goes over to the top of the statement of cash flows. The $5,000 worth of sales wasn't paid to us. Half of it instead went to accounts receivable ($2,500). When that happens it decreases the amount of cash available, therefore a negative number. But you can also see that it increases the accounts receivable showing on the balance sheet $2,500. But then, we didn't pay some of the costs this month. That increased our accounts payable $1,000 and also increased the amount of cash that we have on hand. There's our accounts payable down here $1,000.

So total cash from operations is ($6,500). We didn't buy any equipment, we didn't take out a loan, but the founder did put in $25,000 against common stock. Therefore, the total cash proceeds coming into the company this month is $18,500. That's the total of this ($6,500) and this zero and this $25,000. Cash at the start of the period was zero. Therefore, cash at the end of the period was $18,500 and this starts off our balance sheet right here.

We know what the accounts receivable is $2,500, therefore total current assets is $21,000. No equipment. There's the accounts payable $1,000. Total current liabilities of $1,000. No long-term liabilities. Total overall liabilities of $1,000.

There's the common stock $25,000 sliding in here. Retained earnings is, as you know, the total of all the profits and losses since the company began. If you look down, you see a total of liabilities and equity of $21,000 which balances with the total assets of $21,000. Our balance sheet balances -- whew.

We're almost there. I just want to show you one more thing.

Ok, so what I've done here is added in another month. We're going to go through the month of February and we're going to do it very quickly.

Alright, sales of $7,000 is up from the previous month. Corresponding 20 per cent of cost of goods sold $1,400 leaves a total gross profit of $5,600. Expenses hasn't changed, still $9,000 worth of expenses. $5,600 of gross profit minus the $9,000 of expenses equals the EBITDA of ($3,400). So we're still losing money but not as badly, which is exactly what you want to see in a new company.

We did pay the bank $100 worth of interest and I'll show you why in just a minute. ($3,400) minus $100 is equal to ($3,500) the loss for the month. And that starts off our statement of cash flows at the top ($3,500).

Ok, here's a little trickiness. The $2,500 in accounts receivable last month got paid to us this month but we also then took half. This sales then went back into accounts receivable. The difference between the $2,500 from last month and the $3,500 from this month is $1,000. So accounts receivable went up by $1,000 as you can see here, which just reduces our cash.

The rest of the video transcript can be found here:

Комментарии

0:12:11

0:12:11

0:06:30

0:06:30

0:01:19

0:01:19

0:09:06

0:09:06

0:01:18

0:01:18

0:01:19

0:01:19

0:02:21

0:02:21

0:12:19

0:12:19

0:00:57

0:00:57

0:16:00

0:16:00

0:07:14

0:07:14

0:41:42

0:41:42

0:30:28

0:30:28

0:09:16

0:09:16

0:06:29

0:06:29

0:30:43

0:30:43

0:11:33

0:11:33

0:33:09

0:33:09

0:13:26

0:13:26

1:34:25

1:34:25

0:02:38

0:02:38

0:12:17

0:12:17

0:03:44

0:03:44

0:15:10

0:15:10